- Major cryptocurrencies fell sharply

- Cryptocurrency miners may be moving to Texas after China crackdown

- PayPal increases Bitcoin purchase limit to $100,000 per week

- Bank of America has approved the trading of bitcoin futures

Last week prices of major cryptocurrencies were in a slow downturn and their range tightened as the volatility has dried up. Bitcoin price rose slightly over the weekend following positive news after Bank of America revealed plans to allow BTC futures trading. However global sentiment turned negative again during today's session amid broad risk aversion which prevails on the markets. From this year's peak, the total capitalization of the crypto market has fallen by exactly half to $1.27 trillion. Bitcoin's dominance increased to 46.3%,while an average daily trading volume is registered at $55.60 billion.

“The great mining migration” is heading towards Texas

Two months ago Chinese authorities called for a severe crackdown on bitcoin mining and trading, setting off what’s being dubbed in crypto circles as “the great mining migration” and Texas is emerging as a new attractive option for Bitcoin miners. Recently Texas authorities passed legislation to establish a blockchain working group and formally define virtual currencies for legal purposes. Meanwhile, the Texas Department of Banking allowed state-owned banks to provide crypto custody services. Several other states also made similar moves in order to attract companies from the cryptocurrency market, however what makes Texas stand out is the state's deregulated energy market. Texas widely uses solar and wind power, which are relatively inexpensive energy sources. Industry advocates in the state say an influx of miners could actually benefit Texas's grid. Experts told CNBC that up to 60% of bitcoin’s total hashrate (a measure of the mining network’s processing power at any time) could eventually leave China and a large part may relocate to Texas.

PayPal increases crypto payment limits for US customers

PayPal has raised cryptocurrency limits for customers from $20k to $100k per week without an annual purchase limit. This applies only to U.S. users of the payment system. However, given the fundamental role of the U.S. in the formation of the cryptocurrency market, such news could well support the market globally.

Bank of America approves bitcoin futures trading

According to anonymous sources Bank of America, the second-largest bank in the U.S., has approved the trading of bitcoin futures for some clients. Reportedly, the financial institution is yet to offer this service to all of its clients. This is a good sign for the cryptocurrency market that large investment banks plan to allow clients to invest in cryptocurrency products despite regulatory uncertainty. Goldman Sachs has recently restarted its crypto trading desk after a three-year wait. One of the major banks has offered to trade cryptocurrencies in partnership with the CME Group, and Bank of America is likely to do the same.

Bitcoin was locked in a narrow trading range with a sequence of lower highs last week, however during today’s session sellers took the initiative. Price fell sharply after the US open and tests $30,298 level. If current sentiment prevails then downward move may accelerate towards the major support at $29,000. However if buyers will manage to halt declines here, then another upward move towards resistance at $32,000 may be launched. Source: xStation5

Bitcoin was locked in a narrow trading range with a sequence of lower highs last week, however during today’s session sellers took the initiative. Price fell sharply after the US open and tests $30,298 level. If current sentiment prevails then downward move may accelerate towards the major support at $29,000. However if buyers will manage to halt declines here, then another upward move towards resistance at $32,000 may be launched. Source: xStation5

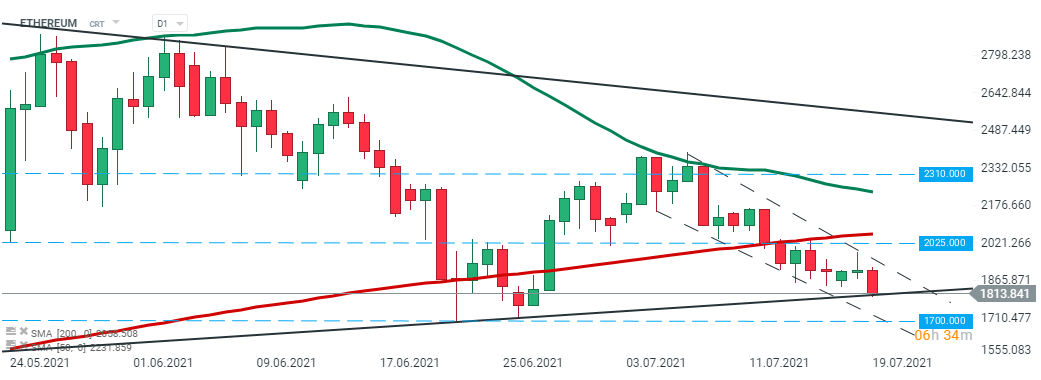

Ethereum followed bitcoin’s footsteps and fell more than 5%. Currently price is testing a long-term upward trendline. Should break lower occur, then major support at $1700 may be at risk. If sellers manage to break lower, then downward move may accelerate even towards the $1400 area. On the other hand, if buyers will manage to halt declines, then nearest resistance can be found around $2025. Source: xStation5

Ethereum followed bitcoin’s footsteps and fell more than 5%. Currently price is testing a long-term upward trendline. Should break lower occur, then major support at $1700 may be at risk. If sellers manage to break lower, then downward move may accelerate even towards the $1400 area. On the other hand, if buyers will manage to halt declines, then nearest resistance can be found around $2025. Source: xStation5

Chart of the day: Bitcoin (21.10.2025)

Crypto news: Bitcoin and Ethereum on the rise again 📈

3 markets to watch next week - (17.10.2025)

Bitcoin drops below important support zone 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.