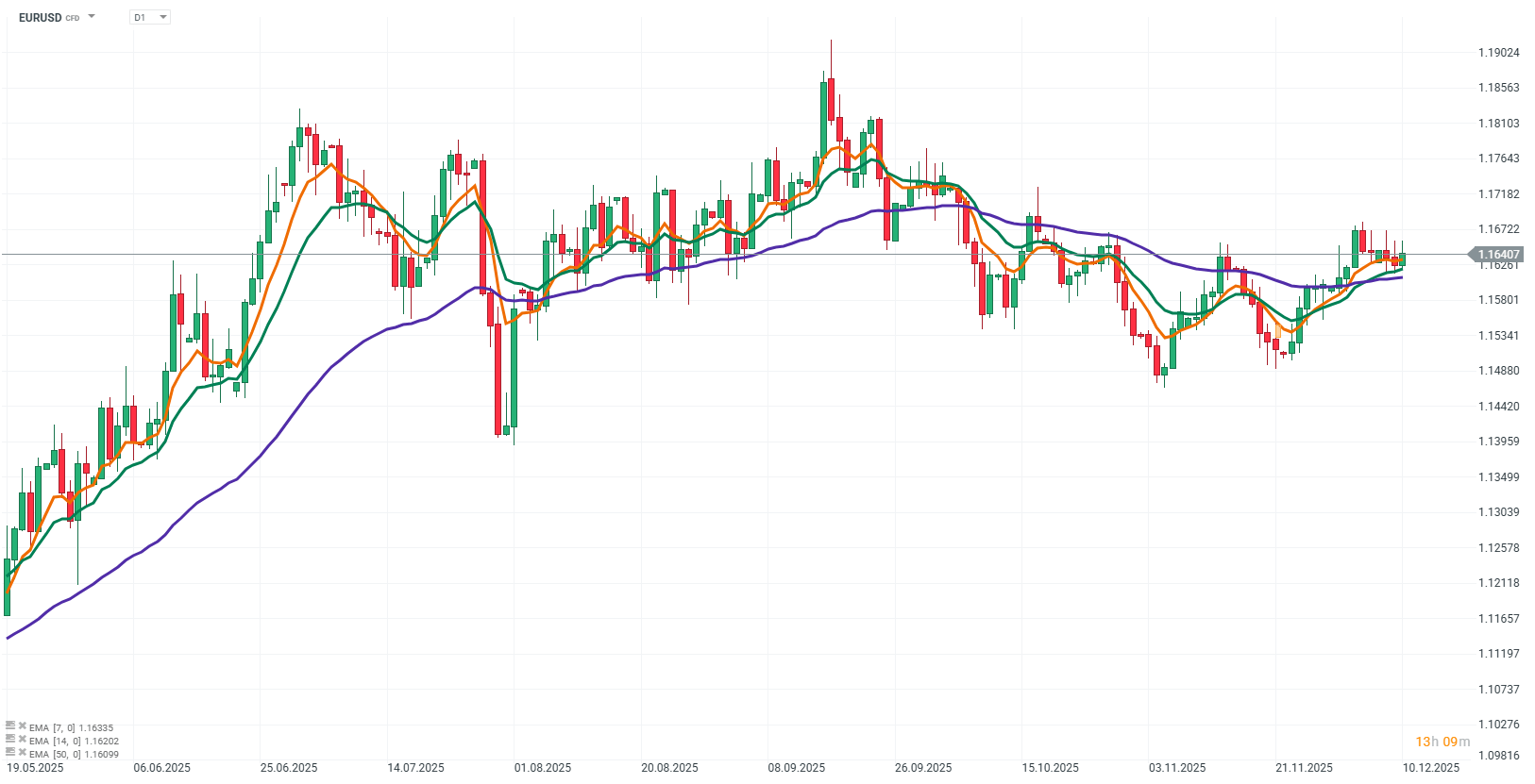

Today, the EUR/USD is trading near 1.164, moving within a relatively narrow range. Markets are holding back on larger positions ahead of the Fed's evening meeting. Slight pressure on the dollar, driven by expectations of possible rate cuts in the U.S., along with stable macro data from the Eurozone, provides moderate support for the euro. Nevertheless, the key factor remains the decision of the U.S. central bank and the accompanying press conference.

Source: xStation5

Factors shaping EUR/USD today

Expected Fed decision

The market is almost fully pricing in a 25 basis point rate cut, so the decision itself may have a limited impact on the currency pair. The most important aspect will be the tone of the statement and the rate projections for the coming year.

A dovish message could strengthen the euro against the dollar, pushing EUR/USD toward 1.1680–1.1730. Conversely, a more hawkish tone, emphasizing inflation risks and labor market stability, could support the dollar, causing the pair to fall toward 1.1615–1.1590 or lower. Markets will therefore closely monitor the nuances in Powell’s remarks.

Stable ECB guidance

The European Central Bank maintains a cautious and stable communication policy. ECB representatives, including Simkus, signal that there is no need for rapid changes in interest rates while inflation remains near target.

The absence of new stimuli from Frankfurt means that the euro is not receiving a clear boost from its own monetary policy. In practice, EUR/USD movements today are driven primarily by signals from the U.S., rather than local central bank statements.

Eurozone macro data

The lack of significant surprises provides moderate support for the euro, reinforcing the narrative of economic stabilization. However, these data do not create a strong trend-driving impulse for EUR/USD, and the main direction will remain dependent on the Fed’s decision and statement.

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Bitcoin jumps above $70k USD despite stronger dollar📈

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

Daily summary: Markets capitulate under the influence of the Persian Gulf

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.