US retail sales data for May was released at 1:30 pm BST today, the final piece of top-tier US data scheduled for this week. However, as the FOMC meeting is already behind us, the impact of the data release on the market was rather limited.

Actual data turned out to be better than the market expected. Headline retail sales beat expectations, core retail sales (ex-autos) came in-line while core-core retail sales (ex-autos & gas) also came in above expectations. Report highlights strength of the US consumer, which is an argument for Fed to continue with rate hikes in order to bring inflation down.

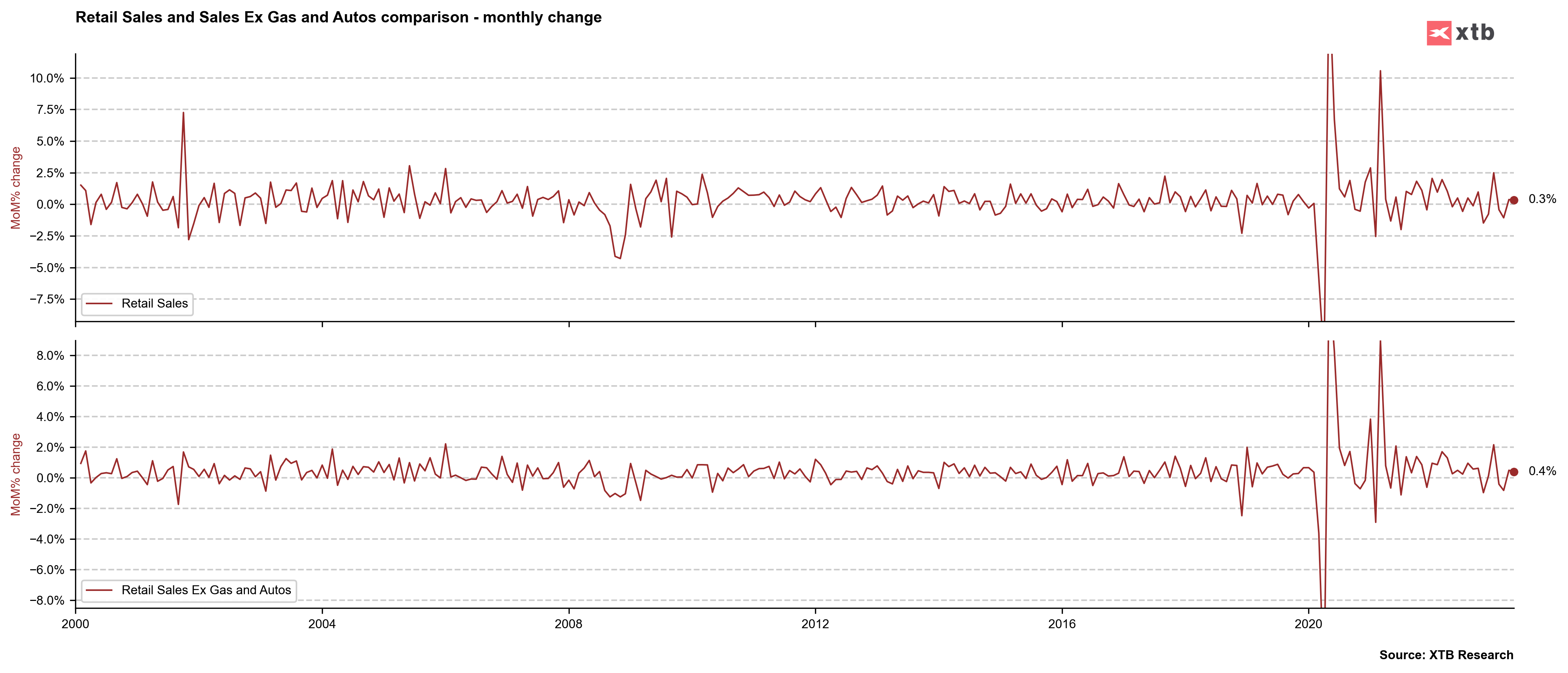

US, retail sales for May

- Headline: +0.3% MoM vs -0.1% MoM expected (+0.4% MoM previously)

- Ex-autos: +0.1% MoM vs +0.1% MoM expected (+0.4% MoM previously)

- Ex-autos & gas: +0.4% MoM vs +0.2% MoM expected (+0.6% MoM previously)

USDJPY dipped following US retail sales release and moved below 50-period moving average on 15-minute interval (green line). Source: xStation5

Source: Macrobond, XTB Research

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.