A three-day summit organized by the World Economic Forum began today in the Chinese city of Tijanjan. Chinese Premier Li Qiang spoke at it today. His comments on supporting the economy supported sentiment on Chinese indices. Investors have come to believe that a broader stimulus program is still on the table and could come as early as July. Qiang's comments on the matter came after ratings agency S&P Global lowered its forecast for China's economic growth to 5.2% from 5.5% previously. Earlier this year, the prime minister encouraged global capital to invest in China but geopolitical issues and a weakening economy are discouraging investors. Will Beijing turn over at least one of these cards? Gains were made today by contracts on CHNComp as well as HKComp, which added nearly 1.5% today and is approaching a key resistance zone.

- Li Qiang assured that Beijing will support faltering economic growth and the forecast of a minimum 5% growth target is upheld. At the same time, the Chinese yuan strengthened as the PBOC is likely to consider moves to strengthen the currency;

- According to Qiang, economic growth in Q2 will be higher than in Q1, and policymakers will create more effective policies to stimulate demand and open Chinese markets. The Premier stressed that globalization remains very important to China and they will strive for an open global market;

- According to China's premier, more concrete stimulus programs are expected to be released in July - they will be designed to decisively stabilize the economy and give a strong boost in the third quarter of the year;

- The PBOC's actions, which sold dollars to strengthen the yuan, and the yuan's nearly 100 pips higher-than-Reuters forecasts fixed exchange rate, as well as Qiang's comments, have caused fears of further capital flight from China to drop somewhat and give way to hopes of a return to positive momentum after recent declines

- The family holding company of one of Hong Kong's richest businessmen offered to buy about 95% of the shares of a real estate development and construction company for $4.53 billion, further supporting sentiment in the Chinese stock market.

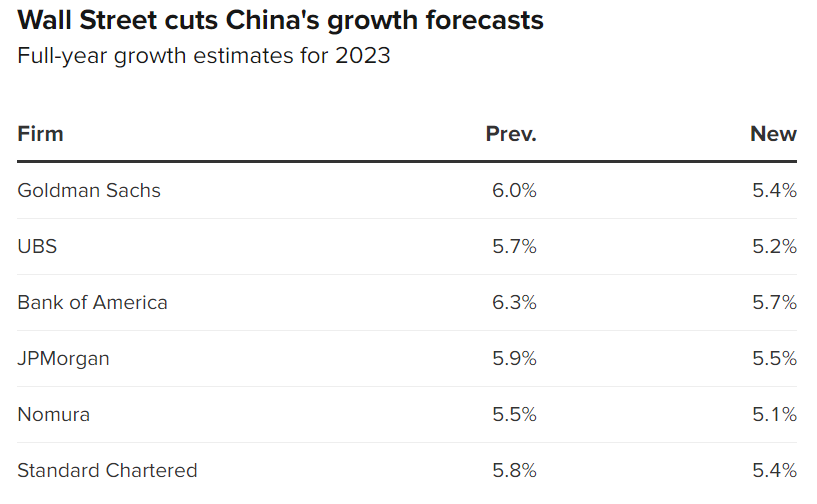

Financial institutions lowered forecasts for Chinese GDP growth, but the Q1 result of 4.5% growth beat analysts' forecasts. The Q2 GDP reading will be published in July. Source: CNBC

Financial institutions lowered forecasts for Chinese GDP growth, but the Q1 result of 4.5% growth beat analysts' forecasts. The Q2 GDP reading will be published in July. Source: CNBC

The HKComp index is approaching key resistance zone in the form of the SMA200 (red line). A break through the SMA50, SMA200 and the nearest Fibonacci retracement of the 38.2 upward wave from October could herald a more sustained return to the uptrend. Source: xStation5

The HKComp index is approaching key resistance zone in the form of the SMA200 (red line). A break through the SMA50, SMA200 and the nearest Fibonacci retracement of the 38.2 upward wave from October could herald a more sustained return to the uptrend. Source: xStation5

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

Market update: energy markets king, as US stock market sell off moderates

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.