- Wall Street is clearly gaining at the end of Friday's session. The Nasdaq index adds nearly 0.34% intraday, the benchmark S&P500 adds 0.44%, the Dow Jones rises 0.7%. However, the benchmark of smaller-cap companies extremely sensitive to credit conditions, the Russell 2000, has the biggest gains, with the index rallying more than 2.3%.

- The improvement in market sentiment (indexes up, the U.S. dollar down, and powerful gains in the gold market) is primarily the result of a dovish reaction to comments made by Powell, who spoke in Atlanta today.

- The banker said that the Federal Reserve's policy is already in a restrictive zone, and the FOMC does not need to rush now; as the latest CPI reports indicated a satisfactory decline in inflationary pressures. The lack of surprise in Powell's communication has reassured markets that Wall Street is probably not wrong about upcoming interest rate cuts, creating a favorable environment for a further rally in bonds and a drop in yields

- The money market is now pricing that the Fed will cut interest rates in 2024 by a total of 125 basis points. The March cut is currently priced at 70%, just yesterday it was around 46%.

- ISM PMI data for US manufacturing for November indicated 46.7 vs. 47.6 expected and 46.7 previously. The sub-indexes for prices paid and orders rose, while the employment sub-index fell. PMI readings from Europe were also a positive surprise today

- In the commodity markets, investors' attention has turned to gold, which is gaining more than 1.82% intraday and is already trading near historic highs. Crude oil is currently losing more than 1%.

- In the FX market, the unprecedented loser today is the US dollar and the euro. The Japanese yen and the Australian dollar are currently posting the biggest gains in the broad market. The USDJPY pair is trading at its lowest levels since September 2023.

- China index futures are trading at record weakness in China's benchmarks, where investors are pricing in the risk of a further decline in private sector sentiment and a failure of state stimulation of the economy. According to WSJ sources, Evergrande and its bondholders are negotiating a last-minute restructuring deal, sources Say. The company may face liquidation on Monday, without a restructuring plan

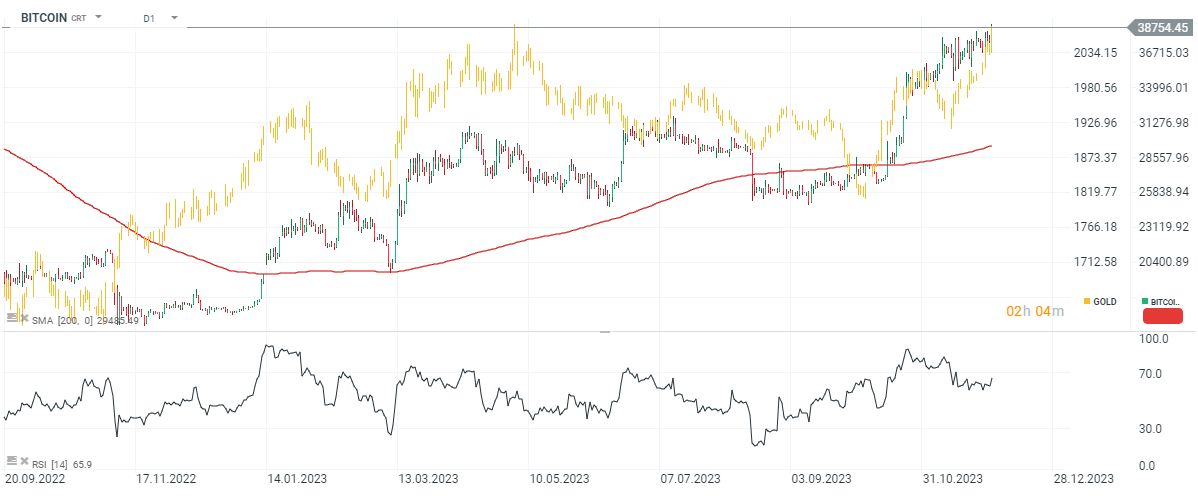

- Bitcoin, following the rise in gold and bond prices, climbed near $38,800, reaching new highs this year.

Bitcoin as well as GOLD reach today new, yearly highs. Source: xStation5

Bitcoin as well as GOLD reach today new, yearly highs. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.