-

Stock markets mostly higher

-

Oil prices advance amid OPEC+ meeting

-

Gold dips below $1900 an ounce

Global stock markets started June on a positive note. European indices finished the day higher with the German DAX (DE30) and EuroStoxx 600 reaching fresh all-time highs. US indices started the session higher, yet pared most gains. Meme stock mania in the US continues, but traders witnessed some interesting headlines as Mudrick Capital is said to have sold the entire stake that the fund had purchased at $27.12, saying that the stock is overvalued.

Oil markets were focused on key OPEC+ meeting that is taking place today. OPEC+ countries are most likely to reconfirm gradual production increase through July. Both WTI and Brent prices soared today, but pared some gains in the afternoon. Gold fell below $1900 an ounce for a while, but the price returned slightly above that threshold.

Today’s calendar was full of interesting macro releases. While OPEC+ discussed key issues for oil markets, investors also paid attention to numerous manufacturing PMI reports - most of them surprised to the upside. On the other hand, CPI report from the eurozone for May came in above expectations (2.0% YoY vs exp. 1.9% YoY). ISM Manufacturing from the US turned out to be better-than-expected as well as the headline index rose from 60.7 in April to 61.2 in May.

Tomorrow traders might expect higher AUD volatility as Australia will release its 1Q GDP report at 02:30 am BST. Apart form that, a retail sales report for April from Germany will be released in the morning European time, which might be helpful in assessing the sentiment among European consumers.

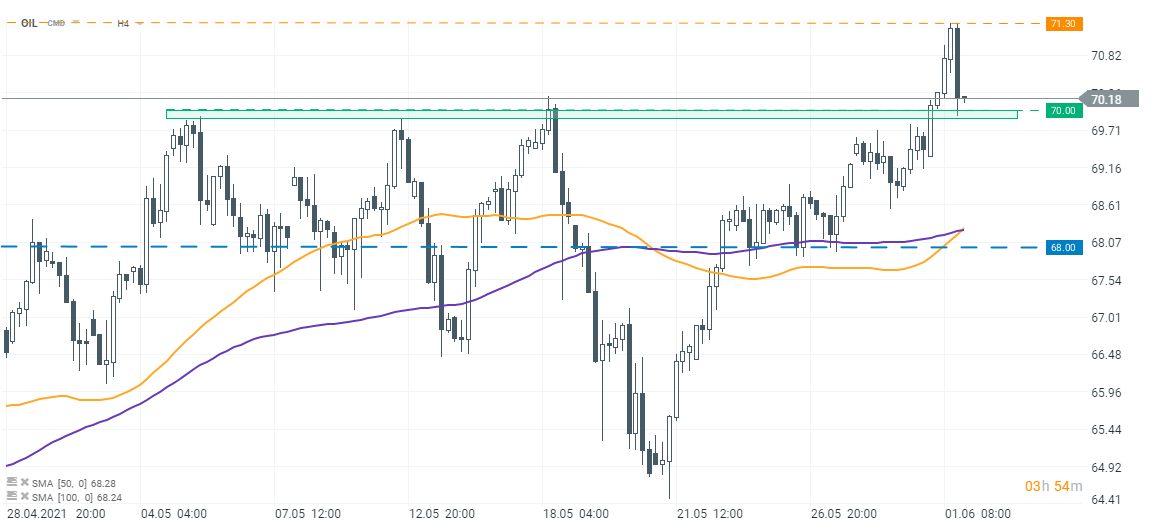

Brent prices (OIL) smashed through key $70 a barrel level today, reaching highest levels since early-March. However, oil suddenly dipped in the afternoon, paring some earlier gains. This does not change the fact that the prices are still trading higher on the day and remain above the $70 mark - key short-term support for now. Source: xStation5

Brent prices (OIL) smashed through key $70 a barrel level today, reaching highest levels since early-March. However, oil suddenly dipped in the afternoon, paring some earlier gains. This does not change the fact that the prices are still trading higher on the day and remain above the $70 mark - key short-term support for now. Source: xStation5

Daily summary: Dollar pulls back, while oil rebounds on US-Venezuela tensions (22.12.2025)

NATGAS slides another 5% 🛢️ 📉 Weather and production exceed expectations❗️

🟡 Gold jumps 1.8% on Fed and geopolitics

US OPEN: Renewed optimism at the beginning of the week

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.