- China's Hang Seng Index failed to repeat yesterday's gains, and Chinese index futures today saw a nearly 3% correction in the rebound, driven by dovish signals from the PBoC. European indices CAC40 and FTSE posted near 0.5% declines, DAX retreated slightly;

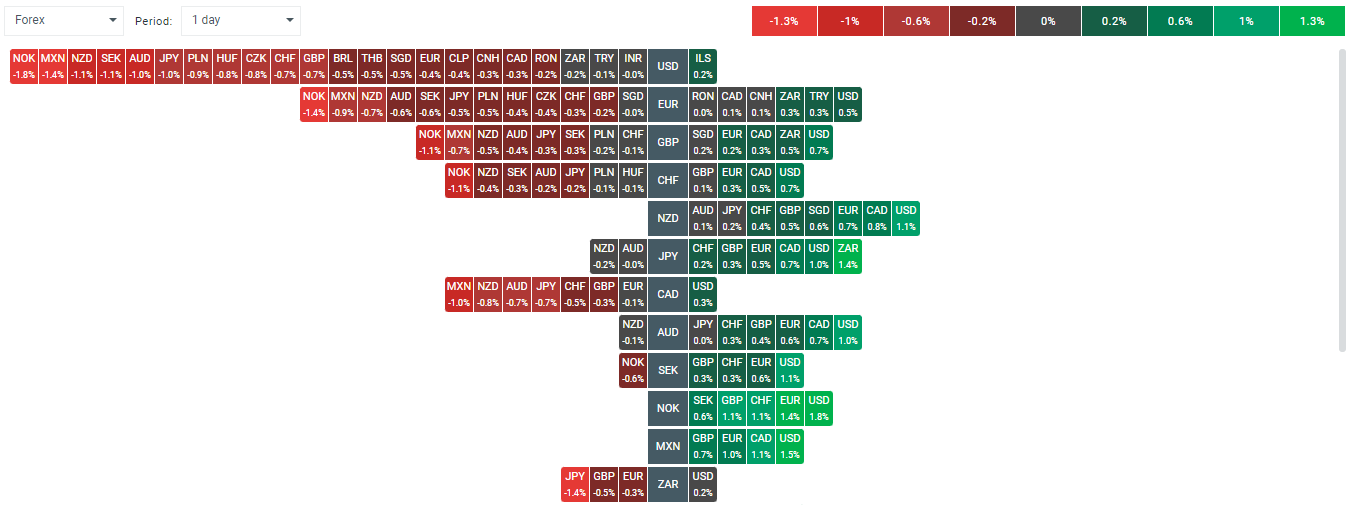

- The attention of the currency market today is captured by the dollar, which is recording a massive strengthening. USDIDX is gaining almost 0.7% and EURUSD has rapidly slid from local maxima near 1.12 to around 1.113 today, losing 0.4%. 10-year bond yields are up about 4 bps to 3.77%. Despite that gold gains 0.2% today,

- After a fairly positive opening of the US stock market, we are seeing a cooling of sentiment. Nvidia erased some of the growth and is now gaining 2%, while the US100 is trading flat and the US30 is losing 0.6%, buoyed largely by a nearly 5% drop in shares of pharmaceutical company Amgen

- Apple shares lose nearly 1% after August data pointed to low demand in China. New Street reported that it expects about 10% negative disappointment in this year's iPhone shipments (215 million shipments expected, 10% below consensus); however, it maintained its $225 per share rating

- Since news of the opening of the Three Mile Island nuclear power plant, which will supply power to Microsoft's data centers, speculative interest has been evident among uranium-related companies, with Denison Mines gaining nearly 6%, following an upgrade at BMO Capital

- U.S. new home sales data turned out to be marginally stronger than forecast. Home sales for August: 716,000 (expected: 699,000; previous: 751,000). The growth rate was -4.7% m/m (previous: 10.3% m/m). Earlier data showed an 11% increase in mortgage applications on a weekly basis, following last week's 14.2% increase.

- According to the US administration, there is still a risk of a full-blown escalation in the Middle East; Biden's statements indicate this, and Anthony Blinken indicated that the situation could escalate rapidly. Yesterday, Hezbollah took another rocket fire at Israel. Oil, however, retreated on the wave of 'de-escalation' of tensions in Libya.

Inventories according to the EIA indicated a stronger than expected decline in stocks. There was a decline in inventories, plus a drop in refining capacity utilization with fuel demand rising, but Brent Crude lost more than 2.3%

- Change in Brent Crude inventories: -4.47 million brk (expected: -1.43 million brk; previous: -1.63 million brk)

- Gasoline inventories: -1.5 million brk (expected: +0.2 million brk; previous: +0.069 million brk)

- Distillate stocks: -2.2 million brk (expected: -1.2 million brk; previous: +0.125 million brk)

- Russian President Putin indicated today that Russia would consider a nuclear response to even a conventional attack on its territory by a non-nuclear-weapon state, but supported by a nuclear-armed state, or group of nuclear-armed states. He indicated that new geopolitical realities will change Russia's 'nuclear doctrine'

- Among agricultural commodities, we can see the largest drop of almost 1.7% in cotton futures, however sentiments around wheat, soybean, coffee and sugar are solid, as grains gain in the range of 1-1.5%.

- Despite positive comments from analysts at QCP Capital, sentiment around cryptocurrencies remains mixed. Bitcoin slides to $63.500, despite dovish signals from China, where the PBoC announced rate cuts, potentially boosting interest in bitcoin and ETFs listed in Hong Kong

- OECD Chief Economist Pereira called, that US economy is very robust. OECD sees the US Federal Reserve cutting rates to 3.50% by end 2025, and ECB cutting to 2.25% by end 2025; estimates 2024 US GDP growth forecast at 2.6% (unchanged), but trims 2025 to 1.6% (1.8% previously).

The US dollar dominates today's currency market session, but despite that gold gains almost 0.2% today. Source: xStation5

The US dollar dominates today's currency market session, but despite that gold gains almost 0.2% today. Source: xStation5

BREAKING: EURUSD reacts 🗽US jobless claims lower than expected

Silver rebounds after a sharp drop 📈Is the uptrend back? ❓

Risk sentiment recovers, as markets more sensitive to tariffs than geopolitics

Chart of the day: AUDUSD Eyes Multi-Year Highs 🇦🇺 📈 Rate hike in February❓(22.01.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.