- Weaker sentiment on stock exchanges did not prevent cryptocurrencies from rising

- The correlation of the price of BTC with the major indices has dropped noticeably recently

- Bitcoin price is approaching overbought levels and 61.8 Fibonacci retracement

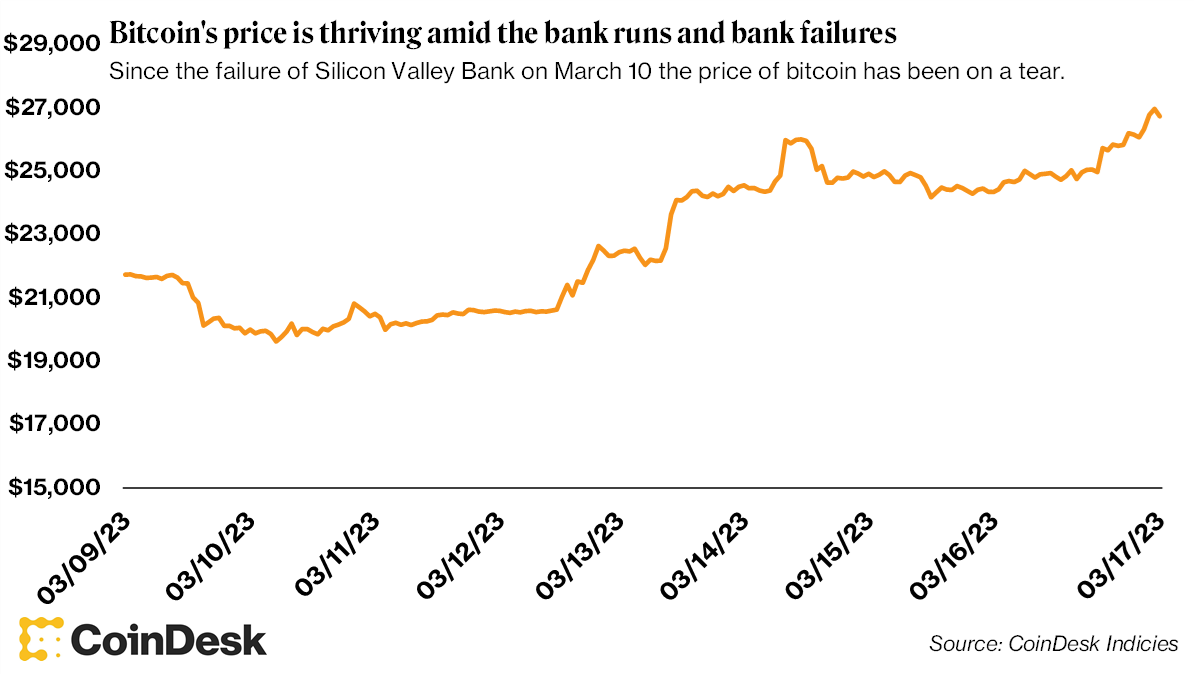

The recent weakness of banks has caused capital to flow into cryptocurrencies for two reasons. The main beneficiary of the rally - decentralized Bitcoin - is not directly dependent on the centralized financial sector. Second, in the face of escalating bank problems, the chances of a Federal Reserve pivot have increased. Since the collapse of SVB, the Fed has already hinted twice at supporting market liquidity, which investors have taken as a positive prognosticator. It's still unpredictable which way the crisis will unfold but its hold on UBS's takeover of Credit Suisse coupled with a potentially dovish Fed could provide a catalyst for upside for risk assets.

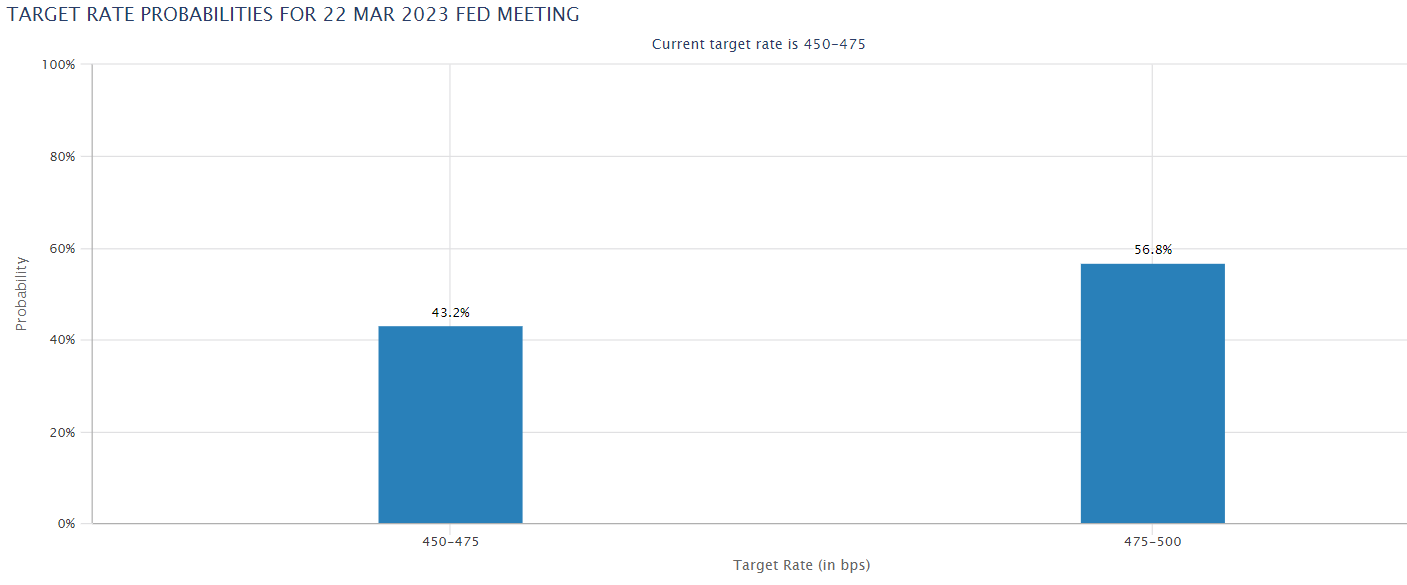

On Wednesday at 8 pm GMT, markets will see if indeed Jerome Powell will be willing to go easy on Wall Street and change to a more dovish stance. If investors sense that the Fed is softening under the pressure of systemic concerns, the rally in cryptocurrencies is likely to be prolonged. At the same time, it is difficult to imagine the price of BTC continuing to rise if the scale of the current crisis were to increase significantly.

The price drop following the collapse of the SVB bank did not last long. Bitcoin surprised the markets and has since risen nearly 30%. Source: CoinDesk

The largest of the cryptocurrencies has had one of its best weeks in the past few years, with the price rising more than 20%. Source: Bloomberg

The largest of the cryptocurrencies has had one of its best weeks in the past few years, with the price rising more than 20%. Source: Bloomberg

The inverted head-and-shoulders formation pattern may herald bullish attempt to btrak the main psychological resistance level of $30,000. Source: Bloomberg

The inverted head-and-shoulders formation pattern may herald bullish attempt to btrak the main psychological resistance level of $30,000. Source: Bloomberg

Markets see more than 43% chance that the Federal Reserve will not raise interest rates on Wednesday. Just two weeks ago, the markets saw a 50bp hike as a chance. That's a drastic change. Source: CME Group

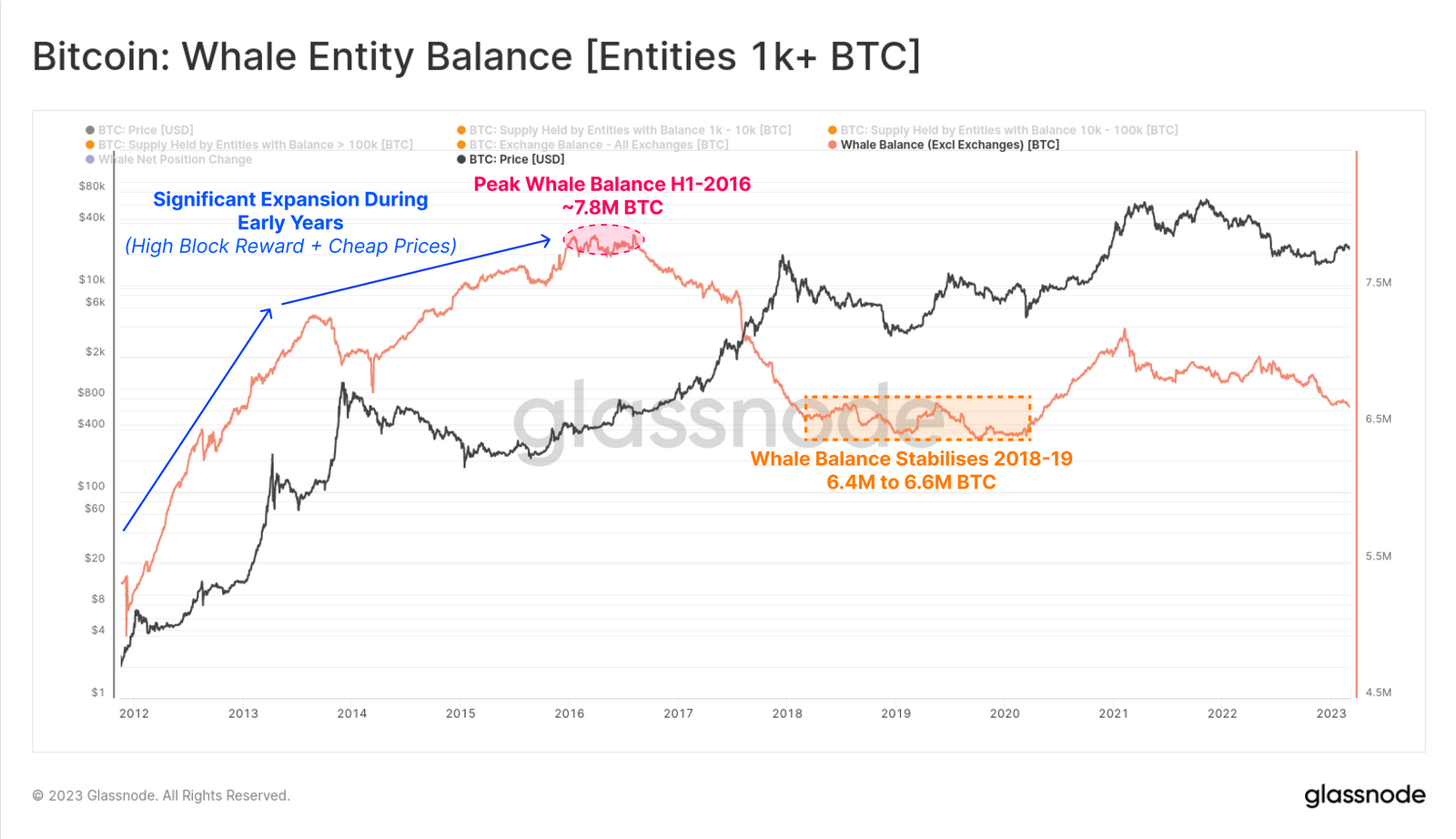

Markets see more than 43% chance that the Federal Reserve will not raise interest rates on Wednesday. Just two weeks ago, the markets saw a 50bp hike as a chance. That's a drastic change. Source: CME Group The amount of stored BTC in the so-called 'cold wallets' of the largest BTC holders of so-called whales (above 1,000 BTC) is at levels last seen in mid-2020. This may indicate that if the BTC price maintains momentum, the amount of BTC in whale portfolios will increase again. For the moment, however, the amount of cryptocurrency in the whales' wallets continues to fall, which could indicate their sending BTC to exchanges and continued risk aversion among the largest holders. A change in this trend would be a sign of the growing strength of the largest of cryptocurrencies. Source: Glassnode

The amount of stored BTC in the so-called 'cold wallets' of the largest BTC holders of so-called whales (above 1,000 BTC) is at levels last seen in mid-2020. This may indicate that if the BTC price maintains momentum, the amount of BTC in whale portfolios will increase again. For the moment, however, the amount of cryptocurrency in the whales' wallets continues to fall, which could indicate their sending BTC to exchanges and continued risk aversion among the largest holders. A change in this trend would be a sign of the growing strength of the largest of cryptocurrencies. Source: Glassnode

Bitcoin, D1 interval. The price has approached $28,700, which coincides with the 61.8 Fibonacci abolition of the upward wave initiated in the spring of 2020. The RSI indicator indicates an overbought level signaling a possible correction. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.