• Nasdaq hits new high

• Pfizer (PFE.US)and BioNTech (BNTX.US) granted FDA fast track designation for two Covid-19 vaccine candidates

European inidices finished today’s session higher as investors cheered signs of progress in COVID-19 vaccine development after two possible Covid-19 vaccines from Pfizer and BioNTech granted FDA fast track designation. DAX finished 1.3% higher, CAC 40 rose 1.7% and FTSE 100 gained 1.3%.

US indices rose on Monday with Nasdaq hitting a new high, helped by a better than expected quarterly results from Pepsi Co (PEP.US), as well as signs of progress in COVID-19 vaccine development. These news completely overshadowed surging numbers of new COVID-19 cases. Coronavirus infections rose above 13 million across the world on Monday, climbing by one million in just five days. World Health Organization chief Tedros Adhanom Ghebreyesus said there would be no return to the old normal for the foreseeable future, with too many countries headed in the wrong direction. "The virus remains public enemy number one," he told a virtual briefing from WHO headquarters in Geneva. "If basics are not followed, the only way this pandemic is going to go, it is going to get worse and worse and worse. But it does not have to be this way." he said. On Sunday World Health Organization recorded record 230,000 of new confirmed COVID-19 cases, while Florida reported a record increase of more than 15,000 infections.

Gold and silver are trading higher, with silver prices scoring an 11-month high and closing in on $20/oz resistance level. Meanwhile gold prices rose above the key $1,800/oz level. Buying interest continues to be fueled by ongoing U.S.-China trade tensions and the record number of new COVID-19 cases. Despite hopes of a vaccine-breakthrough, many investors remain concerned that the recovery of the global economy may take longer than originally assumed.

Oil prices managed to erase early losses as investors await OPEC technical meeting this week, which is expected to recommend an easing in output cuts. Both WTI and Brent are trading flat.

There is quite a lot of data scheduled for release tomorrow. During the Asian session investors will get to know trade data from China and Japanese industrial production figures. GDP data from the UK, German ZEW Economic Sentiment Index and inflation figures will be the key releases of the European session. Apart from that Consumer Price Index figures will be published in the afternoon. Last but not least, FED Kaplan and Williams are scheduled to speak. Oil Traders will be looking at API inventory numbers. On the earnings front JPMorgan Chase, Wells Fargo, Citigroup Inc, Continental AG, Delta Airlines will publish their quarterly results.

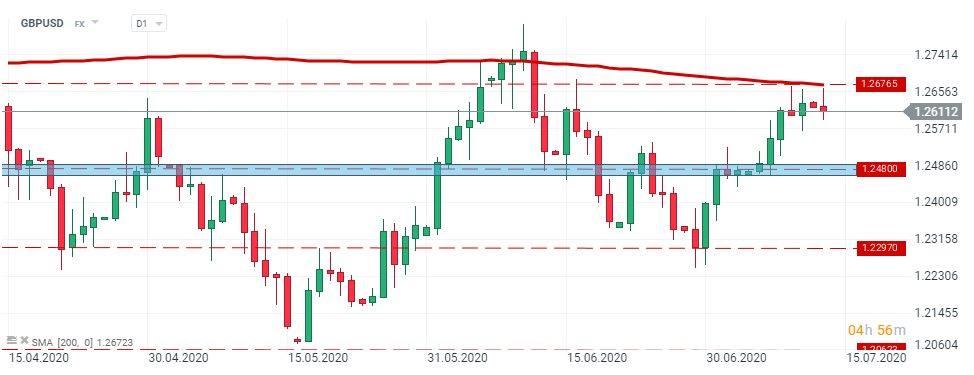

GBPUSD - price again bounced off the 200 MA (redline), signaling that bears are in control of the market. Should downbeat moods prevail, support at 1.2480 may come into play. On the other hand, breaking above the 1.2676 handle may lead to a bigger upward move. Source: xStation5

GBPUSD - price again bounced off the 200 MA (redline), signaling that bears are in control of the market. Should downbeat moods prevail, support at 1.2480 may come into play. On the other hand, breaking above the 1.2676 handle may lead to a bigger upward move. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.