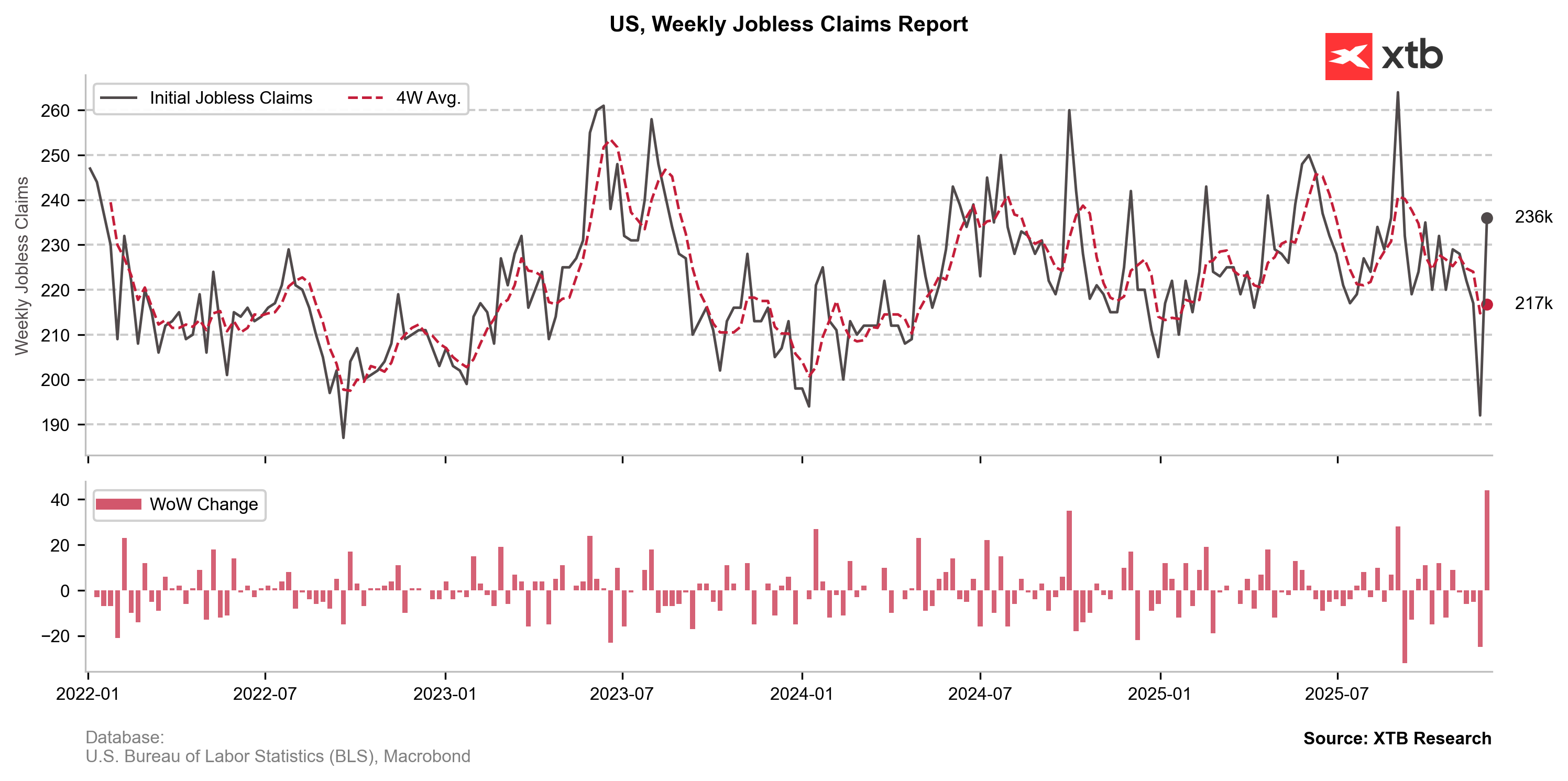

US Initial Jobless Claims: 236k (Forecast 220k, Previous 191k, Revised 192K)

- US Continued Jobless Claims: 1.838M (Forecast 1.938M, Previous 1.939M, 1.937M)

US Trade Balance Actual -52.8B (Forecast -63.1B, Previous -59.6B, Revised -59.3B)

Jobless claims rose by the largest since the 2020 COVID-19 pandemic (44,000), but that reading followed the lowest level since 3 years in the last week. However, the average from those two reports is almost 215k, which is still quite low number.

On the other side, the US trade deficit came in at the lowest level since June 2020; export rose by 5.7% while import fell by 3.7%. The report may boost US GDP in Q3, which will be supported also by inventories' drawdown.

EURUSD weakens slightly despite weaker than expected jobless claims report. However, the overall jobless claims report is not supportive for the US dollar.

Source: xStation5

Source: Bureau of Labor Statistics (BLS), Macrobond

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion

Economic calendar: PMI data in focus 💡

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.