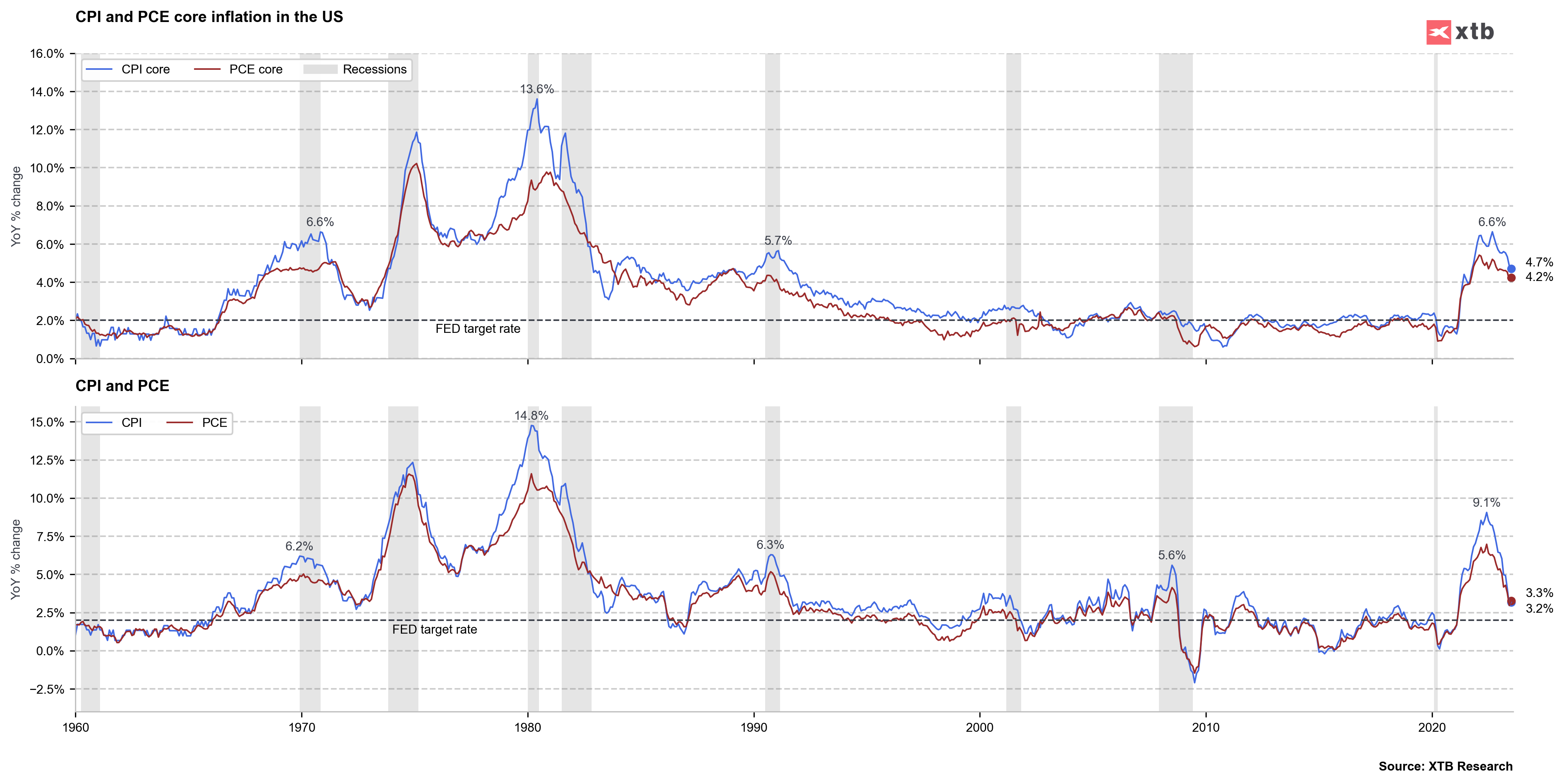

US Core PCE Price index y/y: 4,2% exp. 4,2% vs 4,1% previously

US PCE Price index: 3,3% exp. 3,3% vs 3% previously

US PCE Price index m/m: 0,2% exp. 0,2% vs 0,2 previously

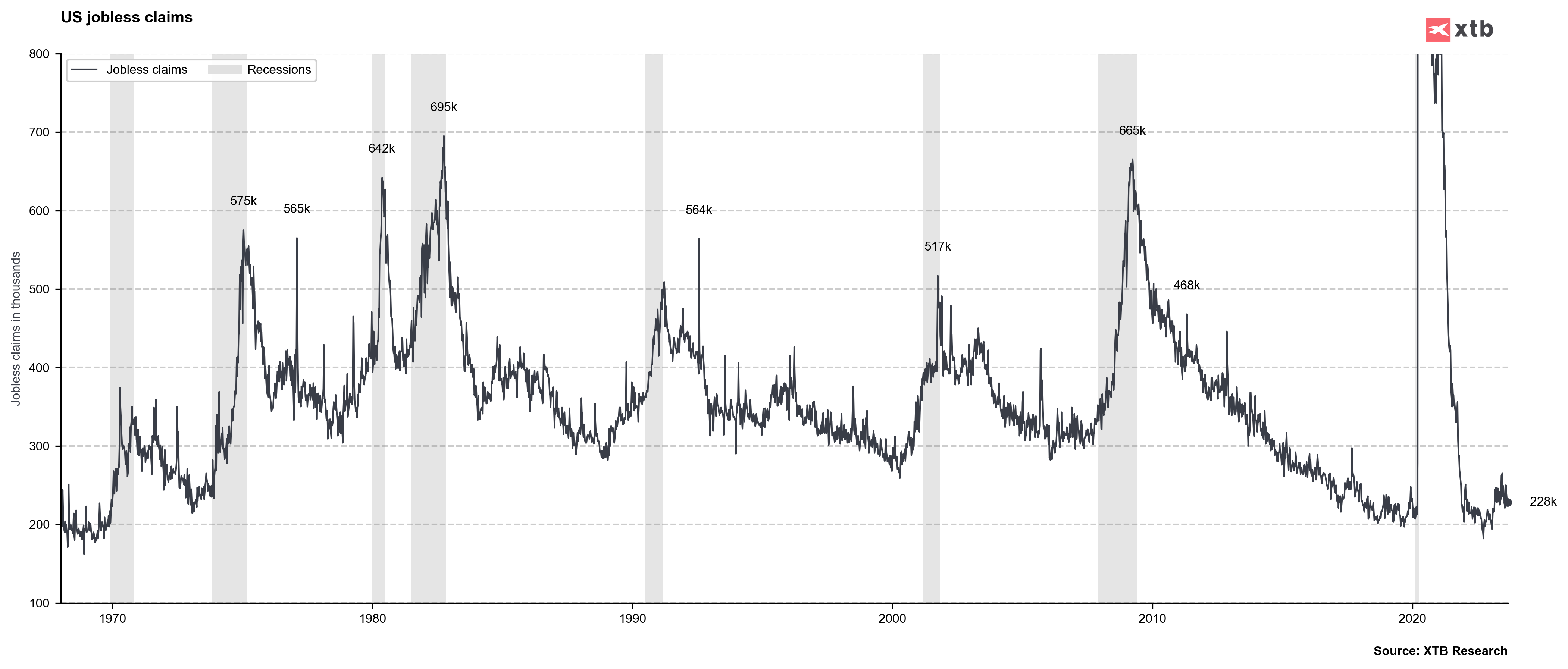

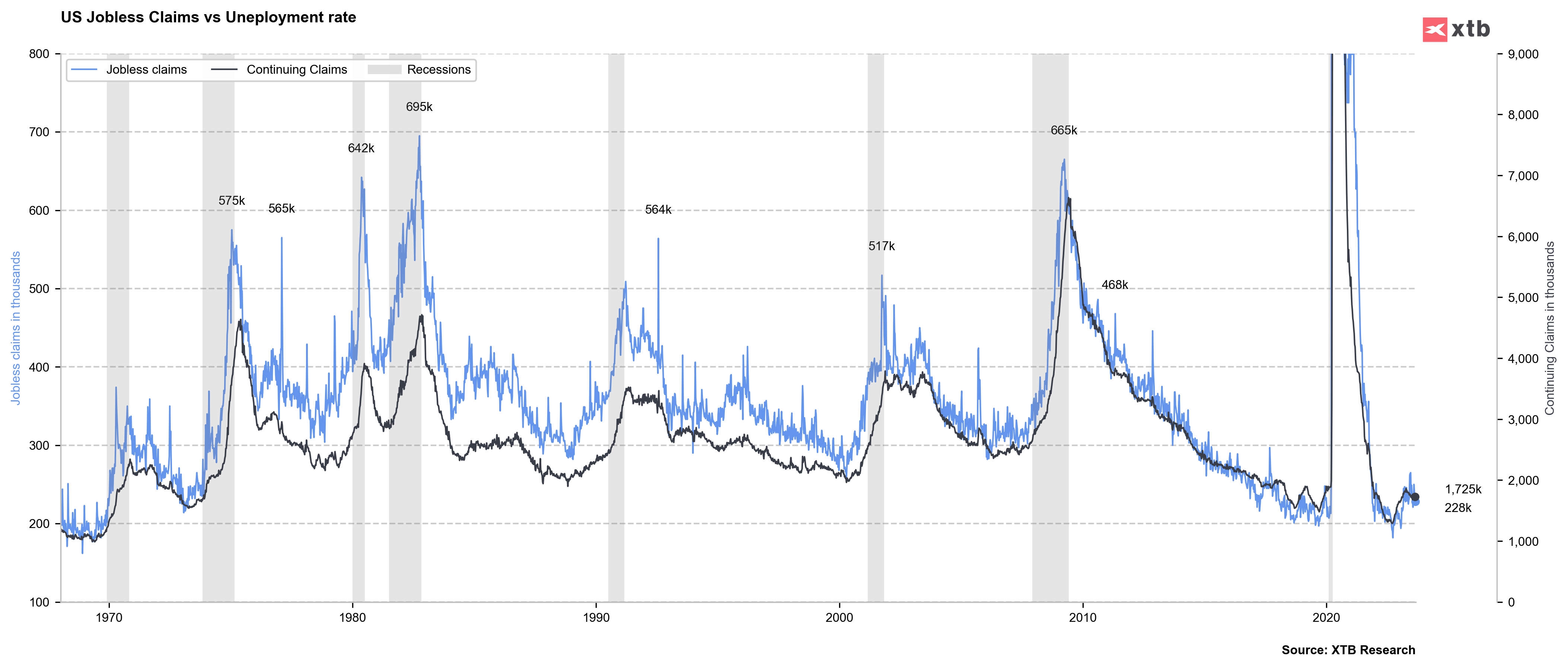

US Initial jobless claims: 228k exp. 235 k vs 230 k previously

US Continued jobless claims: 1,725 mln exp. 1,706 mln vs 1,702 mln previously

US Personal income m/m: 0,2% exp. 0,3% vs 0,3% previously

US Personal consumer spending m/m: 0,8% exp. 0,7% vs 0,5% previously

US Real Personal Consumption m/m: 0,6% exp. 0,5% vs 0,4% previously

In first reaction after new US data US500 falls down slightly but reading was quite good for the stock market. Lower claims signalize that job market is still strong and important for Fed PCE data came in line with Wall Street expectations (July PCE inflation was higher than in June due to underlying y/y factors). At the same time real US personal consumption is slighlty higer than expected and faster than before (0,6% vs 0,4% previously). It's worth noting that Challenger report (layoffs) today came in 75,151 reading vs 23,697 expected. Tomorrow's US Non-farm payrolls (NFP) report will be the most important reading this week.

Source: xStation5

Source: xStation5

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Daily Summary: The Supreme Court halts Trump's tariffs; but for how long?

Trump will hold a press briefing on the Supreme Court's tariff decision in 12 minutes 💡

Disappointment for Trump, Resilience for Everyone Else: The Truth About US GDP 🇺🇸

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.