Cryptocurrency prices are falling at Monday’s market open, tracking weakness in US index futures, with US100 down nearly 1 percent ahead of the ISM Manufacturing data scheduled for release at 16:00. Bitcoin is testing the 85,000 USD area and is trading almost 5 percent lower. Ethereum has retreated to 2,800 USD, losing nearly 10 percent from the peak of the latest rebound.

- On-chain data suggests that the market may be repeating the scenario seen in late 2021 and early 2022, when the broader crypto market entered a bear phase and hit its lows roughly 13 months after the initial sell-off in November 2021. If such a pattern were to repeat, it would imply that a meaningful recovery in the crypto market might not arrive until November 2026.

- In theory, Bitcoin could fall well below key on-chain levels in the 81,000 USD region, potentially dropping as low as 55,000 USD. If the price falls below 80,000 USD, this scenario will need to be considered a serious risk. However, if BTC finds the strength to return above 90,000 USD and, critically, 100,000 USD, the dominant scenario remains a continuation of the bull market.

Charts (Bitcoin and Ethereum), D1 interval

Bitcoin and Ethereum would currently need to rise almost 30 percent to test the 200-day EMA (red line) for both cryptocurrencies. In practice, this means that the combined market capitalisation of the two assets would need to increase by roughly 700 billion dollars (effectively several hundred billion dollars of net positive inflows into the crypto market) for this scenario to materialise. Without a sustained improvement in sentiment on Wall Street, the crypto market may struggle to regain momentum, while profit-taking among large holders and persistent demand for hedging via derivatives (options and futures) continues to make this scenario more difficult to achieve.

Source: xStation5

Source: xStation5

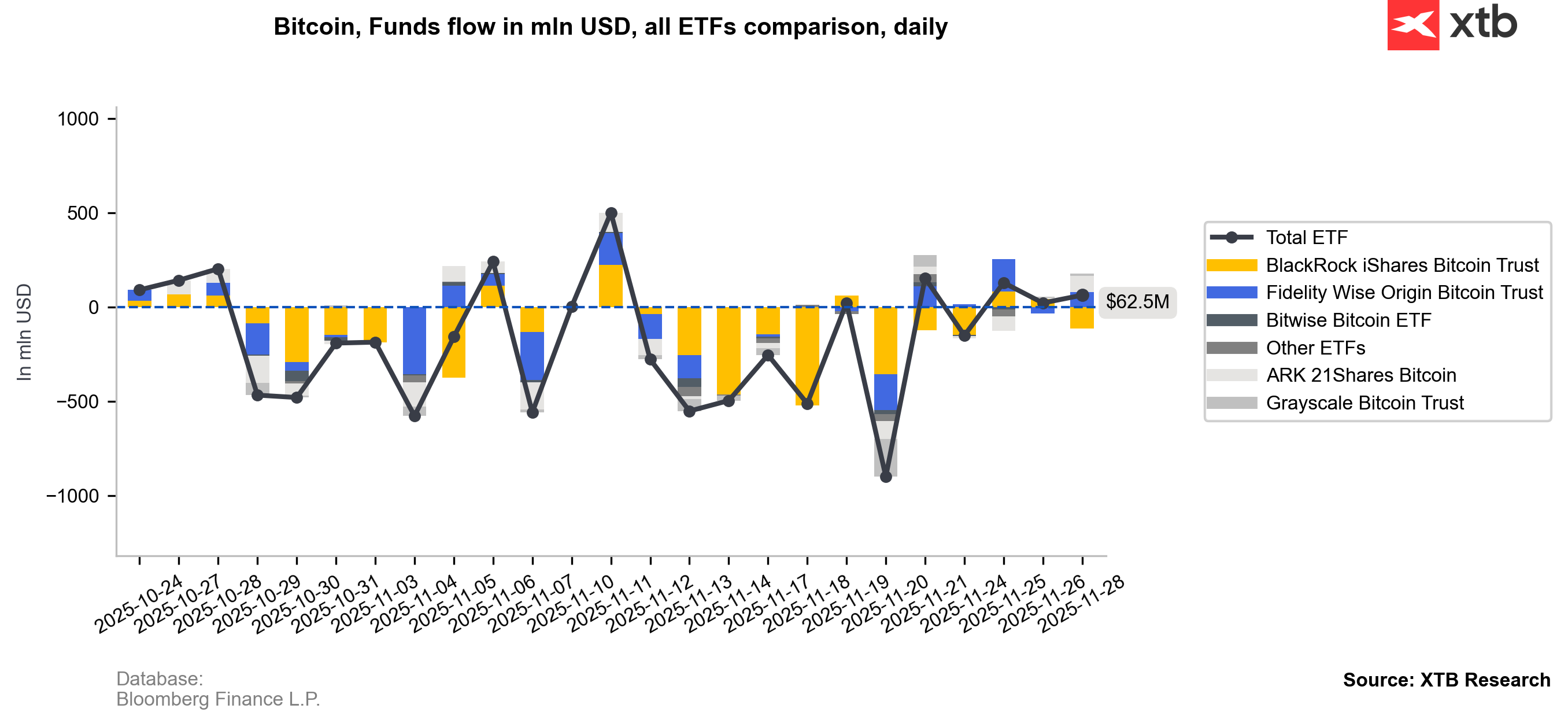

Net inflows into Bitcoin ETFs have recently been positive, but the scale of these inflows can be considered minimal compared to demand during the previous two deeper corrections, when the market was much more aggressive in buying the dips. This may also be a sign of demand exhaustion.

Source: Bloomberg Finance L.P.

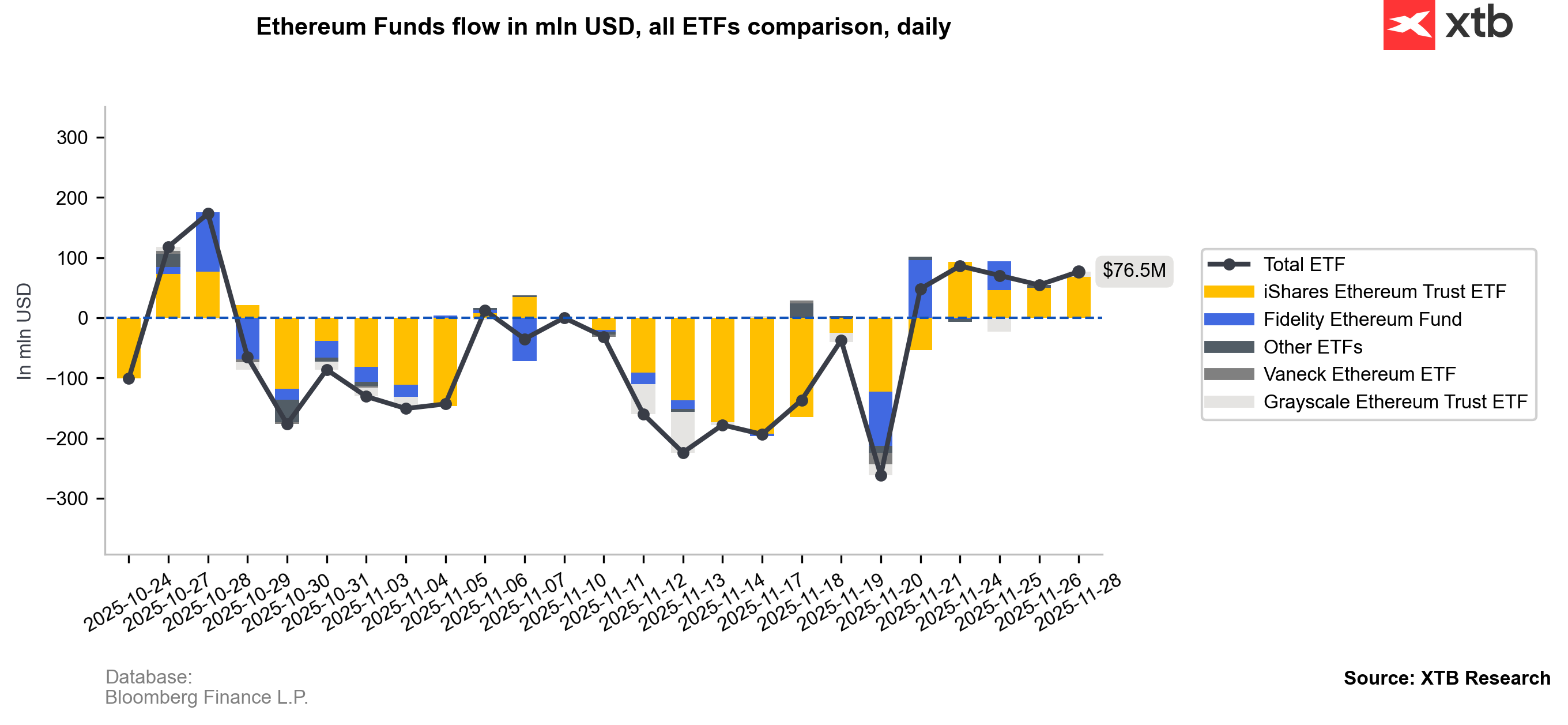

Ethereum inflows have been stronger, yet they still do not offset the market impact of the disastrous November, when over 1 billion USD worth of shares were redeemed from US spot ETFs.

Source: Bloomberg Finance L.P.

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.