Bitcoin's price has been falling over the weekend, and today the 'king of cryptocurrencies' dropped to levels not seen since July 2021, in the area below $33,000. What to expect next from the crypto market?

-

The future is still crucial for the markets, and the immediate reasons for the weekend's decline are not of much importance at the moment. Nevertheless, it is worth noting that over the weekend we did not observe significant news for the cryptocurrency market as a whole, nevertheless the price of bitcoin and altcoins fell. Potentially, this indicates a retreat of investors due to the weakening atmosphere in the market and concerns around the economic slowdown which could indicate long-term weakness;

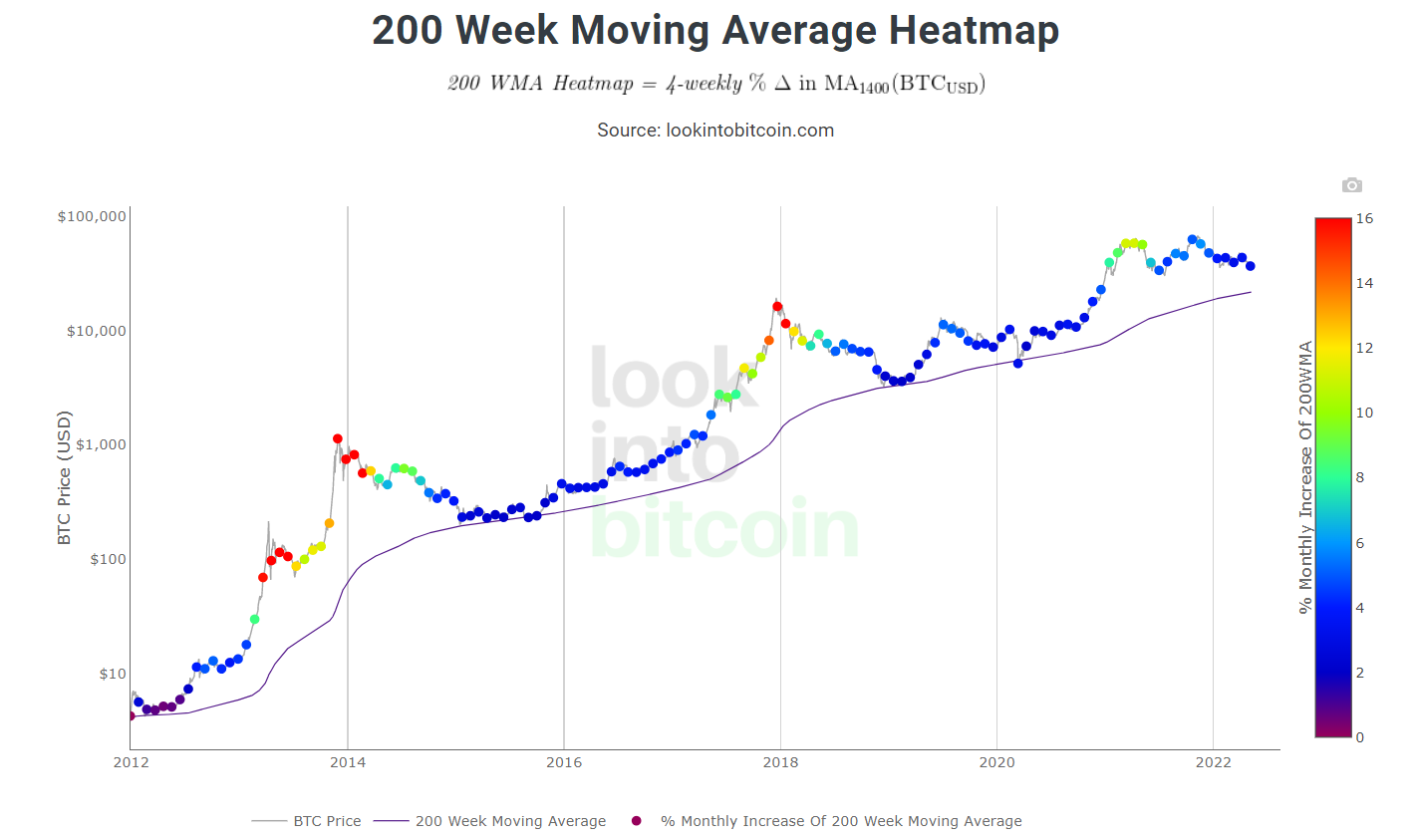

- The SMA 200 average that long-term investors have been using to determine the trend for over 100 years is near $21,000. Overnight, the average rises slightly as long as bitcoin remains above it. In Bitcoin's previous uptrend cycles the price has broken below the SMA 200 'testing' it each time, the declines were usually followed by very strong demand which did not allow Bitcoin to stay in the downtrend zone for too long:

- Transaction volume in the cryptocurrency market is declining significantly which indicates an exodus of a large portion of investors and tokens being sent off cryptocurrency exchanges to external wallets as shown by on-chain data. Declining volume makes 'violent price movements' and high volatility more likely and easier at the same time;

Historical chart of Bitcoin against the SMA200 average. The price after each uptrend broke below the average eventually always responding with strong demand. Source: lookintobitcoin.com

-

Declines in cryptocurrencies prove that digital assets are sensitive to galloping inflation and rising interest rates. We can say that the investment of many individual investors in cryptocurrencies and the increase in volumes was due to positive investor sentiment and a lack of concern about the broader economy. Right now, we are seeing a deterioration in sentiment, and some households will be cutting back on spending due to rising living costs and loan installments. In this context, attracting many people to the speculative cryptocurrency market could be a problem in the coming months which could favor sellers;

- Bitcoin's next halving is scheduled for early 2024, by which time the health of economies may have improved and monetary policy may have stabilized which may favor the return of positive sentiment to the cryptocurrency market and the start of another bull market cycle. Investments may also be reluctant to start a large accumulation of cryptocurrencies in the face of deteriorating market sentiment, at the same time it is worth mentioning that the interest rate hike cycle in the U.S. is only in its early stages;

- Cryptocurrencies can still attract due to their anonymity and low transaction costs and fast transactions. At the same time, some cryptocurrencies (such as Bitcoin), unlike fiat currencies of central banks, are deflationary assets and their supply is limited in advance, which can promote growth if demand remains high;

-

Luna altcoin, which has attracted investors in recent times by offering attractive rates for 'staking' on the network, has been significantly affected by the declines. After a sale of $285 million in value by one of the 'whales' on the stablecoin network, UST lost momentarily to the dollar and was trading at $0.98. Luna has slipped below $60 and has already lost nearly 40% of its valuation in the last 5 days alone;

Bitcoin chart, W1 interval. The weekly interval shows how volatile an asset Bitcoin is, the most stable and largest of the cryptocurrencies. On the chart, we can see an RGR-like formation being drawn, whose neckline runs around $29,000 and almost perfectly coincides with the 61.8 Fibonacci retracement. Another potential support is the 71.6% retracement, which in the vicinity of $22,000 coincides with the 200 SMA average, which has been frequently tested in the past. However, the sentiment around the cryptocurrency market may improve if we observe a recovery in the financial markets. Source: xStation 5

Daily summary: Wall Street climbs, oil slides 🗽 Is a stronger dollar weighing on Bitcoin?

ETHEREUM: Is the crypto bull run back? 🎢

Technical Analysis - Ethereum (14.01.2026)

Crypto News: Bitcoin builds momentum 📈 Is a triangle pattern forming on Ethereum?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.