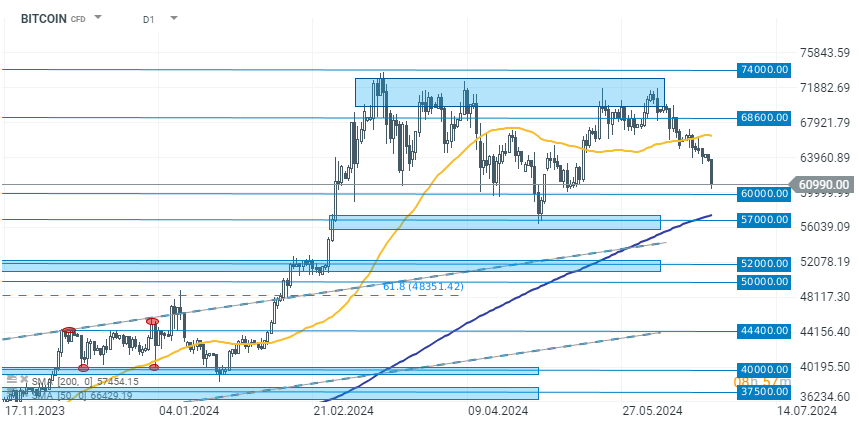

Selling pressure on Bitcoin has intensified following the public announcement from Mt. Gox, revealing plans to start distributing assets stolen in a 2014 hack starting July 2024. Currently, Bitcoin has dipped by 3.20% to $61,000. This distribution by Mt. Gox, which once handled over 70% of all Bitcoin transactions, involves substantial amounts of Bitcoin and Bitcoin Cash, potentially impacting market dynamics due to expected sales from early investors who might capitalize on the current higher market values.

Mt. Gox's trustee, Nobuaki Kobayashi, announced that the repayment plan, which has been delayed multiple times, is set to commence in the first week of July 2024, aiming to address claims from approximately 127,000 creditors affected by the hack. The exchange had moved 141,686 BTC (valued at approximately $9.62 billion) to new wallets in May as part of the preparation for these repayments. Despite this, the full impact of the repayments on the market remains uncertain, especially with concerns over potential downward pressure on Bitcoin prices as recipients may sell their recovered assets.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.