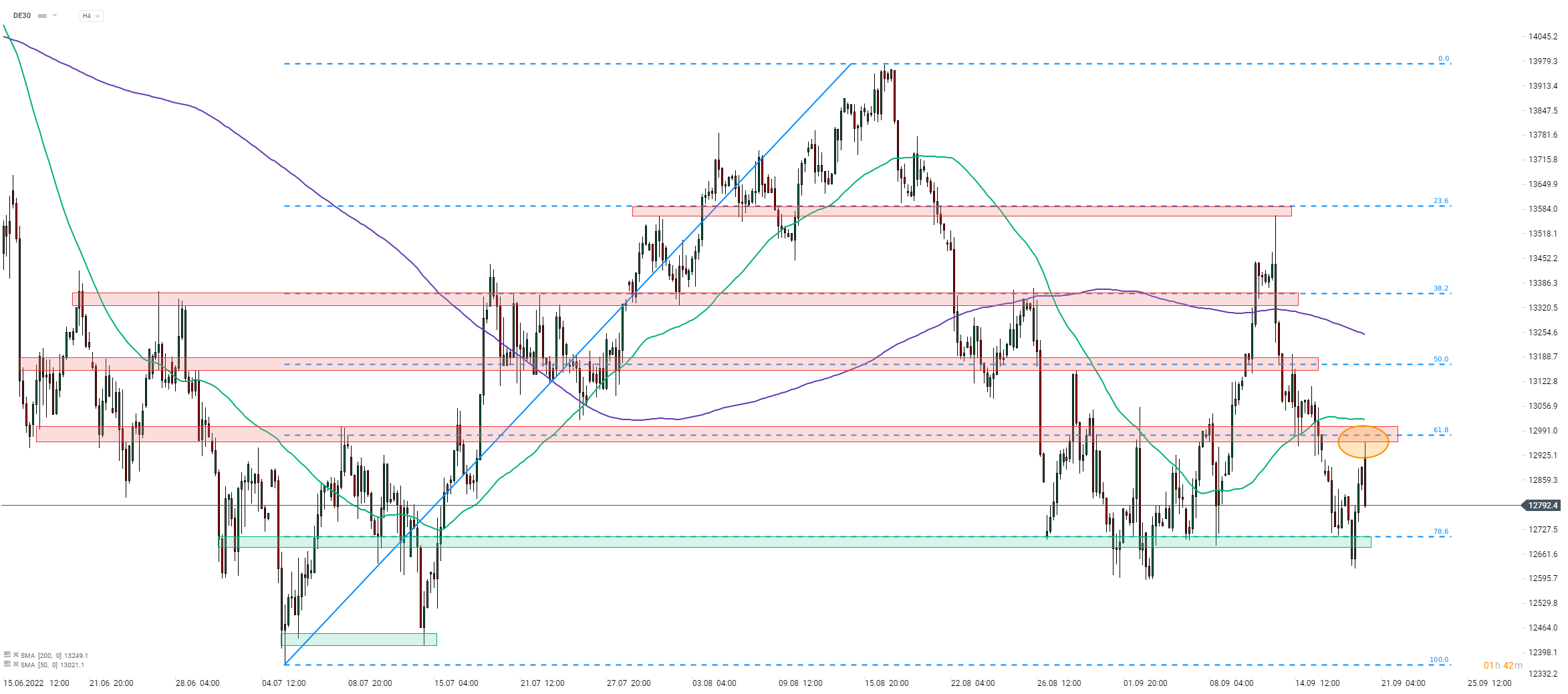

European indices halted recent downward move, triggered after the disappointing US CPI report last week, and managed to regain some ground at the beginning of a new week. However, this rebound looks to have halted today with the majority of blue chips indices from the Western Europe trading mixed. Taking a look at the DE30 chart at H4 interval, we can see that the German index turned lower today following a failed test of the resistance zone, marked with 61.8% retracement of the upward move launched in early-July 2022. The index is trading more than 150 points off a daily high already and should the ongoing pullback deepen, a test of the support zone marked with 78.6% retracement (12,700 pts area).

There are two main reasons behind sluggish performance of stock markets and neither of them is a new one. Firstly, the global economy is slowing. Secondly, central banks are tightening policy in order to combat inflation, what threatens to transform a slowdown into a recession. Riksbank went ahead of the curve today with a 100 basis point rate hike, signaling that it expects interest rates to raise further in the next 6 months. However, a key factor for risk-sentiment is upcoming Fed meeting (Wednesday, 7:00 pm BST), that may also result in a 100 bp rate move, although this is not the base case scenario.

Source: xStation5

Source: xStation5

Three markets to watch next week (20.02.2026)

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

Market Wrap: Europe is back to green 🇪🇺 📈 Business activity finally accelerating ❓

US500: US stocks lose momentum despite the strongest S&P 500 revenue growth in 3 years 📊

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.