- European bourses finished in red

- US stocks slumped pressured by financials and tech shares

- US bond yields hit two-year high

Majority of European indices finished today's session 1% lower as government bond yields extended recent upward move, with the German 10-year Bund yield approaching its highest level since early 2019. Amid individual sectors, travel and tech stocks fell over 2.0%, while energy segment increased 0.6%, as oil futures rallied to a more than seven-year high on concerns over rising tensions in the Arabian peninsula. On the data front, Germany’s ZEW economic sentiment survey surged to 51.7 in January, well above analysts’ estimates of 32.0.

Major Wall Street indices fell sharply on Tuesday amid soaring Treasury yields which put pressure on the tech sector. The closely watched 2-year yield jumped above 1% for the first time since February 2020, while the benchmark 10-year note rose to 1.85%, its highest since January 2020. The Dow Jones dropped 1.54% and reached its lowest level since December 20th, the S&P lost 1.8% and is testing December lows while the Nasdaq tanked 2.3% to the lowest since October 12th. Also weak earnings from Goldman Sachs weighed on market sentiment. On the other hand, Bank of New York Mellon quarterly results beat market consensus. Meanwhile Microsoft stock lost over 1.0% after the tech giant announced it will buy Activision Blizzard for $68.7 billion.

Mixed moods prevail today in most commodity markets. Gold managed to partially erase early losses but is still trading 0.30% lower, while silver at one point rose 2.70% despite stronger dollar and higher treasury yields. WTI oil added over 1% and tested $85.20 level, while Brent price jumped to 7-year high around $88.00. Some downward pressure can be spotted on the cryptocurrency market. Bitcoin price fell to $41 500 level, while Ethereum broke below $3100 handle.

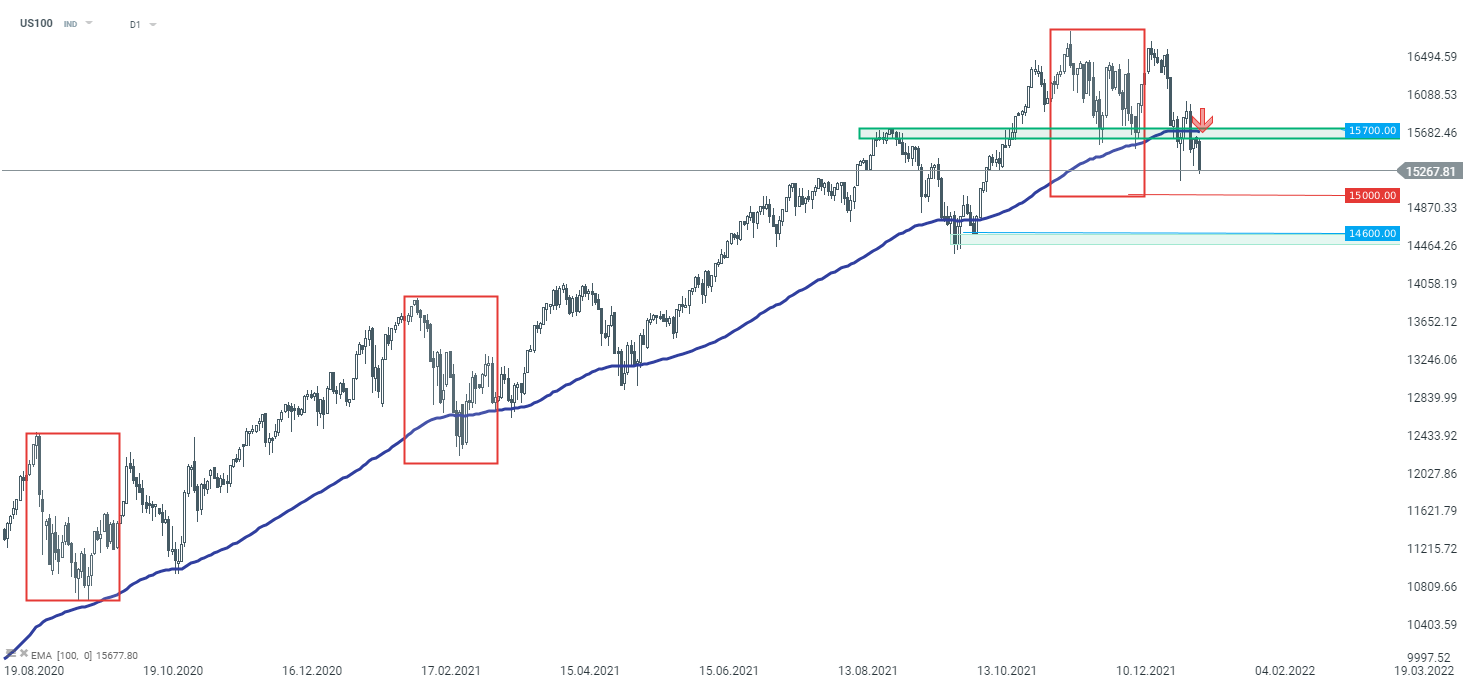

US stock indices are under pressure and the US100 lost more than 2%. Looking at the chart from the technical analysis perspective, the key support zone has been breached at 15700 pts, which causes a risk that downward correction may deepen. The nearest key support is located around the psychological 15 000 pts level and is marked with a lower limit of the 1: 1 structure (red rectangle). Source: xStation5

US stock indices are under pressure and the US100 lost more than 2%. Looking at the chart from the technical analysis perspective, the key support zone has been breached at 15700 pts, which causes a risk that downward correction may deepen. The nearest key support is located around the psychological 15 000 pts level and is marked with a lower limit of the 1: 1 structure (red rectangle). Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.