Today’s trading day has been dominated by a slight correction as some investors clearly realise profits while others are having some second thoughts about the coronavirus pandemic. As the number of new infections is still on the rise, some might worry about the second lockdown. In fact, some regions around the world have already decided for this step, for instance Catalonia locked down an area of 210 thousand people.

Most European indices declined almost 1.00% today - DAX lost 0.92% while Euro Stoxx 50 finished the session 0.85% lower. FTSE 100 is among top laggars as the index fell 1.53%. However, moods in the U.S. are rather mixed. While S&P 500 and DJIA are trading lower, Nasdaq managed to broke above the flatline today.

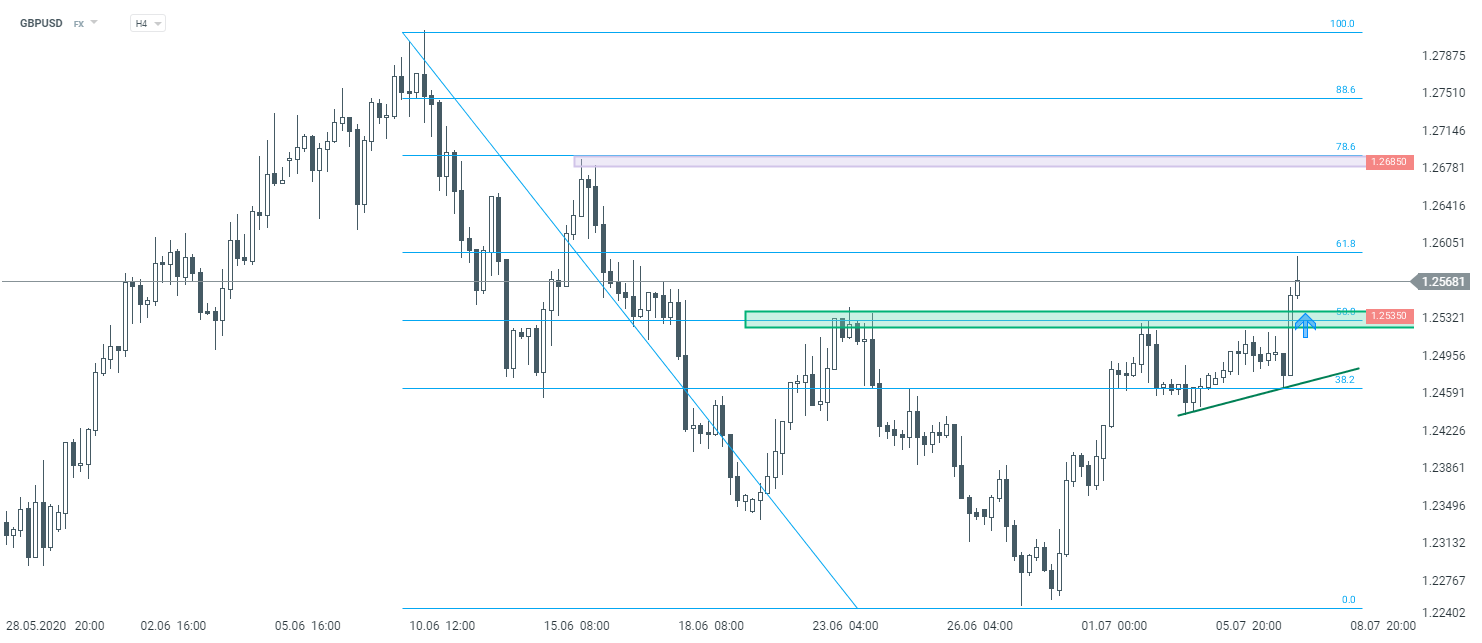

As the optimism faded away today, gold has been surging and its price is approaching the $1,800.00 level. Silver prices are up as well and one should certainly pay attention to pre-pandemic highs - $18.60 might serve as the first resistance in this case. GBPUSD is posting some decent gains today (+0.60%) and the currency pair broke above crucial 1.2530 area.

Today’s economic calendar was rather light. Apart from RBA’s interest rate decision (main interest rate was left unchanged), Japan published its household spending for the month of May - the reading came in below expectations. German industrial production in May turned out to be worse than expected as well (+7.8% MoM vs expected 10.0%). Apart from that, The European Commission lowered its GDP forecasts for 2020 and 2021 (respectively: -8.7% and +6.1%).

Tomorrow investors may pay attention to unemployment rate in Switzerland and housing starts in Canada. Crude traders might also be interested in EIA’s report on crude oil inventories. All in all, we should not see any “market-moving” events.

GBPUSD is surging 0.60% today as the currency pair broke above crucial 1.2530 price zone. 61.8% Fibo retracement might serve as the first resistance level now. Should the market smash through that barrier as well, market participants will focus on 1.2685 area (which is additionally strengthened by the 78.6% Fibo retracement). Source: xStation5

GBPUSD is surging 0.60% today as the currency pair broke above crucial 1.2530 price zone. 61.8% Fibo retracement might serve as the first resistance level now. Should the market smash through that barrier as well, market participants will focus on 1.2685 area (which is additionally strengthened by the 78.6% Fibo retracement). Source: xStation5

Cosmic increases in precious metals, yen in turbo mode! 🚀

Canada in the Tariff Fire. Markets React to Political Tensions in North America

US Open: Big Tech, Fed and Politics in Action. A Test Week Ahead for the Markets!

🔝Gold breaches $5100 as silver tests $110

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.