-

European benchmarks ended today's trading higher; the DAX gained 0.84%, the CAC 40 rose 0.8%, and the WIG20 climbed 2.64% higher.

-

The only interesting reading today was the Sentix index (reflecting investor sentiment), which came in at -25.2 against the last reading of -26.4 and the consensus of -24.6. The mood on the Old Continent was supported today by good foreign trade balance data in China.

-

U.S. indices negated gains from the beginning of the session, with the NASDAQ in particular under bearish pressure.

-

Palantir (PLTR.US) and Nvidia (NVDA.US) released weak financial results and lowered full-year forecasts.

-

Of particular interest today were so-called 'Meme stocks', i.e. shares of companies such as GameStop (GME.US), AMC (AMC.US) and Bed Bath Beyond (BBBY.US), which gained as much as 40% today. The reason for such strong rallies was the renewed action of Wall Street Bets investors, who sought to make so-called short squeezes on the shares of these companies.

-

The currencies of the antipodes can count Monday's session as a success, with AUD strengthening more than 1% against the USD and NZD gaining 0.7% against the U.S. dollar

-

In the commodities market we are seeing high volatility. Precious metals post sizable gains, with silver breaking out above its 50-day moving average and negating the extent of the biggest correction in the current trend. In the energy commodities market, we can observe an upward pressure for WTI and Brent crude oil prices while US gas prices are falling.

-

Most cryptocurrencies started the week with gains. Bitcoin adds less than 3%, while Ethereum gains 3.1% and approaches the $1,770 level.

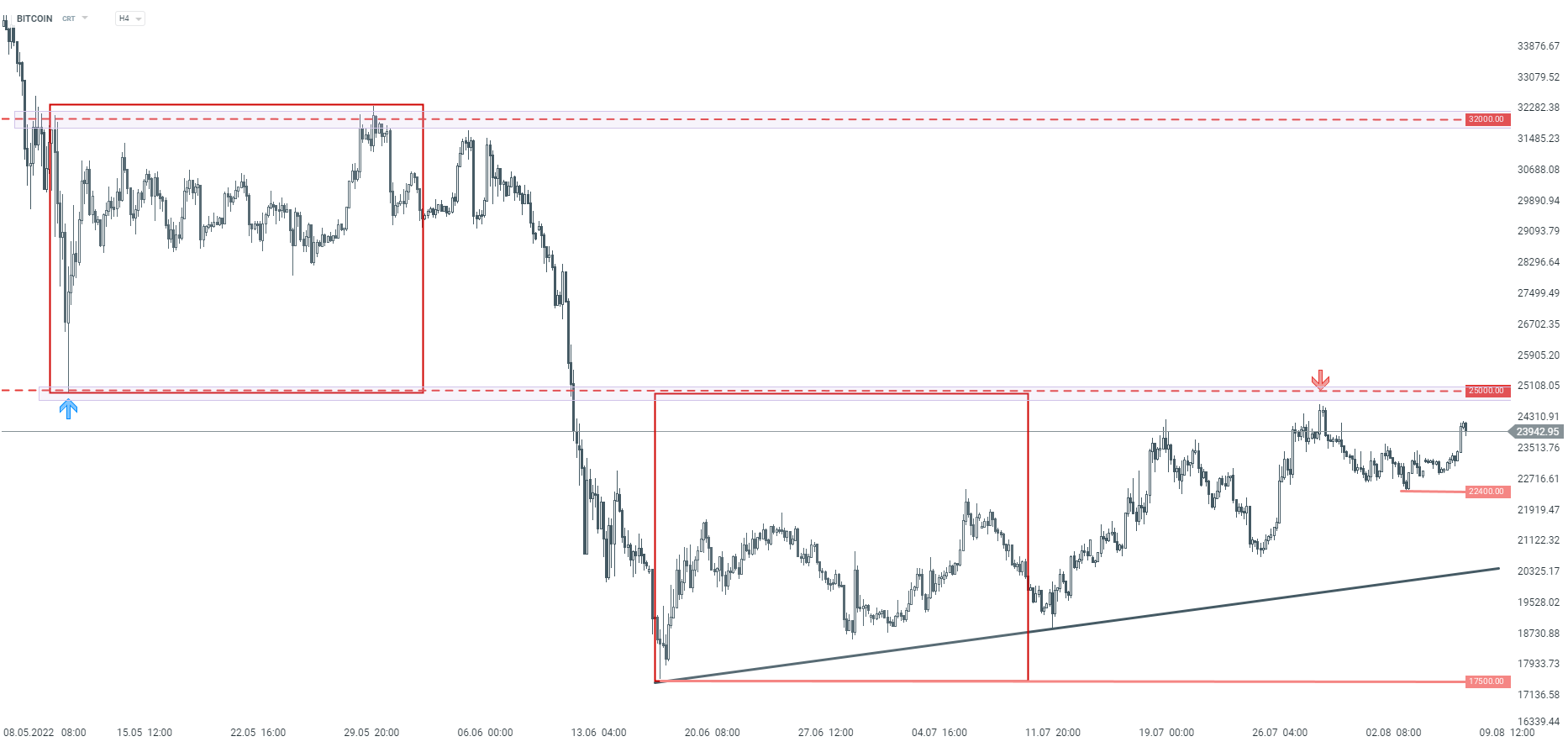

Bitcoin's trading started the week with upward pressure. Looking technically at the H4 chart, if the current momentum continues, a renewed attack on key resistance at the $25,000 level is not out of the question. This zone stems from the May 12 bottom and the upper limit of the broad 1:1 system: If, on the other hand, declines occur, the $22.400 level should be considered as the first support. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.