- The dollar weakened against other major currencies on Friday

- Good moods in the stock market

- DE30 is approaching its historic highs

European indices rose sharply higher today, as dovish comments from several central bankers managed to calm the markets again. Fed chair Jerome Powell and Andrew Bailey, Governor of Bank of England reassured that any increase in price pressure will be transitory and expected to wane as supply chains adjust to rising demand. The DE30 erased recent losses and is trading only about 100 pts below its historical highs. Meanwhile ECB minutes showed that policymakers agreed that Euro Area financing conditions had remained broadly stable since the last monetary policy meeting in March thanks to the central bank's decision to significantly increase the pace of net asset purchases under the PEPP. However, members recalled that the monetary policy meeting in June would provide the next opportunity to conduct a thorough assessment of financing conditions and the inflation outlook, as they seemed especially concerned about the firming of the euro against the dollar.

US stocks are also rising, rebounding for a second day led by technology shares even despite weak economic data. Retail sales unexpectedly stalled in April, while analysts expected a 1% increase. However, last month the figure was upwardly revised to 10.7% as the first round of stimulus checks was sent to most households in March. Meanwhile the University of Michigan's consumer sentiment dropped to 82.8 in May from 88.3 in April, well below market estimates of 90.4, due to rising inflation concerns. However, it seems that investors still prefer to trust the Fed's assurances rather than macroeconomic data.

WTI crude rose more than 2.2 % and is trading around $65.26 a barrel, while Brent is trading nearly 2.3% higher around $68.60 a barrel. Elsewhere gold rose 0.65% to $ 1,838.00 / oz, while silver is trading 0.8 % higher, around $ 27.30 / oz amid a weaker dollar. Looking at the Forex market, the New Zealand dollar appreciated 0.9% against the USD. We also saw gains on the AUD, which jumped 0.65% against the US dollar. The EURUSD currency pair rose 0.5% up, while CAD, GBP and CHF added 0.3% up in the evening hours.

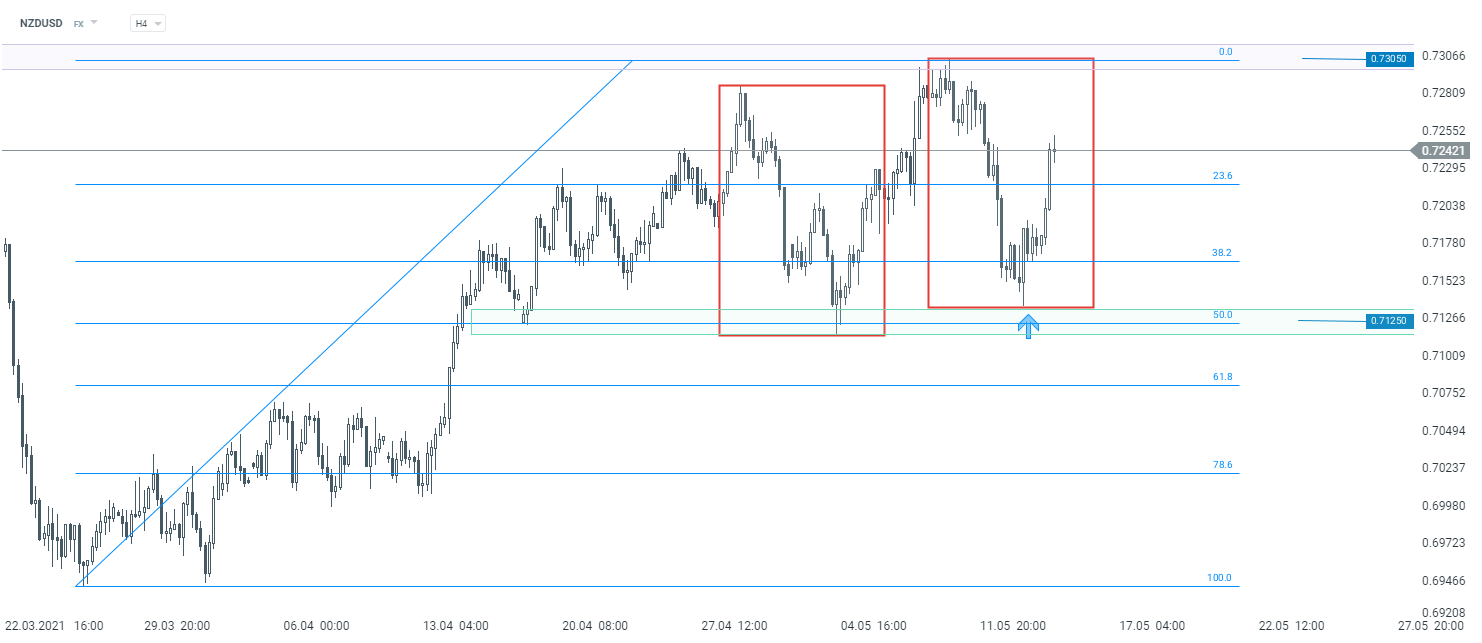

The recent correction on the NZDUSD pair slowed down near the key support at 0.7125. Buyers appeared at the lower limit of the 1: 1 structure and then the upward movement continued. If the current sentiment prevails, another upward impulse towards resistance at 0.7305 could be launched. Source: xStation5

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.