-

Stocks gain around the world

-

Solid U.S. retail sales in September

-

Earnings season in full swing

Global stock markets try to recover some of this week’s losses. European stocks ended the day higher. DAX gained 1.62%, CAC 40 rose 2.04% while FTSE 100 added 1.49%. U.S. indices opened on a positive note and were pushing higher for some time. However, a small pullback occurred later. S&P 500 is 0.49% up at press time.

Friday has been another volatile day for GBP due to Brexit-related news. As Boris Johnson hinted a no-deal Brexit, the pound tumbled. Meanwhile EURUSD stays above 1,17 mark, the euro gains against the U.S. dollar in the evening.

CPI data from the euro zone for the month of September pointed to 0.3% deflation (year-over-year basis). U.S. retail sales report for September turned out to be a positive surprise (1.9% MoM vs expected 0.7%). Industrial production figures from the United States were disappointing, though. Nevertheless Michigan Consumer Sentiment rose to 81.2 pts in October, above expected 80.5 pts.

On Monday China will release a set of crucial data including Q3 GDP, industrial production for September as well as retail sales. Markets will also pay attention to several central bankers’ speeches, among others, ECB President Lagarde and Fed Chair Powell. Apart from that, investors will focus on various Q3 earnings reports.

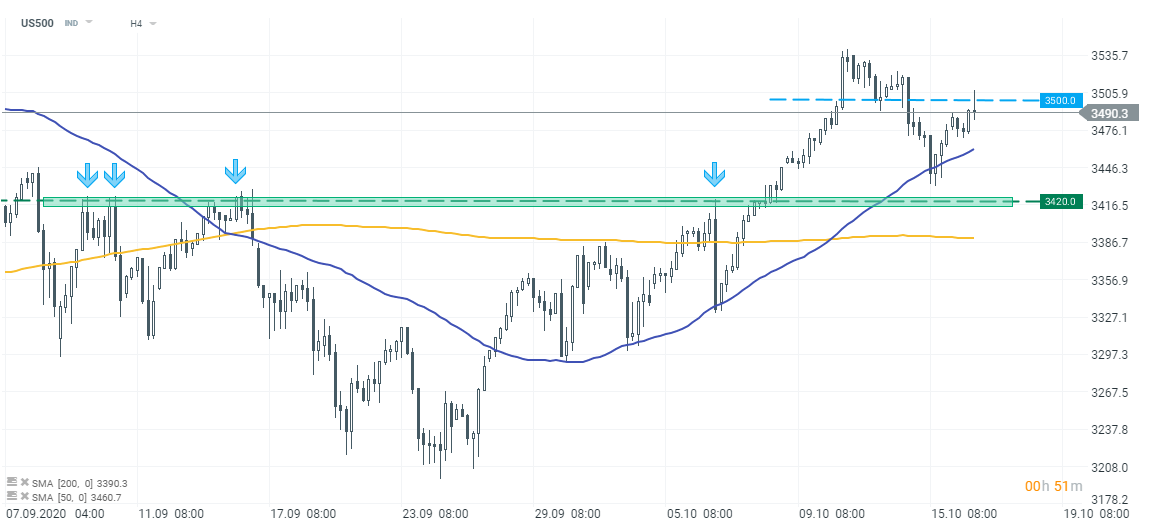

US500 climbed above the 3,500 pts during today’s session, but a pullback occurred later. Nevertheless market bulls try to regain control and smash through that threshold. Meanwhile the area at 3,420 pts remains key support level. Source: xStation5

US500 climbed above the 3,500 pts during today’s session, but a pullback occurred later. Nevertheless market bulls try to regain control and smash through that threshold. Meanwhile the area at 3,420 pts remains key support level. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.