- The NFP report turned to be a huge disappointment

- Stock markets continue their upward rally

- Weaker dollar, EURUSD above 1.2150

The Friday session in the equity markets was very optimistic. All major European indices ended the day in positive territory. The German blue chip index gained 1.34%, the British FTSE 100 increased by 0.76% and the French CAC 40 added 0.45%. On the data front, German industrial production rose in March by the most in five months, while better-than-expected exports and imports figures from Europe's largest economy signaled a solid rebound in global demand.

Market attention today focused on the NFP report from the United States, which definitely disappointed - in April, the US economy created only 266k jobs, while some analysts expected a reading of 1 million! Markets treated this, however, as "bad news is good news" - a poor reading means that the Fed will postpone a potential tightening of the policy, as the labor market recovery still requires some time (although it should be remembered that rising inflation is still a risk). For this reason, the US indices continue to rise, climbing to new historical highs. Elsewhere, the data from the Canadian market also disappointed, although the scale of the surprise was smaller there.

The pessimistic reading of the NFP from the US led to a sharp decline of US bond yields (by over 7 bps), although this move has already been completely negated. Both gold and silver are gaining in the evening hours - the first metal jumped above $ 1800/oz (also rose sharply after the NFP reading). The dollar is weakening against other major currencies, and the EURUSD currency pair reached its highest level since the end of February (above 1.2150). Copper prices also continued their upward rally today (+ 3.14%).

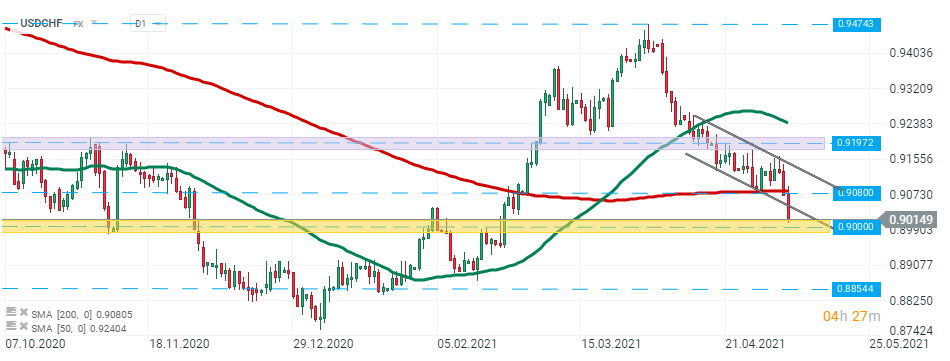

USDCHF broke below major support 0.9080 and lower limit of the descending channel. Currently the pair is approaching psychological support at 0.9000. In case of a break lower, downward move may gain further momentum and reach support at 0.8854. Source: xStation5

USDCHF broke below major support 0.9080 and lower limit of the descending channel. Currently the pair is approaching psychological support at 0.9000. In case of a break lower, downward move may gain further momentum and reach support at 0.8854. Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.