- Global stocks under pressure

- Growing tensions in Ukraine

- Gold breaks $1900 level, Bitcoin under pressure

It cannot be denied that the markets currently mainly focus on the potential conflict between Ukraine and Russia. At the beginning of this week, Russia said it was withdrawing its troops from the border. In turn, NATO or the United States claim that the situation looks completely different and the Russian army is preparing for the invasion. There is a lot of uncertainty in the market, but investors do not panic yet. Global indices erased most of the recent gains during today's session after the RIA reported that the Deputy US Ambassador was expelled from Russia. In addition, the US ambassador to the United Nations emphasized that the current deployment of Russian troops indicated that the invasion could begin at any moment. Russian-backed rebels and Ukrainian forces traded accusations that each had fired across the ceasefire line in eastern Ukraine, while Russia previously indicated that on Thursday and Saturday, weapons could be used during maneuvers with Belarus.

Wall Street traded lower on Thursday, with the Dow Jones falling around 400 points while both the S&P 500 and the Nasdaq declined over 1% each. Gold topped the $ 1,900 mark, extending its upward momentum to levels not seen since June of 2021. At the same time, EURUSD remains stable today, while bond yields pulled back in response to the rising risk of armed conflict and yesterday's Fed minutes, which turned out to be slightly less hawkish than it was. expected.

US data was rather mixed. Unemployment claims rose to 248k, however continued claims fall below 1.6 million. Meanwhile data from the real estate market was puzzling - number of building permits increased, but house starts dropped to the lowest level in 3 months.

Oil tried to rebound today, mainly due to uncertainty over Russia and Ukraine. On the other hand, information has emerged that the United States and Iran may sign an agreement which may reduce supply problems on the market.

The dollar remained under pressure, but comments from Bullard regarding potential 100bp rate hikes through July raised expectations of more decisive Fed actions. Cryptocurrencies took a hit during today's session, which indicates that the correlation with the stock indices is still strong. Bitcoin fell below $41500, while Ethereum broke below $3000 level.

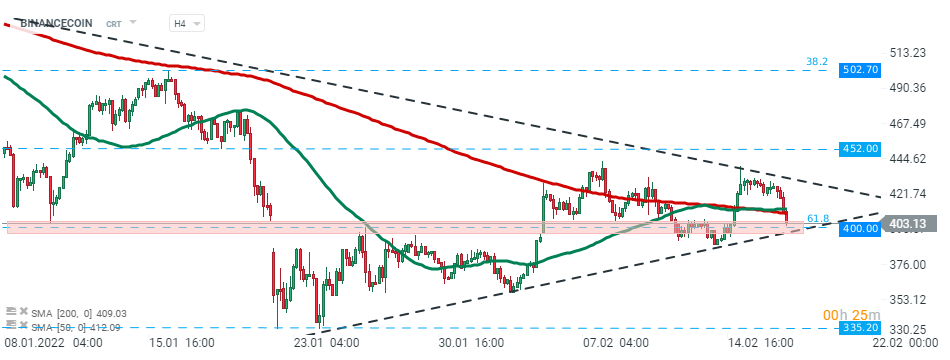

Binance Coin, which is a native token of world’s largest crypto exchange’s Binance, fell sharply following news that the company has stopped trading activities in Israel as the country’s capital markets authority examines the exchange’s licenses. Currently price is approaching psychological support at $400.00 which is marked with 61.8% Fibonacci retracement of the upward wave launched in June 2021 and lower limit of the triangle formation. Source: xStation5

Binance Coin, which is a native token of world’s largest crypto exchange’s Binance, fell sharply following news that the company has stopped trading activities in Israel as the country’s capital markets authority examines the exchange’s licenses. Currently price is approaching psychological support at $400.00 which is marked with 61.8% Fibonacci retracement of the upward wave launched in June 2021 and lower limit of the triangle formation. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.