- EC warns that 2021 recovery may be weaker than expected

- US initial jobless claims worse than expected

- OPEC revises down global oil demand forecasts for 2021

European indices finished today's session mixed, after the European Commission lowered its GDP forecasts for 2021, due to the resurgence in COVID-19 infections since the autumn and appearance of new, more contagious strain of COVID-19, which forced many governments to reimpose or tighten restrictions. The Eurozone is seen growing 3.8 % this year and the same in 2022, compared with previous estimates of a 4.2 % expansion in 2021 and a 3 % growth in 2022. On the corporate front, AstraZeneca product sales rose 10% last year while Commerzbank quarterly revenue fell 6.6%.

US indices are trading mixed despite the positive start of the session. Weekly jobless claims fell less than expected to793K, above analysts' expectations of 757k. Many economists, however, ignored the weaker data, noting that claims remained well below their January peak at a time when another potential round of stimulus should boost the labor market recovery. This puts a lot of pressure on the US government. Still a large number of people are unemployed, which poses a risk of weak consumer spending. Therefore, the new administration wants to quickly deliver the so-called "Biden vouchers", but also provide support with "covid" benefits as long as it is needed. As a result, Wall Street is once again close to historic highs, which is also related to the Fed's assurance that interest rates will remain low for a long time. Of course, there is speculation that interest rates could be raised at a time when significant price pressure would emerge. Meanwhile, earnings from PepsiCo and Kraft Heinz came above forecasts while those from Kellogg disappointed. Disney will report its quarterly figures after market close.

WTI crude fell 0.70% and is trading around $58.30 a barrel while Brent lost 0.50% after OPEC lowered non-OPEC production growth forecast by 200,000 barrels to 700,000 barrels per day and reduced demand growth expectations by 110,000 bpd. Elsewhere, gold futures fell 0.80% to $ 1,825.00 / oz, while silver is trading 0.2% lower below $ 27.00 / oz amid a firm dollar and soaring US Treasury yields.

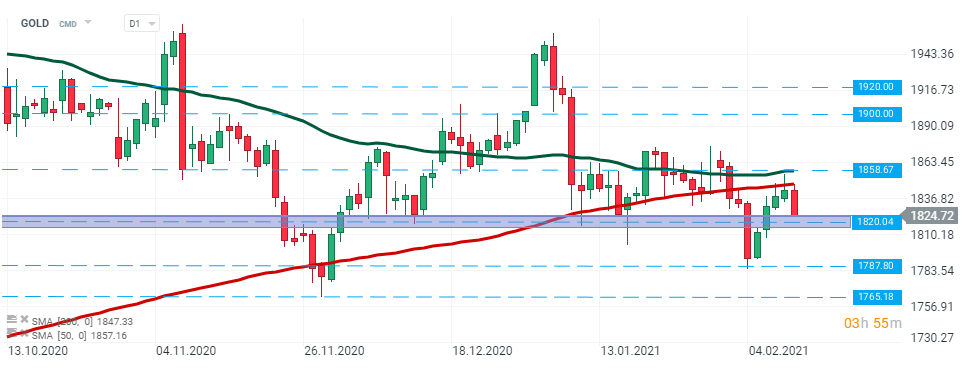

Gold - price bounced off the 200 SMA (red line) during today's session and is currently approaching major support at $1820. Should a break below occur, downward move could be extended towards $1787 handle or even support at $1765. Source: xStation5

Gold - price bounced off the 200 SMA (red line) during today's session and is currently approaching major support at $1820. Should a break below occur, downward move could be extended towards $1787 handle or even support at $1765. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.