Cryptocurrencies are trading slightly weaker amid mixed sentiment on indexes ahead of the Federal Reserve decision and Fed chief Jerome Powell's conference, which will potentially provide assets with a risk of high volatility. Bitcoin is trying to hold near $23,000, while most altcoins are trading down, with Dogecoin, Avalanche and Dydx prevailing among them.

- Traders are beginning to assess the chances of a continuation of the January increases. Matrixport analysts noted that statistically, in 5 of the 6 total years in which BTC recorded a rally in January, it ended the year 245% higher on average with the exception of 2014 when it reached a bull market peak in January;

- Binance announced a partnership with Mastercard on payment services in Brazil allowing users to pay with their own card at all Mastercard terminals. The exchange intends to incentivize with a payment return of 8% in Binancecoin (BNB). The two companies collaborated in the Argentine market that year;

- A Financial Times report indicates that Twitter has applied for regulatory permits regarding payment processing in the US market. Integration with financial services and cryptocurrencies has been heralded in the past by Elon Musk himself, prompting a wave of speculation about possible cryptocurrency backing that Dogecoin could benefit from.

According to Reuters reports, financial institutions are increasingly eager to look to cryptocurrencies, with Bitcoin pointing to it after the second-best January on record for the major cryptocurrency. Institutional inflows into BTC between January 20 and 27 totaled nearly $116 million. Source: Coinshres, Reuters

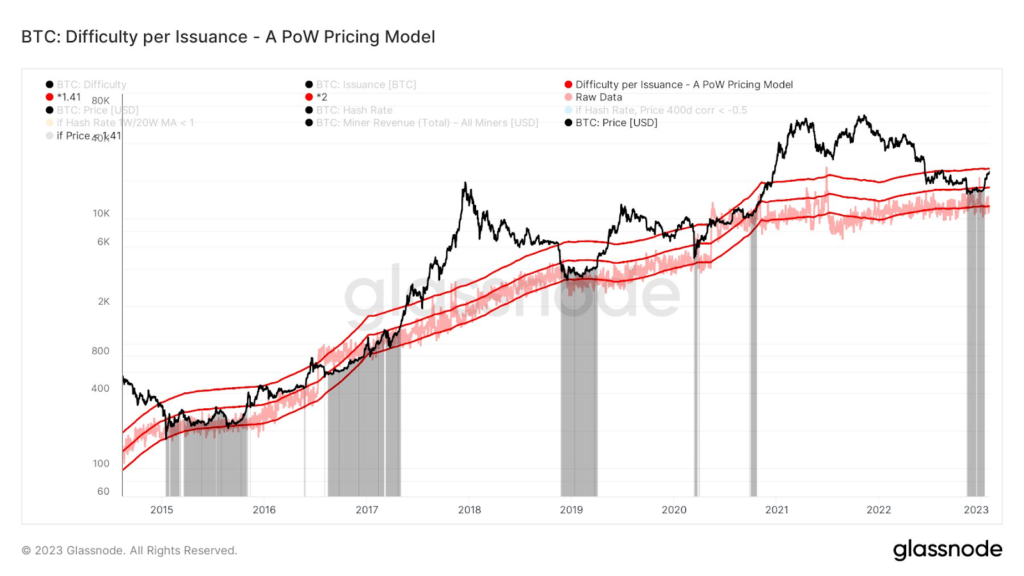

The Proof of Work valuation model indicates that BTC is approaching a significant level at 2.0, meaning that its price is almost double the cost of 'mining' 1 BTC by miners. In previous bull markets, crossing this zone was a good predictor, however, a downward reaction from outlying levels could indicate strong supply and a repeat of the situation from 2015, when the price twice found a bottom at the same level before Bitcoin began its bull market. Source: Glassnode

The Proof of Work valuation model indicates that BTC is approaching a significant level at 2.0, meaning that its price is almost double the cost of 'mining' 1 BTC by miners. In previous bull markets, crossing this zone was a good predictor, however, a downward reaction from outlying levels could indicate strong supply and a repeat of the situation from 2015, when the price twice found a bottom at the same level before Bitcoin began its bull market. Source: Glassnode

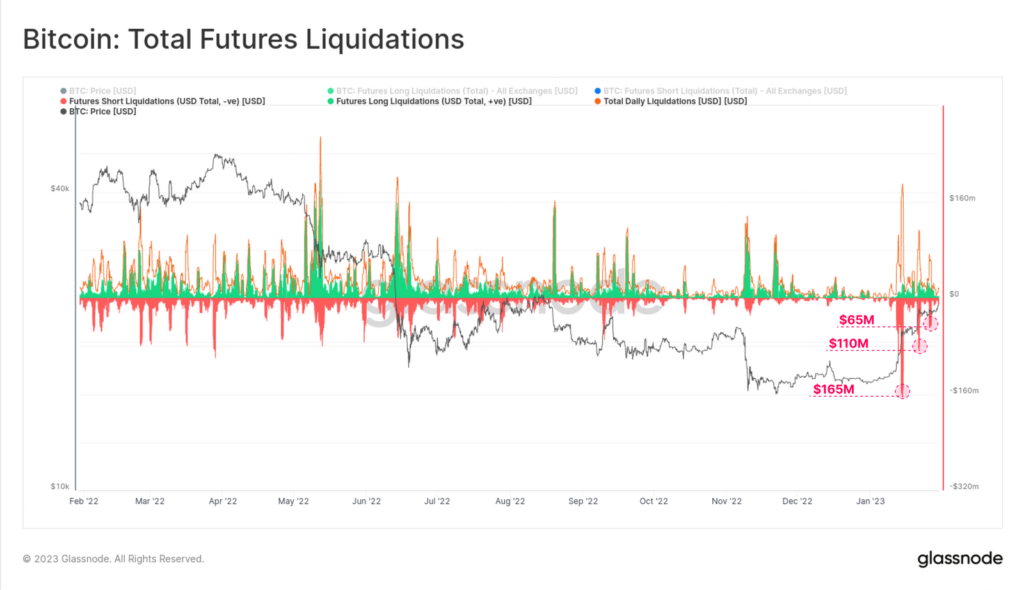

The largest wave of liquidation of short positions in several months took place in January. 85% of futures traders' positions on cryptocurrency exchanges predicted further declines. Faced with a massive 'short squeeze', the positive sentiment may last longer, a sizable portion of traders forecasting declines were removed from the market. Historically, such major deleveraging events have preceded fundamental trend changes. Source: Glassnode

Bitcoin price, H4 interval. Bitcoin's correlation with the NASDAQ (yellow chart) rose to record levels in May 2022, which underscores the importance of today's Fed decision. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.