- European stocks ended the week lower

- Wall Street swings between gains and losses

- NATGAS price surges ahead of winter storm

European indices finished the week in negative territory, with the German DAX down 1.3%, CAC 40 closed 0.8% lower and FTSE 100 fell 1.1% amid mounting geopolitical tensions in Ukraine and recent hawkish narrative from the Federal Reserve. On the data front, GDP readings from France, Spain and Sweden surprised on the upside. For the week, DAX dropped 1.8%, the second straight weekly loss.

Major Wall Street erased early losses and are trading higher. Dow Jones gains 0.40% after losing more than 300 points early in the session, the S&P 500 jumped 1% and the Nasdaq rose 1.5%. On the other hand, both Dow and the S&P are heading towards a fourth week of losses and the Nasdaq is set to fall for a 5th straight week as recent FED hawkish comments regarding monetary policy weighed on market sentiment. On the data front, PCE inflation YoY came in slightly above market estimates, while employment costs increased 4% from a year ago, the fastest in the 20-year data history, though the quarterly rise of 1% was less than expected. On the corporate front, Apple jumped 5% after the company reported record revenues and said it expects supply chain constraints, which are contributing to inflation, to ease in the coming months.

Mostly downbeat moods prevail today in commodity markets as the dollar continues to move higher while the US 10-year Treasury yield remains elevated at 1.78%. Over the past few weeks, the dollar has been consolidating and even depreciating against some emerging currencies. However, the ever stronger message from the US central bank regarding interest rate hikes and excellent GDP data finally made it back to the top. As a result gold fell at one point 1.0% and tested $1,780.00 level while silver dropped 2.6% to $22.10 level however managed to erase some of the losses. WTI cut early gains and is trading 0.50% lower around $87.20 level. On the other hand, natural gas prices jumped 14% on stronger demand for heating and power plant fuel as a powerful winter storm is set to hit the U.S. Northeast. Major cryptocurrencies traded sideways this week. During today’s session Bitcoin rose slightly and is testing $37 000 level while Ethereum rose 5% to $2460 mark.

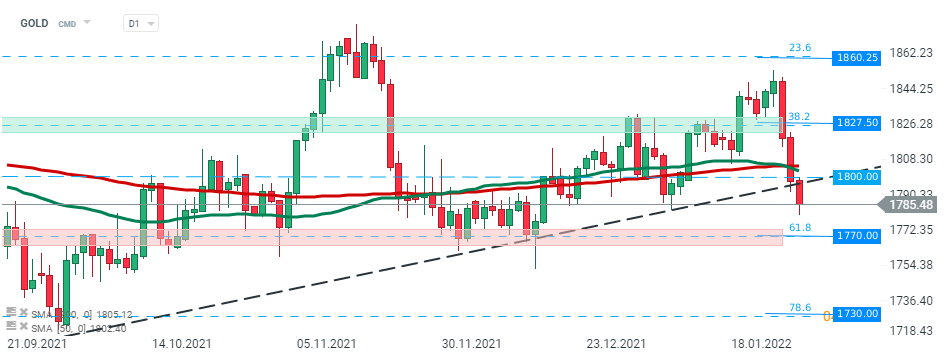

GOLD fell sharply following the FED decision on Wednesday and downward move accelerated during today's session. Price broke below long-term upward trendline and if current sentiment prevails, next support at $1770 may be at risk. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.