-

FOMC delivered a 75 bp rate hike, in-line with market expectations

-

New FOMC projections showed downward revisions to GDP growth forecast and upward revisions to inflation and unemployment forecasts

-

New FOMC dot-plot showed rates at 4.4% at the end of 2022, compared to 3.4% in June forecast. Terminal rate still seen in 2023 but at 4.6%

-

Indices dipped and USD gained following decision but those moves were reversed during Powell's press conference amid lack of further hawkish comments

-

Gold and silver jumped during Powell's press conference as the market took it as dovish. Silver gains 3% while gold trades over 1% higher

-

US indices trade higher with Nasdaq leading the gains (+1.2%). Dow Jones is top laggard but still gains around 0.5% at press time

-

Russian President Vladimir Putin announced a partial mobilization. It will cover reservists and former soldiers. Russia plans to mobilize around 300 thousand additional troops

-

European stock market indices finished today's trading higher. German DAX, UK FTSE 100 and French CAC40 gained 0.6-0.8%. Main Russian indices slumped around 4%

-

China has put Tangshan city, an important steel-making hub, under lockdown

-

DOE report confirmed a smaller-than-expected build in US oil inventories signaled by API report yesterday (+1.14 mb vs +2.3 mb expected)

-

US existing home sales dropped from 4.82 million to 4.80 million in August (exp. 4.71 million)

-

Oil had a volatile session today, jumping after Putin's address and pulling back later on. Brent currently trades around 0.5% higher

-

AUD and NZD are top performing G10 currencies while EUR and GBP lag the most

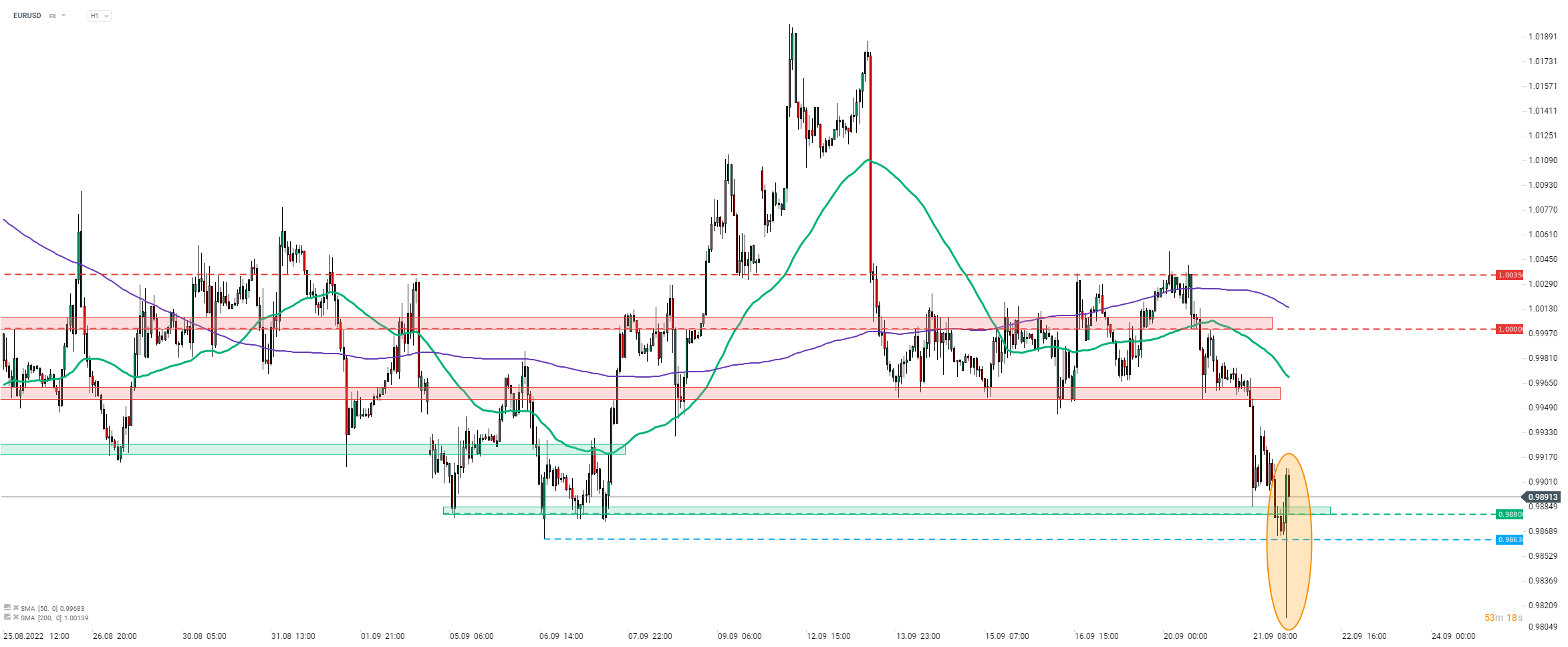

EURUSD plunged to a fresh 20-year low after Fed decision announcement as US dollar strengthened on hawkish dot-plot. However, the move was reversed during Powell's press conference. Source: xStation5

EURUSD plunged to a fresh 20-year low after Fed decision announcement as US dollar strengthened on hawkish dot-plot. However, the move was reversed during Powell's press conference. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.