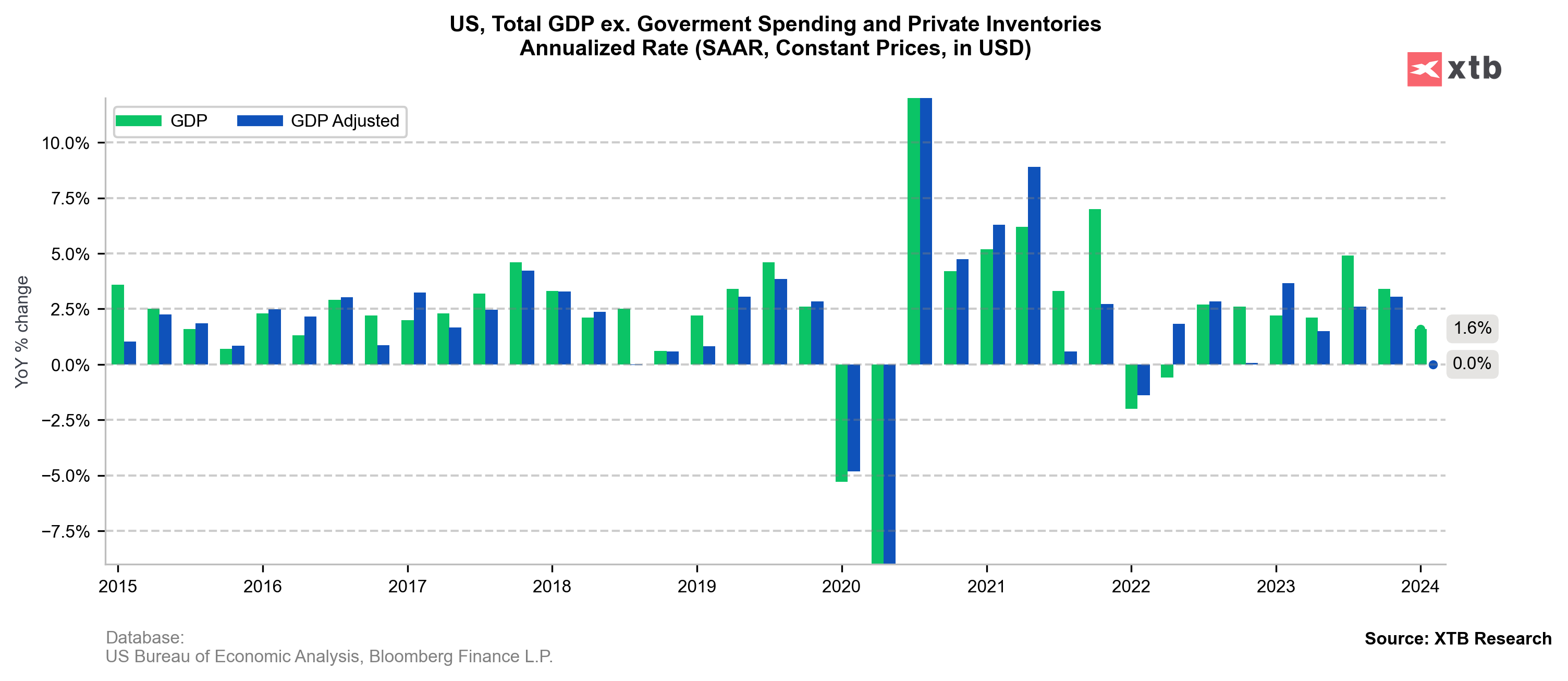

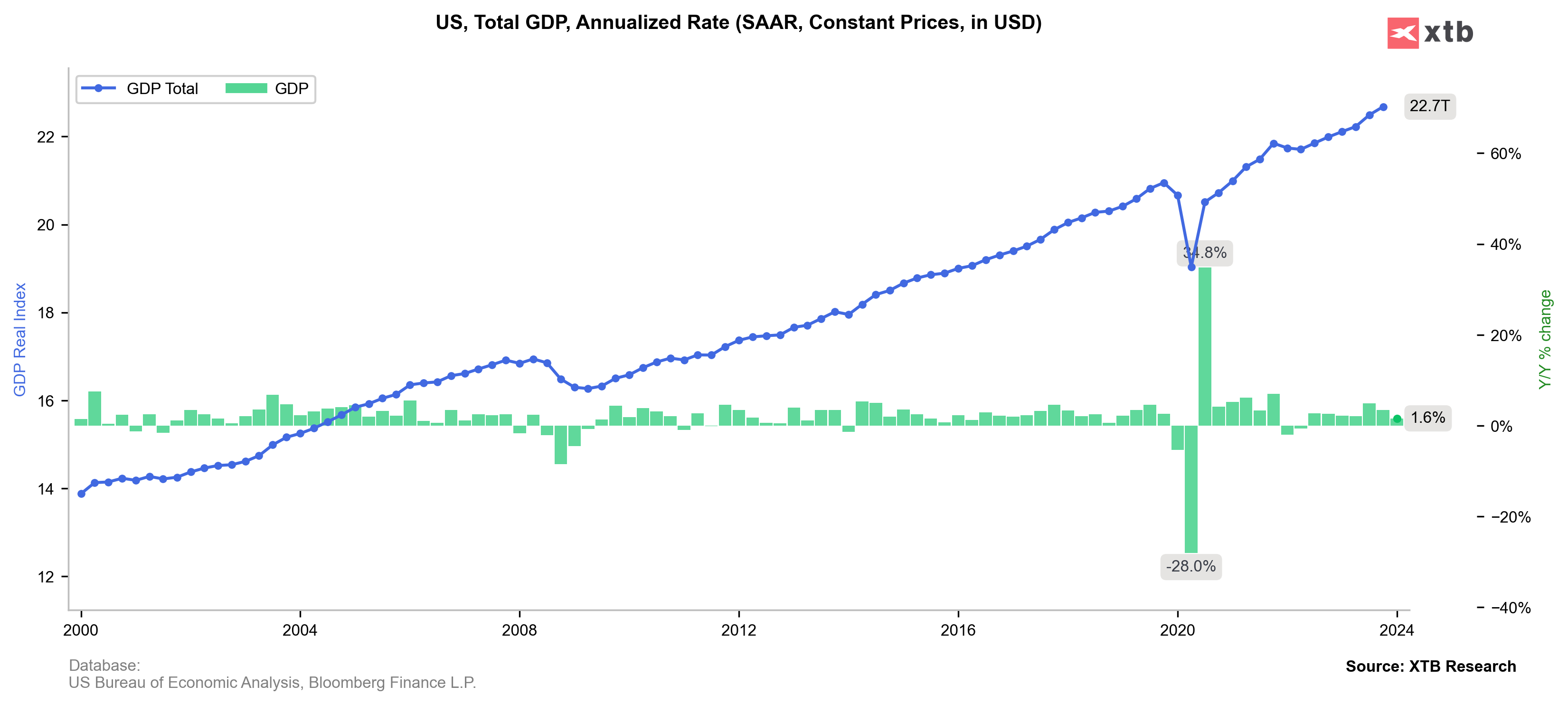

US GDP (Q1) QoQ advance: 1.6% vs 2.5% exp. and 3.4% previously (GDP deflator seasonally adjusted: 3.1% vs 1.7% previously)

- US GDP price index: 3.1% vs 3% exp. vs 1.6% previously

- US Core PCE prices advance: 3.7% vs 3.4% exp. vs 2% previously

US jobless claims: 207k vs 215 k exp. and 212 k.previously

- Continued jobless claims: 1,781 k vs 1,8135 k exp. vs 1,812 k previously

US Wholesale inventories: -0.4% vs 0.3% MoM vs 0.5% previously

- Retail inventories: -0.1% vs 0.4% previously

US Advance goods trade balance: -91,83 bln USD vs -91 bln USD exp. and -90,3 bln USD previously

US100 loses after the important US data

After weaker than expected GDP data with very low jobless claims and higher than expected price index, futures on Nasdaq 100 (US100) weakened as traders expect Fed members to be pressured and hawkish, despite not as strong as expected American economy momentum. The biggest risk is of course as higher prices meaning inflationary pressure.

Source: xStation5

Source: xStation5

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.