Equity markets in Europe are enjoying another day of strong gains. Major blue chips indices from Europe trading over 1% higher at press time. The biggest gains can be spotted in Austria with ATX (AUT20) trading 2.8% higher and in Poland with WIG20 (W20) rallying 2.3%. The move is a continuation of the recovery rally as concerns over conditions of banks and potential financial crisis ease. A softer CPI reading from Spain may also be providing some fuel to the move. Having said that, German CPI data at 1:00 pm BST should be watched closely as it may also have impact on the markets.

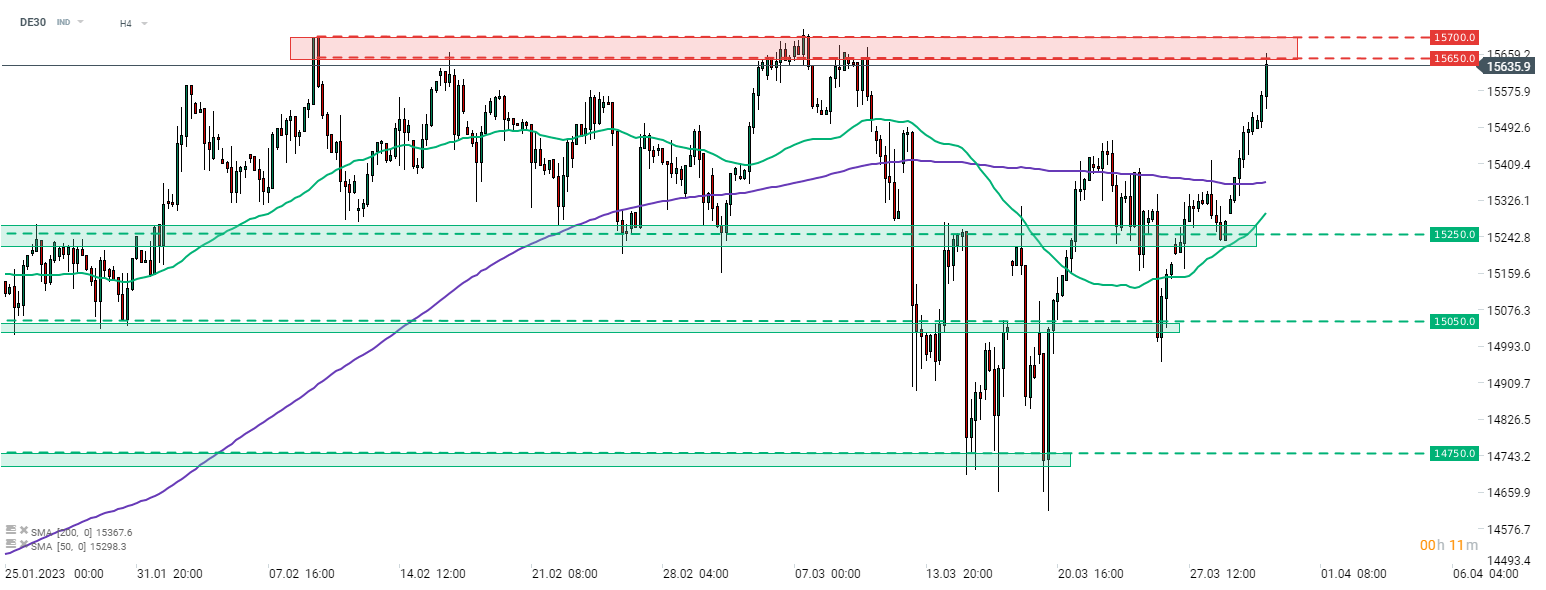

Taking a look at German DAX futures (DE30) chart at H4 interval, we can see that the index has almost fully recovered from a sell-off triggered by problems in US and European banking sectors and is on its way to year-to-date highs. Index reached a 15,650-15,700 pts resistance zone today, where 2023 highs can be found. A break above this area would put the index at the highest level since the turn of 2021 and 2022.

DE30 at H4 interval. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.