-

Stocks in Europe trade mixed

-

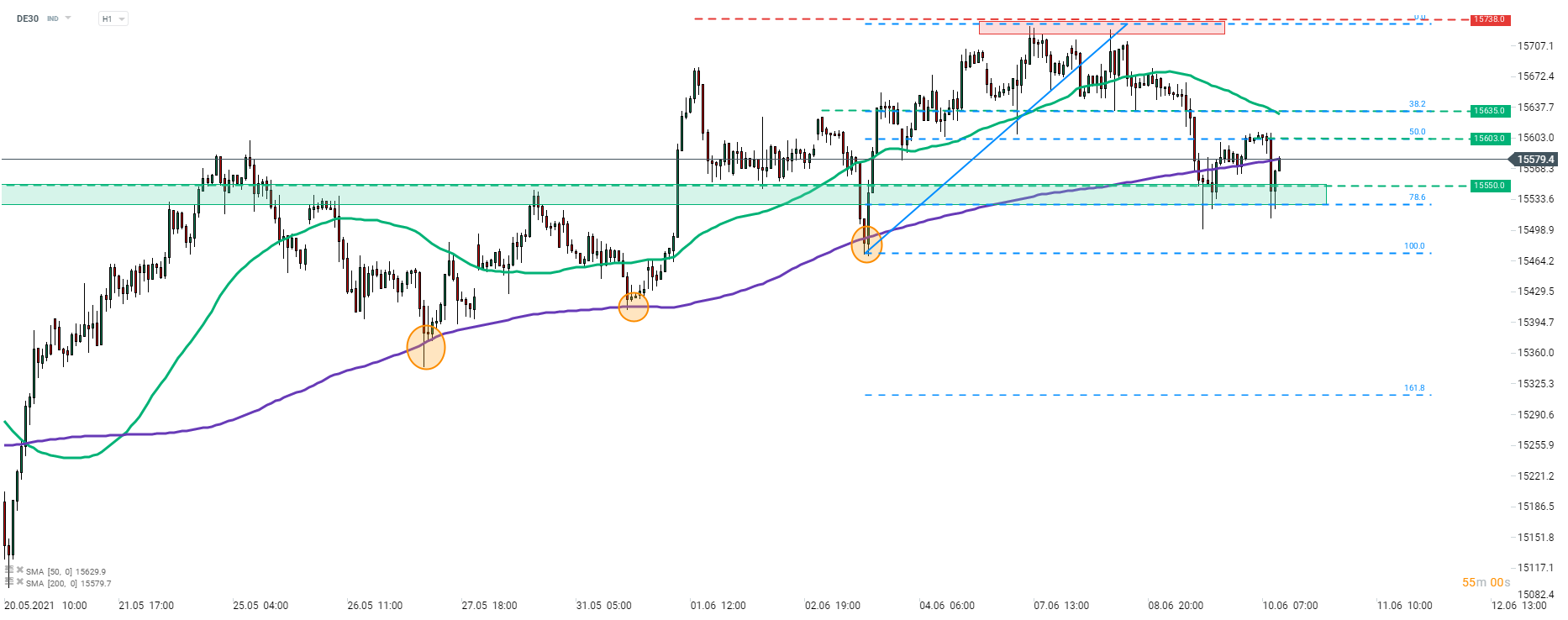

DE30 paints double bottom pattern

-

Daimler to reduce investments in autonomous driving unit

European stock markets are trading mixed on Thursday. However, the range of moves is rather minor. German DAX (DE30) trades flat, UK FTSE 100 (UK100) and Dutch AEX (NED25) gain while French CAC40 (FRA40), Italian FTSE MIN (ITA40) and Spanish Ibex (SPA35) drop. Polish WIG20 (W20) is European outperformer today, gaining around 0.4%. US inflation release for May (1:30 pm BST) and ECB rate decision (12:45 pm BST) are key macro events of the day.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30 dropped today and retested a low from yesterday. As a result, a double bottom pattern has surfaced on the H1 interval. Neckline of the pattern can be found at 15,603 pts and is additionally strengthened by 50% retracement of the upward move launched on June 3. Should bulls manage to break above this hurdle, the potential range of a breakout from the pattern is more or less 90 points. This hints at a possible test of the 15,700 pts area should the pattern play out in a textbook manner. Traders should keep in mind that equity indices may experience a jump in volatility near US CPI data release at 1:30 pm BST. Today's ECB meeting should not have a major impact on stocks.

Company News

Murat Aksel, head of procurement of Volkswagen (VOW1.DE), told Handelsblatt that the German carmaker expects global semiconductor shortages to ease in the third quarter of 2021. Aksel said that currently is the worst moment but around 10% chip shortage is expected to remain for a few years, until new production capacity is built.

According to a Business Insider report, executives at Daimler (DAI.DE) decided to cut investments to an autonomous driving division and redirect funds to EV and software units.

According to reports in Finnish media, Bayer (BAYN.DE) plans to invest €250 million in a new pharmaceutical manufacturing plant in southern Finland.

Deutsche Bank (DBK.DE) said it will book €100 million in Q2 in provisions related to court ruling on client accounts. Ruling paves a way for some of the Bank's clients to challenge high fees on their accounts. Deutsche Bank also said it expects ruling to negatively impact revenue by €100 million in Q2 and Q3 2021.

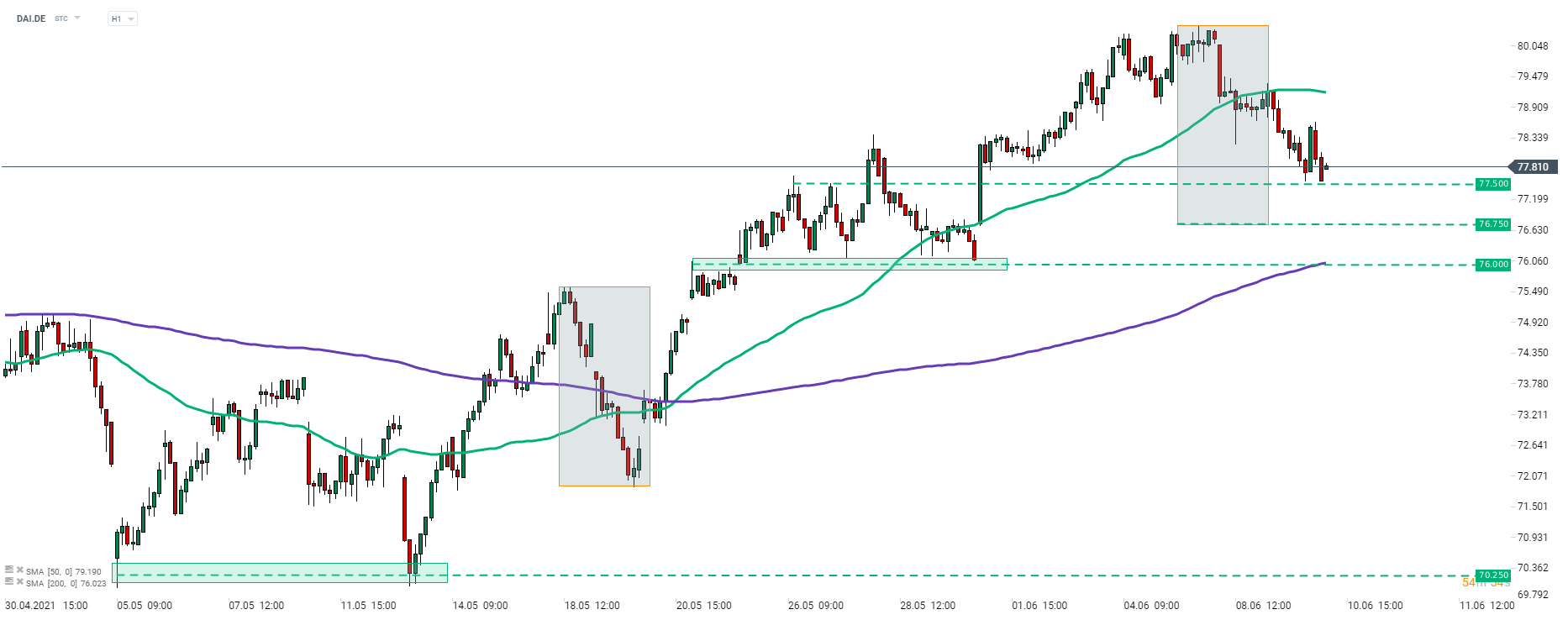

Daimler (DAI.DE) continues to pull back today and drops to the lowest level since the beginning of June. Short-term swing level at €77.50 is being tested at press time and breaking below would pave the way for a test of the lower limit of the Overbalance structure at €76.75. Source: xStation5

Daimler (DAI.DE) continues to pull back today and drops to the lowest level since the beginning of June. Short-term swing level at €77.50 is being tested at press time and breaking below would pave the way for a test of the lower limit of the Overbalance structure at €76.75. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.