AUDUSD is one of the pairs that may see some moves in the coming hours and days. The pair took a hit at the launch of this week's trading as China set a rather disappointing 2023 GDP growth target of 'around 5%'. This is because trading AUDUSD is often seen as a proxy China trade due to the Australian economy being highly dependent on demand from China, especially for its commodities.

The pair will likely also see some moves during the coming Asian session as the Reserve Bank of Australia is set to announce a monetary policy decision on Tuesday, 3:30 am GMT. Market expects a 25 basis point rate hike, to 3.60%. If confirmed, this would mark the fifth consecutive 25 basis point rate hike. Statement accompanying the latest decision noted that the RBA Board sees further rate hikes as appropriate and minutes from the latest meeting even showed that discussions were whether to hike by 25 or 50 bp. While a 25 bp rate hike looks like a done deal at a meeting tomorrow, a lot of attention will be paid to guidance and whether the RBA remains on a hawkish path.

When it comes to the US dollar, the currency may become more volatile on Tuesday and Wednesday when Fed Chair Powell delivers his semiannual testimony to Congress (3:00 pm GMT on both days, text release around 1:30 pm GMT on Tuesday). However, as Powell's speeches will come ahead of key US macro data, like NFP this Friday or CPI next week, it is widely expected that Powell will stick to his previous messaging and will not deliver any surprises.

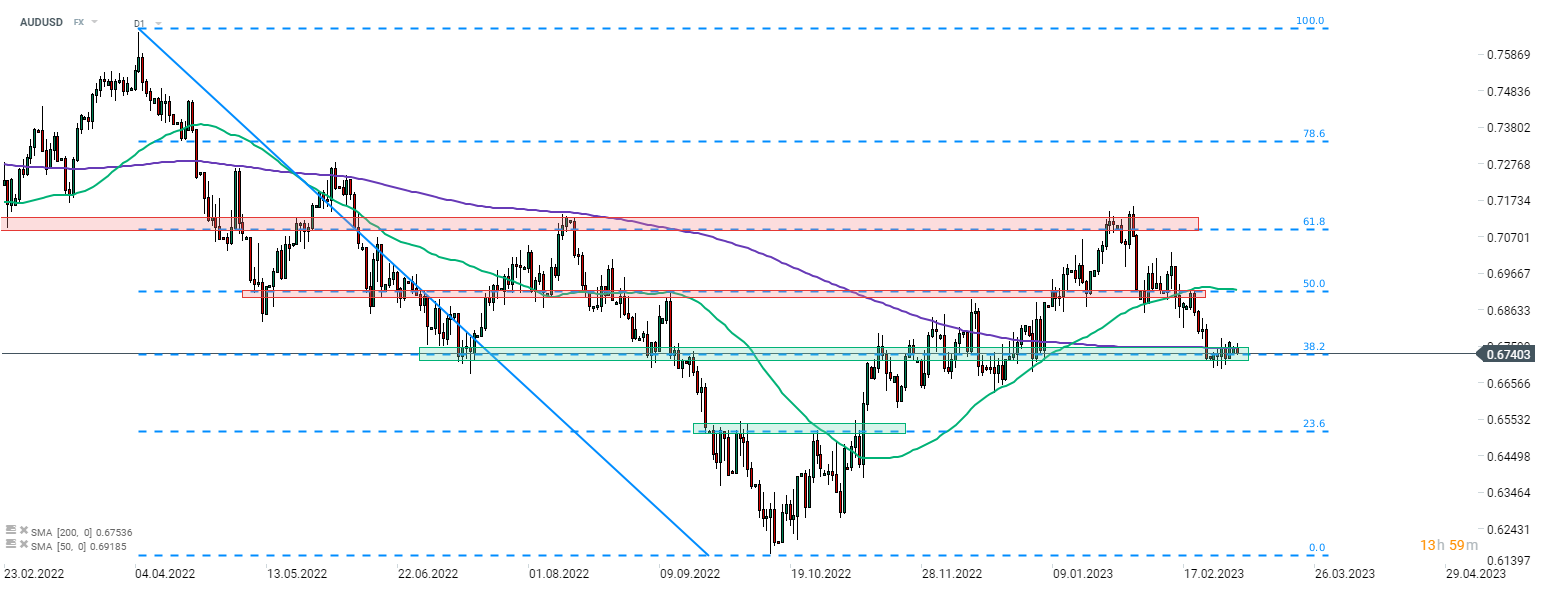

Taking a look at AUDUSD chart at D1 interval, we can see that the pair has been attempted to make a break below the 38.2% retracement of the downward move launched in April 2022 for a few days. No such break occurred yet but it cannot be ruled out, especially if RBA surprises with a dovish message, like for example hinting that rates are close to peak. On the other hand, defending this area would be a strong bullish signal and could pave the way for a recovery towards 50% retracement in the 0.6900 area.

Source: xStation5

Source: xStation5

Daily summary: A day without excitement on the markets

Banks recover after AI scare trade, as UK Gilts get boost from PM

The Week Ahead

Three markets to watch next week (13.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.