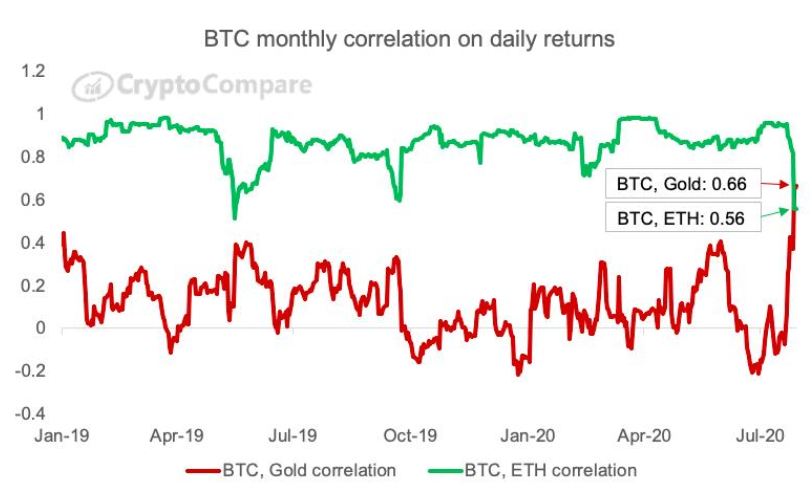

• Growing correlation between Bitcoin and gold

• Ripple become the third most valuable crypto asset

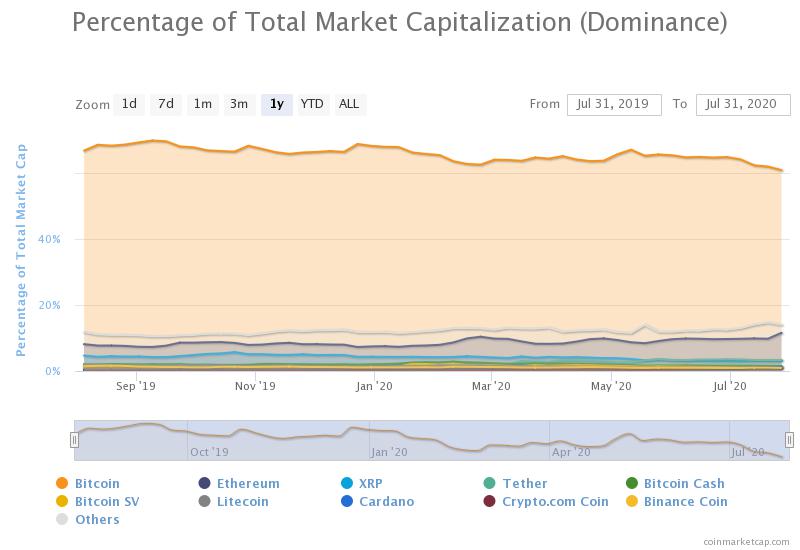

Bitcoin's market dominance decreased to 62.3%. The capitalization of all digital assets in circulation increased to 327.9 billion from reached almost $284 billion last week, while an average daily trading volume is registered at $82 billion. Source: Coinmarketcap

Bitcoin's market dominance decreased to 62.3%. The capitalization of all digital assets in circulation increased to 327.9 billion from reached almost $284 billion last week, while an average daily trading volume is registered at $82 billion. Source: CoinmarketcapAccording to James Li, a research analyst at CryptoCompare:

"Last time Bitcoin had a moderate correlation with gold (around 0.5) was towards the end of 2018. That was when a month earlier in November 2018 bitcoin suffered a 50% drop (at the height of the bitcoin cash war) and made some subsequent rebounds. Gold was recovering from a somewhat cyclical drop a couple of months earlier. The moderate correlation back then was perhaps a bit of a coincidence".

Bitcoin’s monthly correlation with gold on daily returns sits at 0.66.Source: CryptoCompare

Bitcoin’s monthly correlation with gold on daily returns sits at 0.66.Source: CryptoCompare Bitcoin price rallied significantly from a tight range between $9,000 - $9,359 and reached new 2020 highs at $11,354. Currently the most popular coin is testing resistance at $11,100. If positive moods persist, then next target for bulls is located at $12,258.58. However, in case sellers regain control, round $10,000 level should provide strong support. Source: xStation5

Bitcoin price rallied significantly from a tight range between $9,000 - $9,359 and reached new 2020 highs at $11,354. Currently the most popular coin is testing resistance at $11,100. If positive moods persist, then next target for bulls is located at $12,258.58. However, in case sellers regain control, round $10,000 level should provide strong support. Source: xStation5Ripple seems to have joined the crypto market rally and on Wednesday reached its highest levels since the beginning of March.

Ripple has been trading in a tight range for more than 2 months with its volatility at its lowest levels. During this period coin did not attract interest, but now the coin becomes valuable again. Since mid-July, the number of wallets holding 1 million to 10 million Ripple has been steadily increasing. Ripple surpassed Tether and become the third most valuable crypto asset in dollar terms, at around $11 billion. There is no clear reason behind the recent rally, but Nairmetrics, through its data feed, noticed that some whales increased their stakes in the digital coin significantly.

Ripple jumped 21% over the past week and 37% over the past month, making it one of the top performers. Coin managed to break above the major resistance level at $0.2258 and rally. Should upbeat moods prevail resistance at $0.2609 may come into play. However if a break below occur, then local support is located at $0.2060 level. Source: xStation5

Ripple jumped 21% over the past week and 37% over the past month, making it one of the top performers. Coin managed to break above the major resistance level at $0.2258 and rally. Should upbeat moods prevail resistance at $0.2609 may come into play. However if a break below occur, then local support is located at $0.2060 level. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.