The Nikkei (JP225) futures contract has enjoyed a strong bullish run, pushing the index to fresh all-time highs above the 43,000 mark for the first time in history and continuing to climb in recent sessions.

- Earlier gains were partially capped by mixed sentiment towards Japanese blue chips and automakers. However, today investors are once again optimistic about U.S.–Japan trade relations, supported by a favorable macroeconomic backdrop and solid corporate earnings from Japanese companies.

- Potential U.S. interest rate cuts could also provide a positive boost for Japanese businesses. Leading the rally are technology giant SoftBank, Sony Group, and semiconductor players Advantest and Renesas Electronics. Shares of premium tire maker Yokohama Rubber and footwear company Asics also surged following strong earnings.

- One ongoing risk for exporters is the potential appreciation of the yen, which appears increasingly likely should the U.S. embark on a series of rate cuts. However, if demand for Japanese goods holds or increases, strong order volumes could offset currency headwinds.

JP225 Chart (D1)

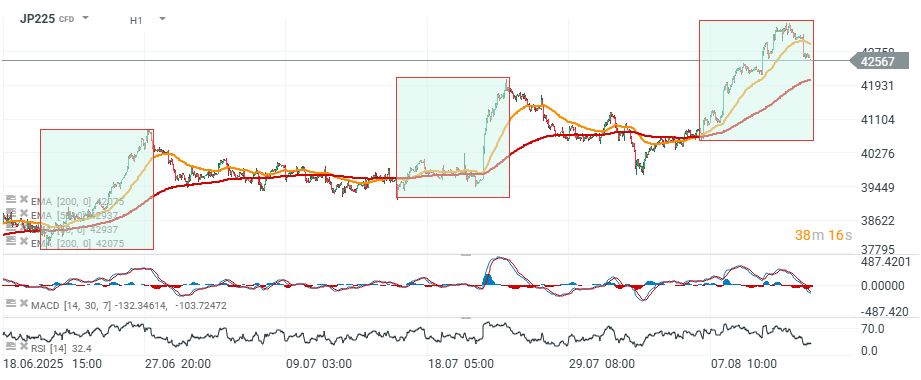

Today, sentiment is stabilizing and profit-taking is emerging, with the index down over 1% and retreating to its record 2024 levels. Volatility in JP225 may rise ahead of key U.S. macroeconomic releases this week (PPI, retail sales). The Nikkei’s RSI recently climbed above 70 (overbought territory) before easing to just under 65 today. On July 24, the RSI was also above 70, followed by four consecutive sessions of decline. Of course, such historical patterns are not a guarantee of future outcomes.

Source: xStation

JP225 Chart (H1)

Source: xStation5

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.