Cryptocurrencies are among the assets that have gained the most in recent days on a 'pivot' that has caused market risk appetite to rise:

- Wall Street bulls today would like to hear from Fed chief Jerome Powell at least hints of lower hikes at the next FOMC meetings, after the Fed is likely to raise interest rates significantly for the 4th time, by 75 bps. Wall Street expectations rose after WSJ reports of a possible 50 bp hike in December and speculation from BlackRock analysts, who indicated they expected 'dovish language' at today's conference;

- The ADP report from the U.S. labor market performed exceptionally well today, and the U.S. economy appears to still be in a condition to allow bankers to maintain tight monetary policy. The dollar is strengthening;

- Institutional investors remain positive about cryptocurrencies and are increasing their interest in the market according to a recent Fidelity fund survey. Dogecoin has risen 140% in the past seven days amid Elon Musk's acquisition of Twitter.

Until October 26, Bitcoin behaved better than almost all risk assets in October. At the end of the month, the largest and mid-cap stocks outperformed the king of cryptocurrencies. On the indices, the 'pivot' is more palpable, which is due to investors' still defensive moves and continued relative risk aversion. This manifests itself in the fact that perceived risky and volatile small-cap companies and cryptocurrencies continue to grow weaker than larger players. Source: Arcane Research

Until October 26, Bitcoin behaved better than almost all risk assets in October. At the end of the month, the largest and mid-cap stocks outperformed the king of cryptocurrencies. On the indices, the 'pivot' is more palpable, which is due to investors' still defensive moves and continued relative risk aversion. This manifests itself in the fact that perceived risky and volatile small-cap companies and cryptocurrencies continue to grow weaker than larger players. Source: Arcane Research

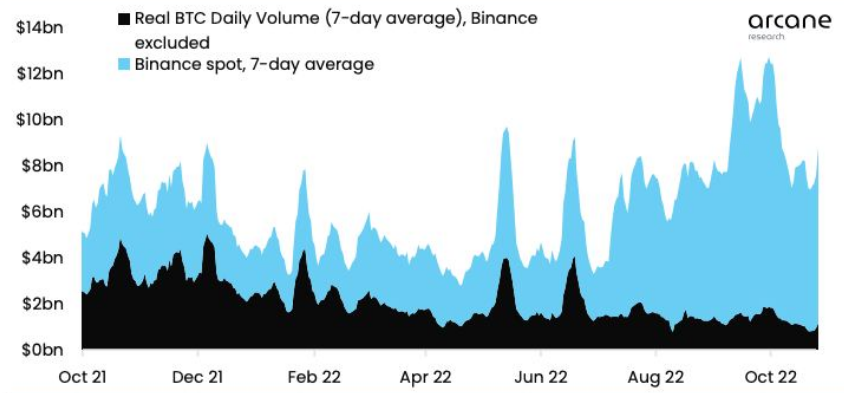

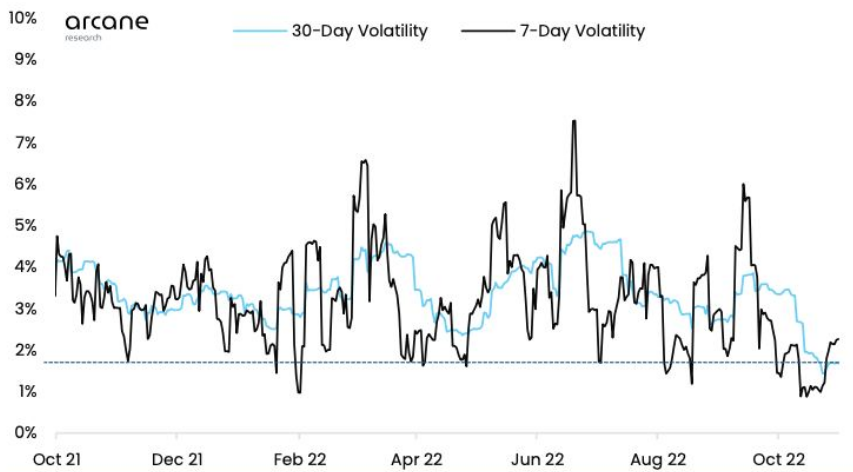

In October, the cryptocurrency market was driven by higher volume and lower volatility, which jumped at the end of the month. In the last week of October, Bitcoin recorded the largest liquidation of short positions since July 26, 2021. Source: ArcaneResearch, Lunde

In October, the cryptocurrency market was driven by higher volume and lower volatility, which jumped at the end of the month. In the last week of October, Bitcoin recorded the largest liquidation of short positions since July 26, 2021. Source: ArcaneResearch, Lunde Bitcoin's spot trading volume has risen more than 45% in the past seven days, and the 30-day volatility index is still at a near two-year low. The seven-day volatility index today stands at 2.2%, and despite a rebound from last week, it is still below the annual average of 3%. According to Lunde analysts, changes of 5 to 6% and the slowing of the rally means that markets should rather prepare for further consolidation and sideways movement. At the same time, today's decision and, most importantly, the FOMC may bring bullish or bearish momentum and decide the next big market move for Bitcoin and all cryptocurrencies. Lunde analysts also say that with the Wall Street pivot becoming a reality, the correlation of the cryptocurrency market with the stock market may weaken, similar to the second half of 2020 when Bitcoin's price shot up to the $20,000 area and cryptocurrency returns statistically far exceeded stock market yields. Source: Arcane Research, Lunde

Bitcoin's spot trading volume has risen more than 45% in the past seven days, and the 30-day volatility index is still at a near two-year low. The seven-day volatility index today stands at 2.2%, and despite a rebound from last week, it is still below the annual average of 3%. According to Lunde analysts, changes of 5 to 6% and the slowing of the rally means that markets should rather prepare for further consolidation and sideways movement. At the same time, today's decision and, most importantly, the FOMC may bring bullish or bearish momentum and decide the next big market move for Bitcoin and all cryptocurrencies. Lunde analysts also say that with the Wall Street pivot becoming a reality, the correlation of the cryptocurrency market with the stock market may weaken, similar to the second half of 2020 when Bitcoin's price shot up to the $20,000 area and cryptocurrency returns statistically far exceeded stock market yields. Source: Arcane Research, Lunde

Bitcoin, H4 interval. Bitcoin showed some weakness as bullish rally calmes down. Bitcoin price is now below SMA50. Relative strenght index at 46 points could indicate volatility incoming. Source: xStation5

Bitcoin, H4 interval. Bitcoin showed some weakness as bullish rally calmes down. Bitcoin price is now below SMA50. Relative strenght index at 46 points could indicate volatility incoming. Source: xStation5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.