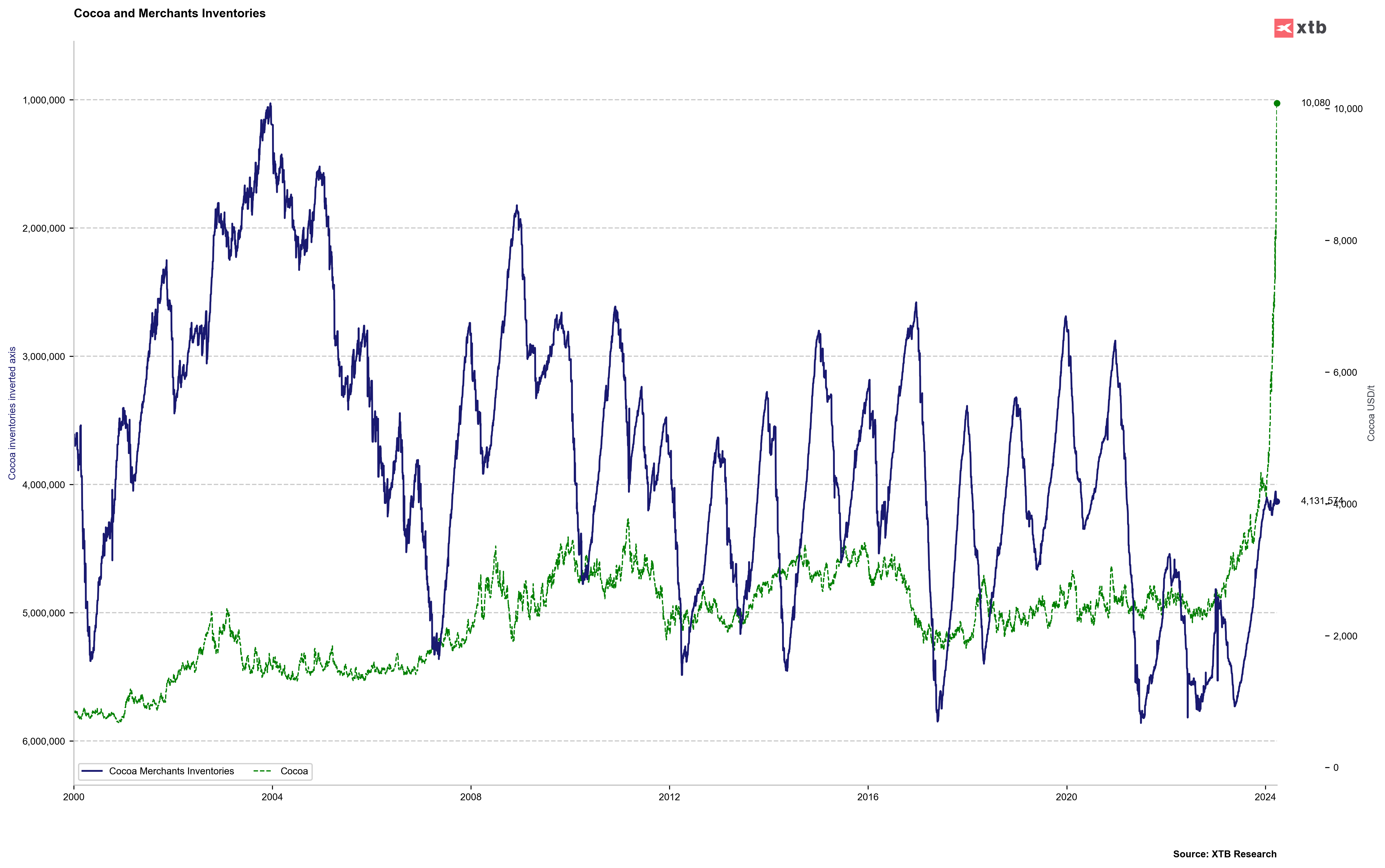

Rally on the cocoa market shows no signs of easing. Front-month cocoa futures (COCOA) jumped above $10,000 per ton for the first time in history today. Reasons behind the move higher remain unchanged, and are of fundamental nature. Poor crops in West Africa, a key cocoa producing region, are expected to lead to a third annual deficit in a row. While other growers like Brazil or Ecuador want to increase their production, it will take a couple of years before newly-planted cocoa trees bear fruit. Moreover, new environmental rules, that are about to be passed in the European Union, a key cocoa importer, are expected to further limit supplies. Cocoa stockpiles have been declining since the second half of 2023, but it is nowhere near the scale of the move on futures prices.

Source: Bloomberg Finance LP, XTB Research

Pace of the ongoing rally on cocoa market is truly astonishing. Cocoa futures trade 12% higher week-to-date, over 60% higher month-to-date and around 140% higher year-to-date. Over the past 12 months, prices climbed almost 270%! Having said that, it should not come as a surprise that cocoa looks overbought in the short- and long-term. Price is trading over 4 standard deviations above 1-year mean, one of the biggest deviations on the record. Commodity looks even more overbought on a long-term basis, with price trading 8 standard deviations above 5-year average.

Source: Bloomberg Finance LP, XTB Research

COCOA prices jump another 3.5% today and test $10,000 per ton area today for the first time in history. Seasonality patterns suggest that a period of relative calmness should begin, starting from April. Source: xStation5

COCOA prices jump another 3.5% today and test $10,000 per ton area today for the first time in history. Seasonality patterns suggest that a period of relative calmness should begin, starting from April. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.