Fed's Federal Open Market Committee (FOMC) announced its latest monetary policy today at 6:00 pm GMT. FOMC delivered a 25 basis rate hike with Fed Funds target rate being now in 0.25-0.50% range, in-line with market expectations. Median interest rate forecast in dot-plot moved higher and now suggests that Fed members expect an interest rate of 1.9% at the end of 2022 and 2.8% at the end of 2023. December's dot-plot pointed to a median expectations of 0.9%. Fed therefore sees a total of 6 rate hikes this year - in-line with current market pricing.

Initial market reaction was negative for indices with S&P 500 (US500) dropping 0.5% in a knee-jerk move. EURUSD dropped from around 1.0985 to around 1.0950. However, those moves were quickly erased.

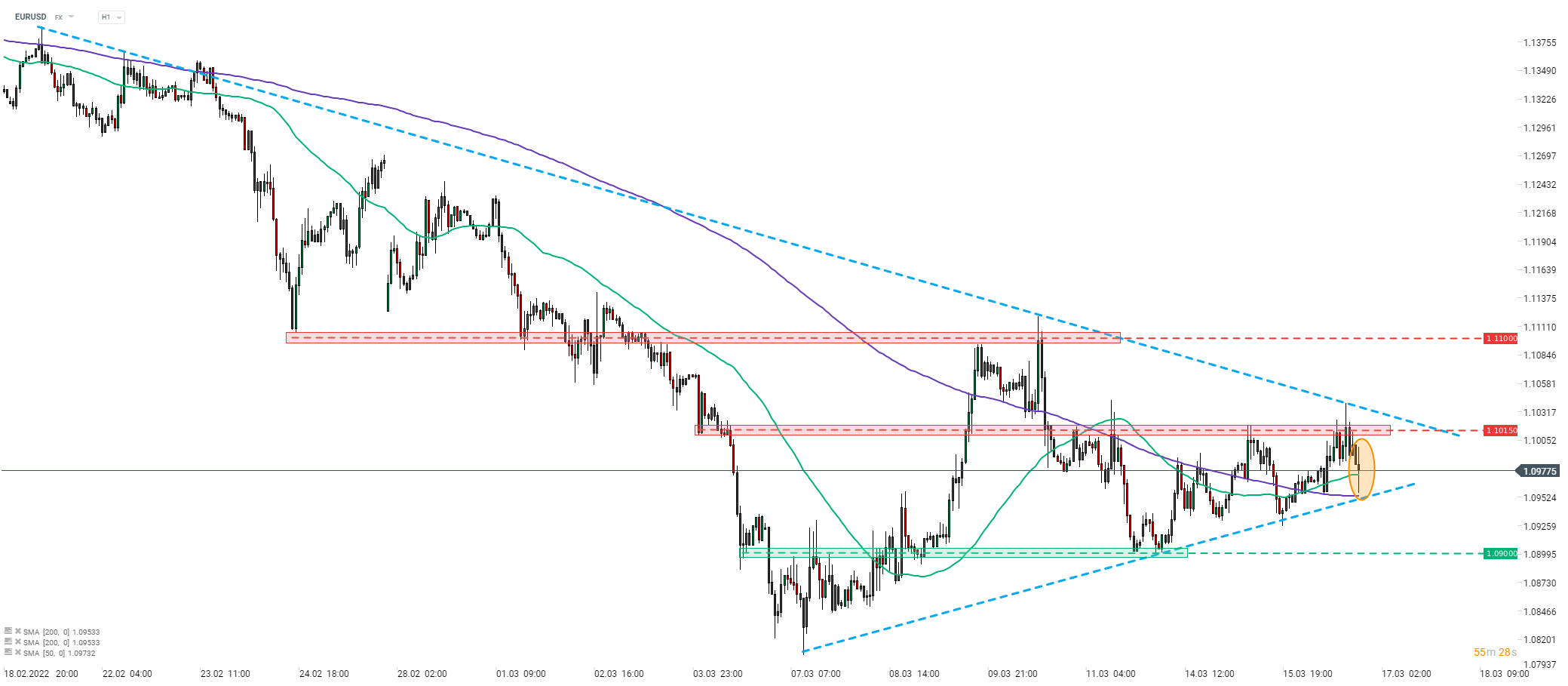

EURUSD dipped in knee-jerk move but has since recovered all of post-decision losses. Source: xStation5

EURUSD dipped in knee-jerk move but has since recovered all of post-decision losses. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.