Cryptocurrencies are posting clear declines on Monday, with Bitcoin retreating from around $96,000 to $92,000, in tandem with weakness in major stock indices and uncertainty linked to escalating trade tensions between the United States and Europe. This is another, so far relatively modest, deleveraging episode that does little to help crypto regain momentum and return to a bull market. If meaningful capital does not flow into the BTC market soon, Bitcoin may struggle to hold above $90,000.

For now, sentiment remains cautious, and it seems investors are unlikely to return to BTC with aggressive buying until the trend on Wall Street becomes more convincing. Digital assets have found themselves in a difficult spot, and if BTC does not move quickly back toward $100,000, the sector may start to be dominated by resignation and a sense that the “fuel” needed to restart the rally is running out.

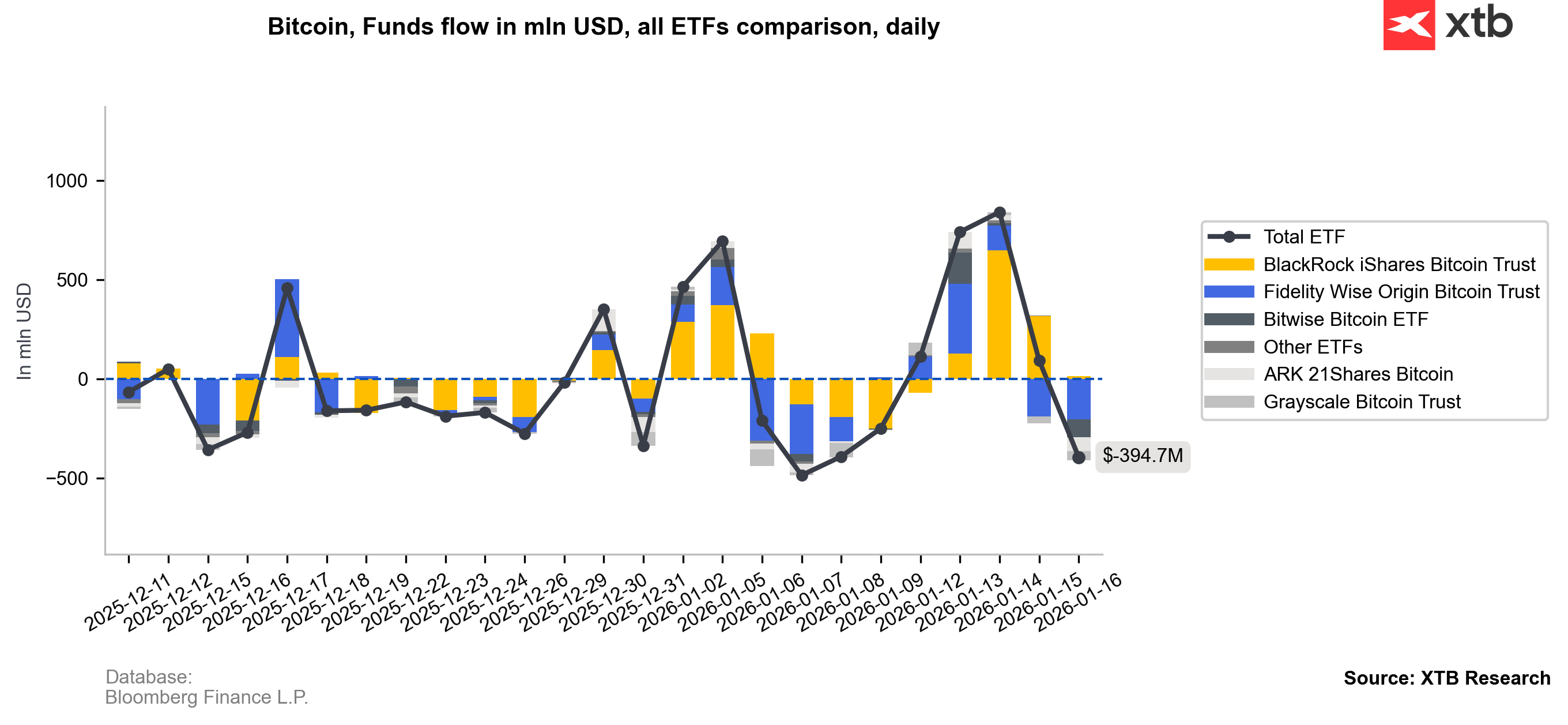

ETF funds without conviction

ETF funds used the latest rebound to sell BTC at higher prices around $95,000 to $96,000. Importantly, we saw two selling sessions in the Fidelity fund. BlackRock has continued to record mostly positive inflows for a long time, but the scale of fresh capital entering the market appears limited and is struggling to sustain the uptrend. According to CoinGlass data, liquidated long positions in the BTC market have already exceeded $525 million.

Source: Bloomberg Finance L.P., XTB Research

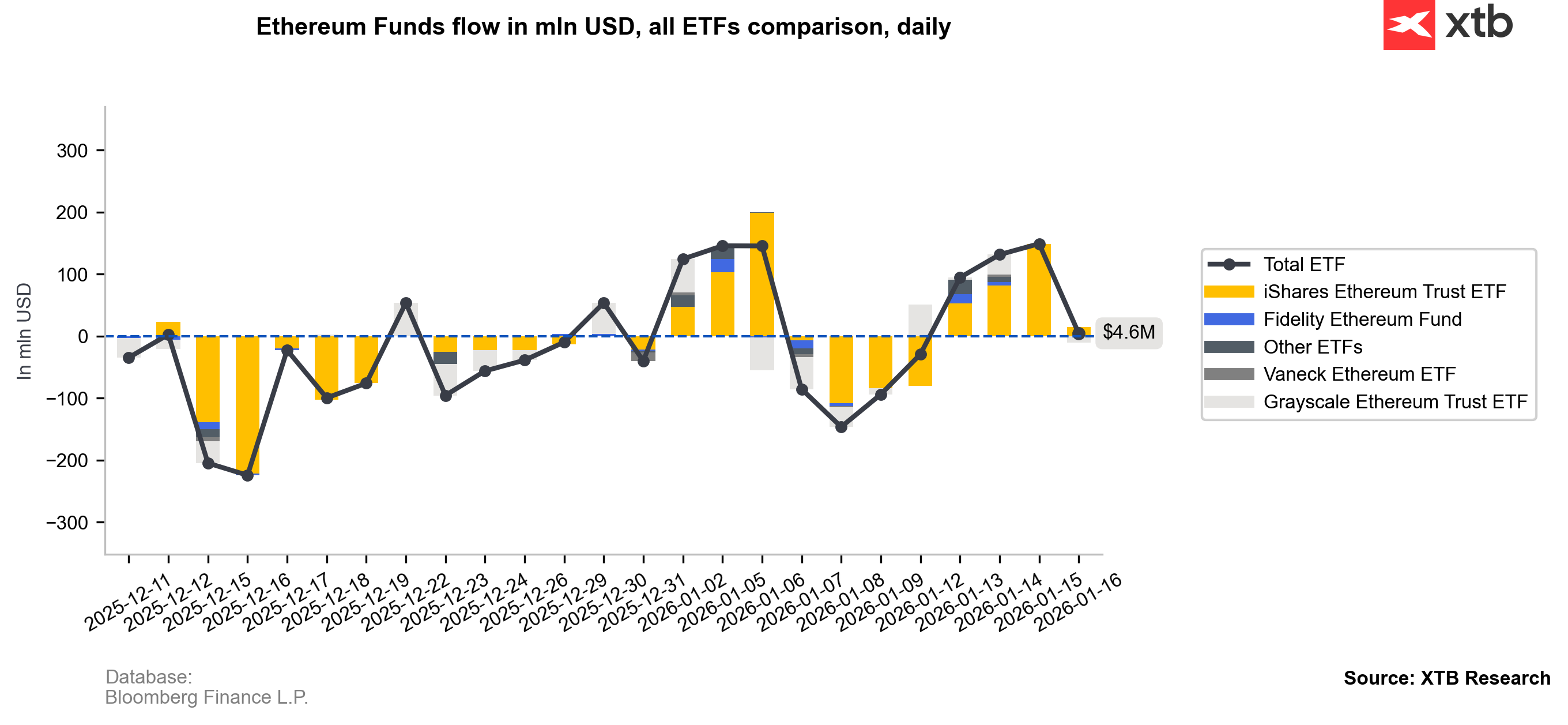

Over the last 30 days, net flows into Ethereum have been clearly negative, and Friday brought just under $4 million in positive net inflows. Overall ETF trading volumes for ETH have fallen noticeably compared with the autumn, reinforcing the uncertainty around the next leg of the trend.

Source: Bloomberg Finance L.P., XTB Research

Bitcoin and Ethereum charts (H1, D1 timeframes)

Looking at the two largest cryptocurrencies, on the hourly timeframe Bitcoin is currently holding a potential 1:1 corrective structure, which gives bulls some hope that $92,000 can hold as a key support level. On the other hand, Ethereum has pulled back to the lower boundary of its rising price channel, and the uptrend remains intact as long as the price does not fall below $3,200.

Source: xStation5

Source: xStation5

itcoin has fallen below the EMA50 again (orange line) and was unable to stay above the average for an extended period. If the price were to move back above $93,600 later today, it could point to a likely, fast reversal of the short-term downtrend. Assuming that a “cooling” of trade tensions between the U.S. and Europe is plausible, Bitcoin could relatively quickly erase the panic reaction.

Source: xStation5

Ethereum has recently struggled to break through a key resistance level represented by the 200-session moving average on the daily timeframe (EMA200). At the moment, it appears that the area around $3,400 is what separates ETH from a broader bull market. The main support level is the psychological $3,000 zone, while buyers should keep the price above the EMA50 ($3,200) if momentum is to hold.

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.