Chinese index futures initially retreated following the release of weaker-than-expected economic data, but buyers are attempting to limit further declines, buoyed by the optimistic tone in global markets and expectations of stronger central-level support for China’s economy. Notably, while the data fell short of forecasts (and unemployment rose), retail sales still appear relatively solid.

- In July, China’s retail sales increased 3.7% y/y, below the forecast of 4.6% and the previous 4.8%. Industrial production rose 5.7% y/y, missing expectations of 6% and down from 6.8% in June. The unemployment rate climbed to 5.2%, up from 5% in June and above the forecast of 5.1%. Fixed-asset investment in urban areas grew 1.6% y/y, compared with an expected 2.6% and 2.7% in June.

- Recently reported results from JD.com were not enough to sustain optimism around the Chinese e-commerce giant, while Alibaba will release its earnings today, just a few hours before the U.S. market open. Hedge fund Bridgewater Associates, linked to Ray Dalio, sold all its Chinese equity holdings and positions in two Chinese ETFs—worth around USD 1.5 billion—in Q2.

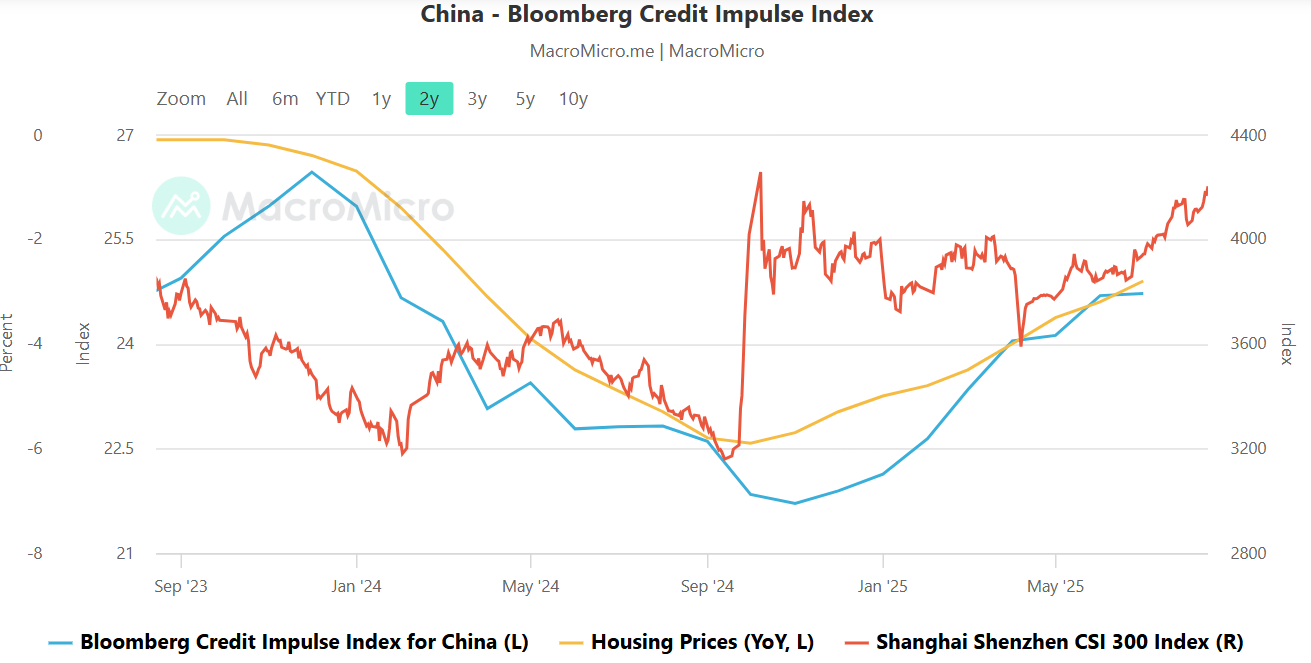

China’s credit impulse has been rising since roughly November 2024, supporting demand for Chinese assets and indicating the potential for a more sustained improvement in domestic economic conditions.

Source: MicroMacro, Bloomberg Finance L.P.

CHN.cash Index (Daily Interval)

Hang Seng futures (CHN.cash) are attempting to halt declines after selling pressure emerged around the 9,300 level, an area that has repeatedly triggered selling in the past. Chinese indices recently recorded their best weekly close in seven months.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.