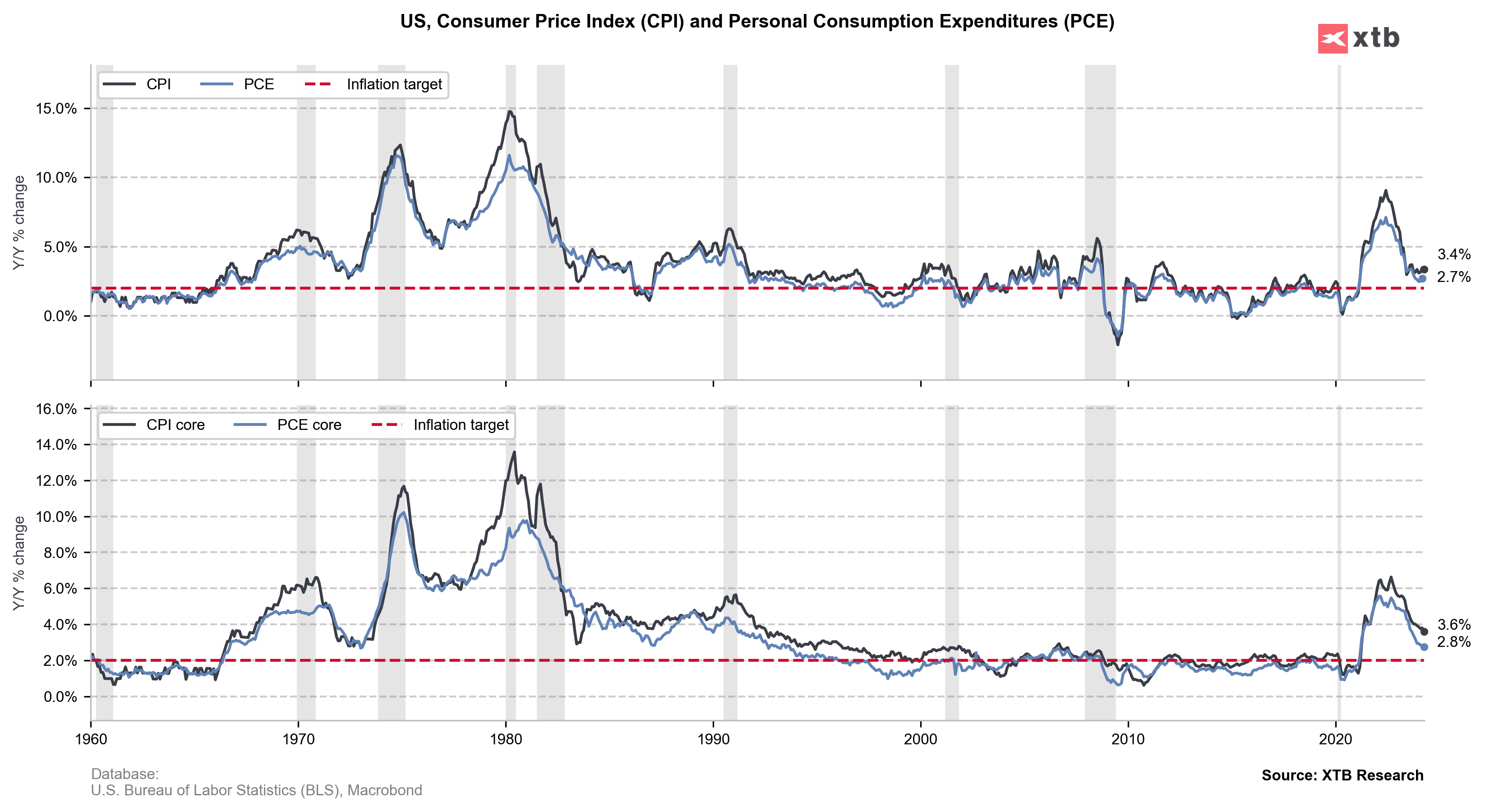

US PCE data (for April)

- Headline (annual). 2.7% Expected: 2.7% YoY. Previous: 2.7% YoY

- Headline (monthly). 0.25% Expected: 0.25% MoM. Previous: 0.3% MoM

- Core (annual). 2.8% Expected: 2.76% YoY. Previous: 2.8% YoY

- Core (monthly). 0.249% Expected: 0.25% MoM. Previous: 0.3% MoM

- US personal income. 0.3% Expected: 0.3% MoM. Previous: 0.5% MoM

- US consumer spending. 0.2% Expected: 0.3% MoM. Previous: 0.8% MoM

- US PCE real personal consumption. -0.1% Expected: 0.1% MoM. Previous: 0.5% previously MoM

US short-term interest-rate futures rise after US PCE data released. Traders are adding bets on Fed rate cuts. Data showed slowed spending and weakening real consumption may be a signal of slightly weakening consumers.

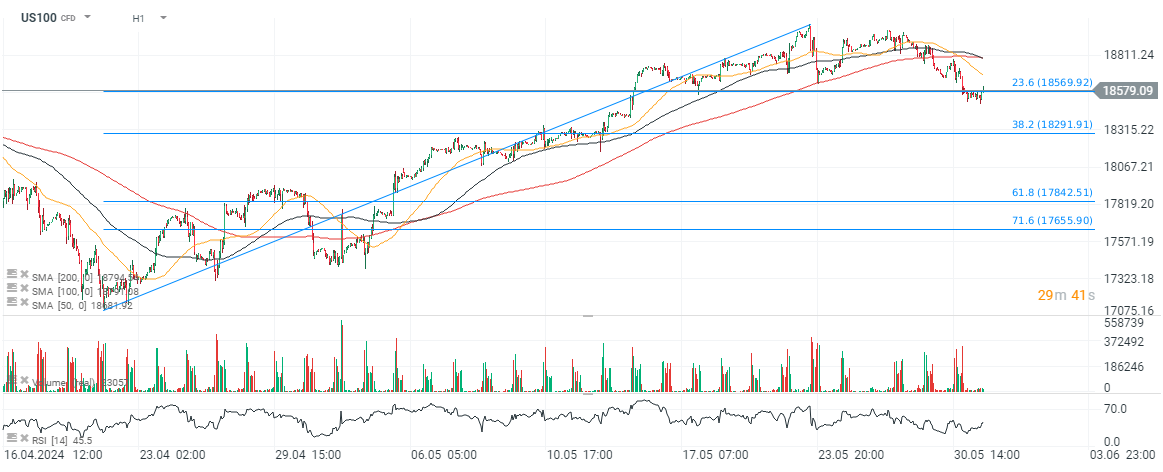

US100

Source: xStation5

Source: xStation5

Source: BLS, Macrobond

Source: BLS, Macrobond

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.