The Kremlin indicated today that it does not see much progress in the peace talks. During the night, despite yesterday's announcements, shelling continued on Kiev and the surrounding area. Russia now intends to focus on the east regions of Ukraine and it is possible that it will want to annex the self-proclaimed republics and then announce that the invasion turned out to be a "success". The United States continues to warn against Moscow's actions and point to a regrouping of Russian forces. Due to the large scale of uncertainty, most indices suffered losses during today's session.

Germany's inflation rate jumped to 7.3% in March, the most since 1981 and well above market expectations. Such high inflation should lead to rapid changes in monetary policy. Today, several bankers from the ECB spoke, although most of them indicated that the QE program would end as planned, in the third quarter of this year. Despite negative sentiment, EURUSD pair moved higher.

In terms of economic data, ADP report showed, private businesses in the United States hired 455K workers in March, slightly higher than market forecasts. On the other hand, the GDP report for the fourth quarter of 2021 raised some concerns. Of course, the situation has changed dramatically since the end of the previous year, but it is worth noting that private consumption has been revised downwards again, adding just over 1.7 percentage points to the growth. Inventories were mainly responsible for the 6.9% increase at an annualized rate! The contribution of inventories was over 75%, and given the current geopolitical unrest, high inflation and rising interest rates, it may lead to an economic recession. Already at this point, US GDP growth is expected to be only 0.5% in Q1 2022. If the labor market slips somehow, the recession scenario will become even more likely.

Oil was gaining today. US crude oil inventories have fallen, and OPEC + is likely to keep its policy unchanged and restore supply at 400k. barrels every month. Russia is starting to have problems with commodity exports, and Poland has announced that it wants to stop importing Russian oil and gas by the end of this year.

New coronavirus cases in China are rising sharply. Of course, the number of cases is much lower than in Hong Kong, but recent data shows potential problems with a zero-tolerance policy, which could lead to a significant economic slowdown.

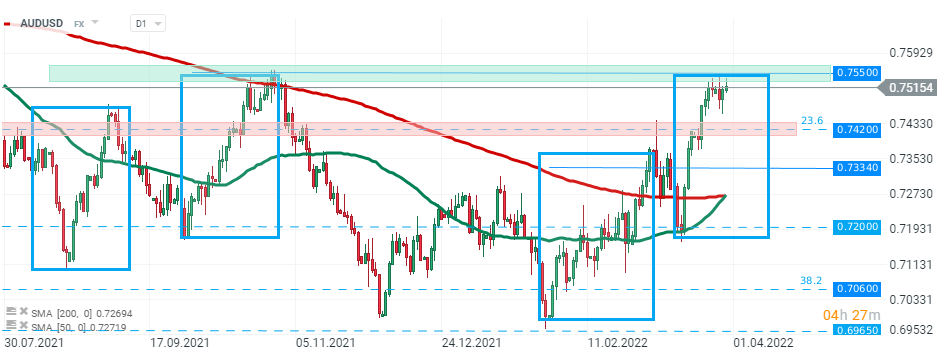

AUDUSD pair rose sharply in recent days, however buyers struggled to break above major resistance at 0.7550 which is marked by the upper limit of the 1:1 structure and previous price reactions. As long as the price sits below, another downward impulse towards support at 0.7420 may be launched. Source: xStation5

AUDUSD pair rose sharply in recent days, however buyers struggled to break above major resistance at 0.7550 which is marked by the upper limit of the 1:1 structure and previous price reactions. As long as the price sits below, another downward impulse towards support at 0.7420 may be launched. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.