- Wall Street indices deepened ongoing downward move today after key support levels on major US indices were breached yesterday

- S&P 500 drops 1%, Nasdaq is down 1.6% and Dow Jones trades 0.6% lower at press time

- Reports from 2 major US tech companies are scheduled to be released today after Wall Street session close - Amazon and Intel

- European stock market indices traded lower today with German DAX dropping 1.1%, UK FTSE 100 taking a 0.8% hit and French CAC40 moving 0.4% lower

- US GDP report for Q3 2023 surprised to the upside showing annualized growth accelerating from 2.1% to 4.9% (exp. 4.3%)

- US Treasury Secretary Yellen said she wouldn't be surprised if the US economy grew by 2.5% in full-2023. She said that it looks US economy is having a soft landing

- ECB left interest rates unchanged today, in-line with market expectations. ECB President Lagarde said that it is now time to hold rates steady and analyze incoming data. However, Lagarde refused to confirm whether rate peak was reached

- CBRT delivered a 500 basis point rate hike today, pushing the 1-week repo rate from 30.00% to 35.00%. Decision was in-line with expectations

- US headline durable goods orders were 4.7% MoM higher in September (exp. +1.7% MoM) while core orders were 0.5% MoM higher (0.2% MoM)

- US pending home sales increased 1.1% in September (exp. -1.9% MoM)

- US trade balance for September came in at -$85.78 billion (exp. -$86.2 billion)

- US jobless claims came in at 210k, slightly above 209k expected

- EIA report showed a 74 billion cubic feet build in US natural gas inventories, less than 82 bcf expected by analysts

- Cryptocurrencies traded lower today with Bitcoin dropping 1.9% while Ethereum and Litecoin are trading 0.4% lower

- Energy commodities are trading mixed - oil drops 2.5-3.5% while US natural gas prices climb 2.5%

- Precious metals trade mixed as well - gold gains 0.4%, palladium trades 0.5% higher while silver and platinum drop 0.2% each

- AUD and NZD are the best performing major currencies while CHF and CAD lag the most

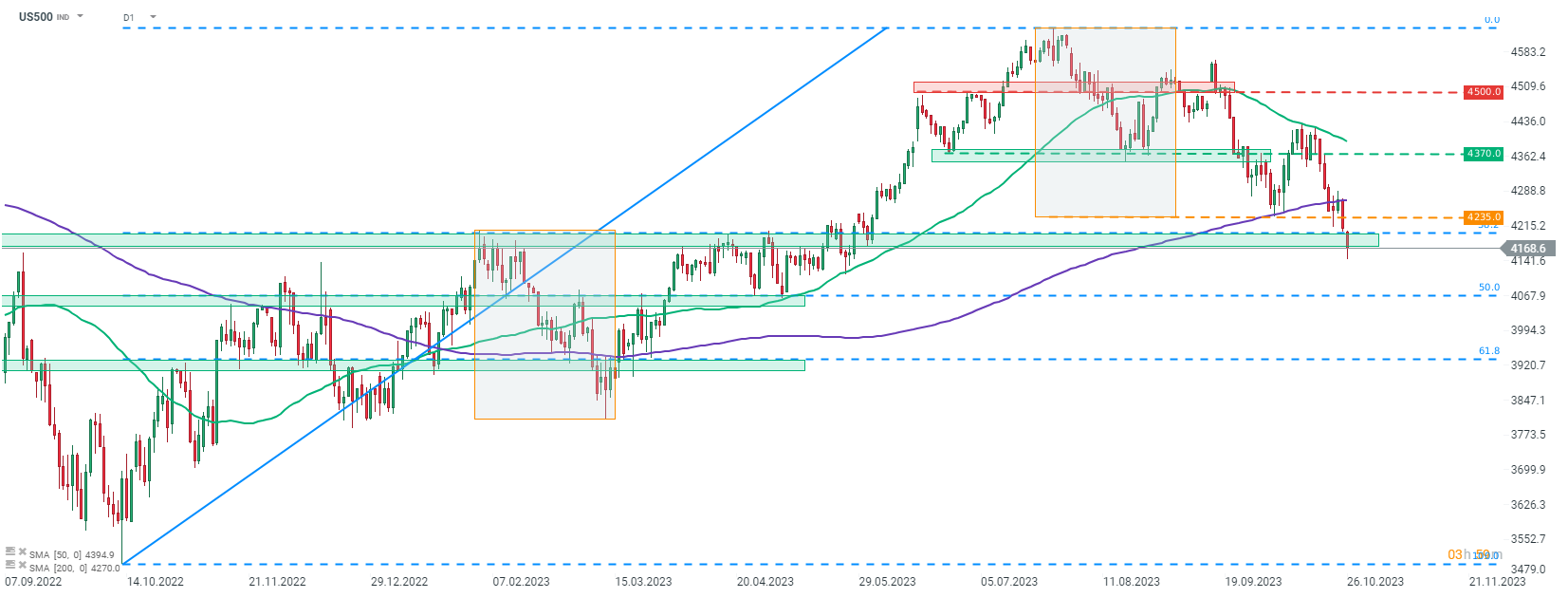

S&P 500 futures (US500) continued to move lower after breaking below the lower limit of the Overbalance structure yesterday. Source: xStation5

S&P 500 futures (US500) continued to move lower after breaking below the lower limit of the Overbalance structure yesterday. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.