The next monetary policy decision by the European Central Bank will be announced this Thursday at 1:15 pm BST. Press conference of ECB President Lagarde will follow half an hour later at 1:45 pm BST. Another rate hike looks certain but the market seems divided between 50 and 75 basis points. In both cases it would be a major hike from a traditionally-dovish central bank. What to expect from the upcoming ECB meeting?

ECB dilemma

The European Central Bank has a tough decision to make - should the bank hikes rates even if it means pushing the euro area economy into recession? Price stability is ECB's main mandate and getting hold of inflation should be a top priority, especially as flash estimates of European HICP inflation for August jumped to a record 9.1% YoY. Some say that this is mostly supply-side inflation and therefore the central bank couldn't prevent it. This is true but it does not mean that the bank should now sit idle and watch as things develop. Tightening policy will help prevent the emergence of a price-wage spiral, that would make things worse.

What do ECB members say?

ECB members seem to understand the dilemma they face and seem ready to make tough decisions. Isabel Schnabel was among the first to deliver a strong hawkish statement - she said during the Jackson Hole Symposium that ECB should hike rates even if it means pushing the economy into recession and risking an increase in unemployment. A number of other ECB members followed suit, suggesting that a 75 basis points rate hike in September is the right move. ECB Chief Economist Lane was more dovish, advocating for a gradual tightening rather than front-loading of rate hikes.

Hawkish camp in ECB is growing with more and more Governing Council members advocating for quick and big rates hikes in order to get inflation under control. Source: Bloomberg

Hawkish camp in ECB is growing with more and more Governing Council members advocating for quick and big rates hikes in order to get inflation under control. Source: Bloomberg

Can ECB save the euro?

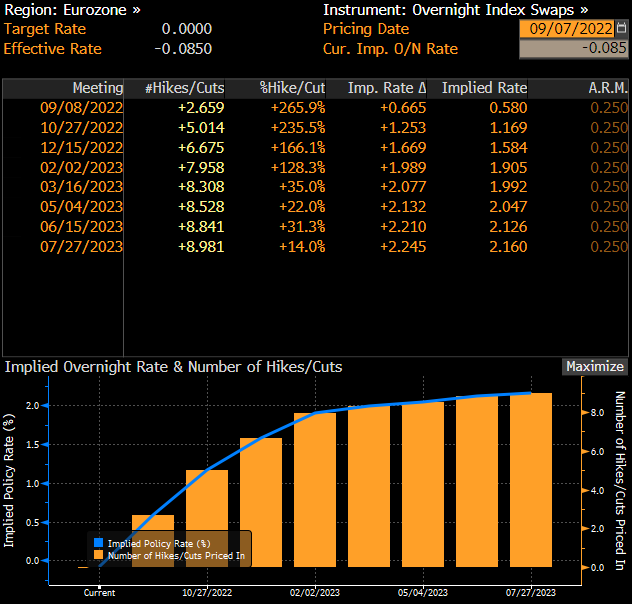

Majority of economists polled by Bloomberg expect the European Central Bank to deliver a 75 basis point rate hike at a meeting on Thursday, putting the ECB Deposit Facility Rate at 0.75%. Money markets are also inching towards such an outcome with 66 basis points of tightening currently priced-in.

Money markets price in 66 basis point of tightening for the upcoming ECB meeting. Source: Bloomberg

Money markets price in 66 basis point of tightening for the upcoming ECB meeting. Source: Bloomberg

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Regardless of whether ECB hikes by 50 or 75 basis points, it would be a big move from a usually-dovish ECB. Still, euro continued to suffer and failed to catch a bid even as expectations got more and more hawkish. Having said that, euro may struggle even if a 75 basis point rate hike is delivered, and a bigger rate hike than that is almost out of the question. Meanwhile, questions on the exchange rate are almost certain given that EURUSD dropped below parity level since the ECB's meeting in late-July. For years ECB said it does not target any specific exchange rate and while this likely remains true, ECB members are more and more often expressing their dissatisfaction with where euro trades.

However, it should be said that the ECB's slow policy response is not entirely to blame for euro's underperformance. Recession fears stemming from the ongoing energy crisis are the main driver of EUR weakness. These are unlikely to fade anytime soon and given that the EU is inching towards a pandemic-style response to the energy crisis, effects of ECB policy tightening may be diluted or offset completely. Summing up, even rate hike front-loading by ECB may have an only short-term impact on the common currency's valuation.

A look at the markets

EURUSD

Main currency pair dropped below parity levels in late-August. While there were attempts to recover from the slump, movements on the pair have been largely limited to the 0.99-1.01 range. However, a drop to fresh lows was made earlier this week with the pair reaching 0.9870 on Tuesday. Hawkish message from the ECB may provide a lift for the pair in the short-term but in order for EUR to outperform the USD over a longer period, fundamentals should favor the common currency and this is not the case (i.e. energy crisis).

EURUSD at H1 interval. Source: xStation5

EURUSD at H1 interval. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

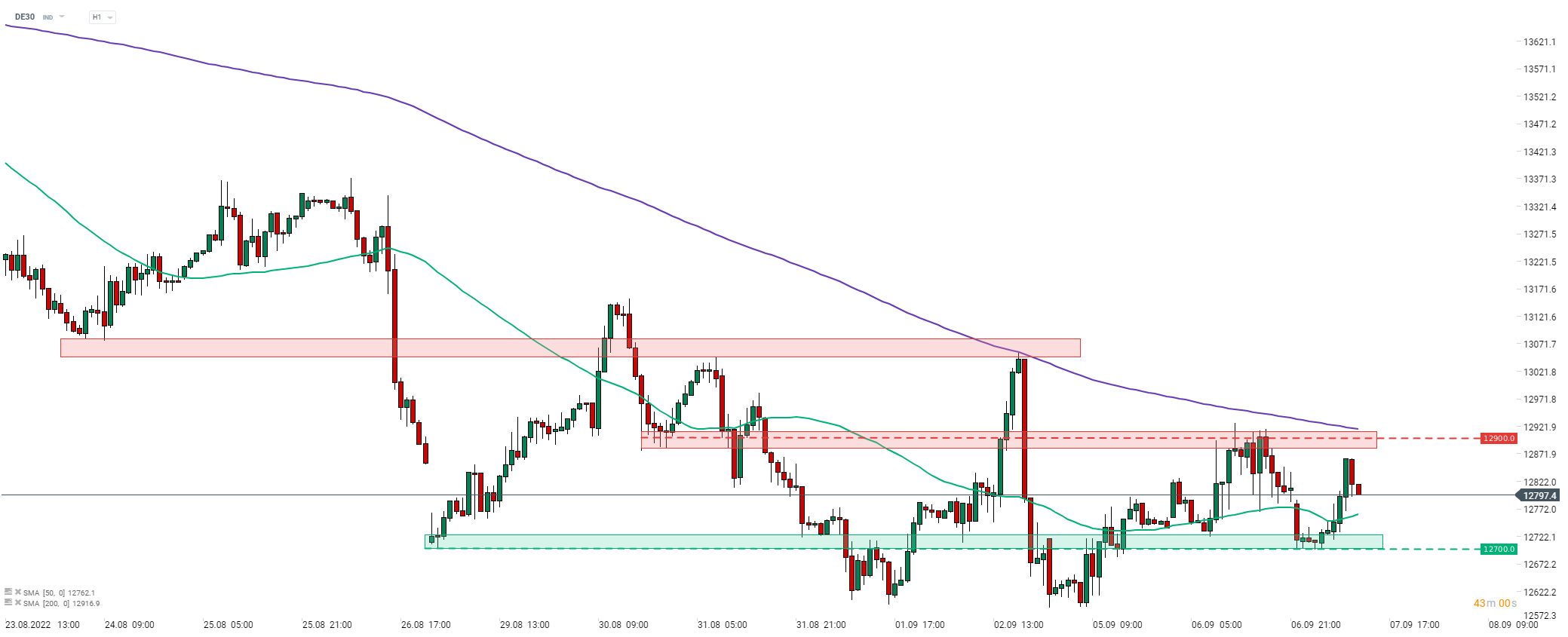

DE30

DE30 has almost fully erased the upward impulse that lasted between mid-July and mid-August. Recent attempts to launch an upward correction were halted by the short-term downward trendline as well as the 200-hour moving average (purple line). German index looks to be in wait-and-see mode ahead of ECB decision as it trades in a narrow 12,700-12,900 pts range since the beginning of the week. High energy prices and expectations of a slowdown or even recession in major European economies are weighing on the European indices but the ECB can do little about it. The European Union is preparing support mechanisms but there is no such thing as "free lunch" and the cost of such relief measures will need to be paid in the long term.

DE30 at H1 interval. Source: xStation5

DE30 at H1 interval. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.