-

DE30 posts modest gains

-

The situation on the Rhine River is getting worse

-

Updates from: Commerzbank (CBK.DE), BMW (BMW.DE) and Siemens Healthineers (SHL.DE)

Market sentiment during today's trading session on European trading floors is mixed. The German DE30 is up 0.21%, the French FRA40 is gaining 0.40% and the Polish W20 is losing 0.80%.

The economic calendar today brought a slew of data from the services sector. Sentiment in services deteriorated in Europe, where most countries revised earlier readings downward. Investors will still focus on the ISM reading from the U.S. at 3 p.m. BST, which could cause additional volatility.

Start investing today or test a free demo

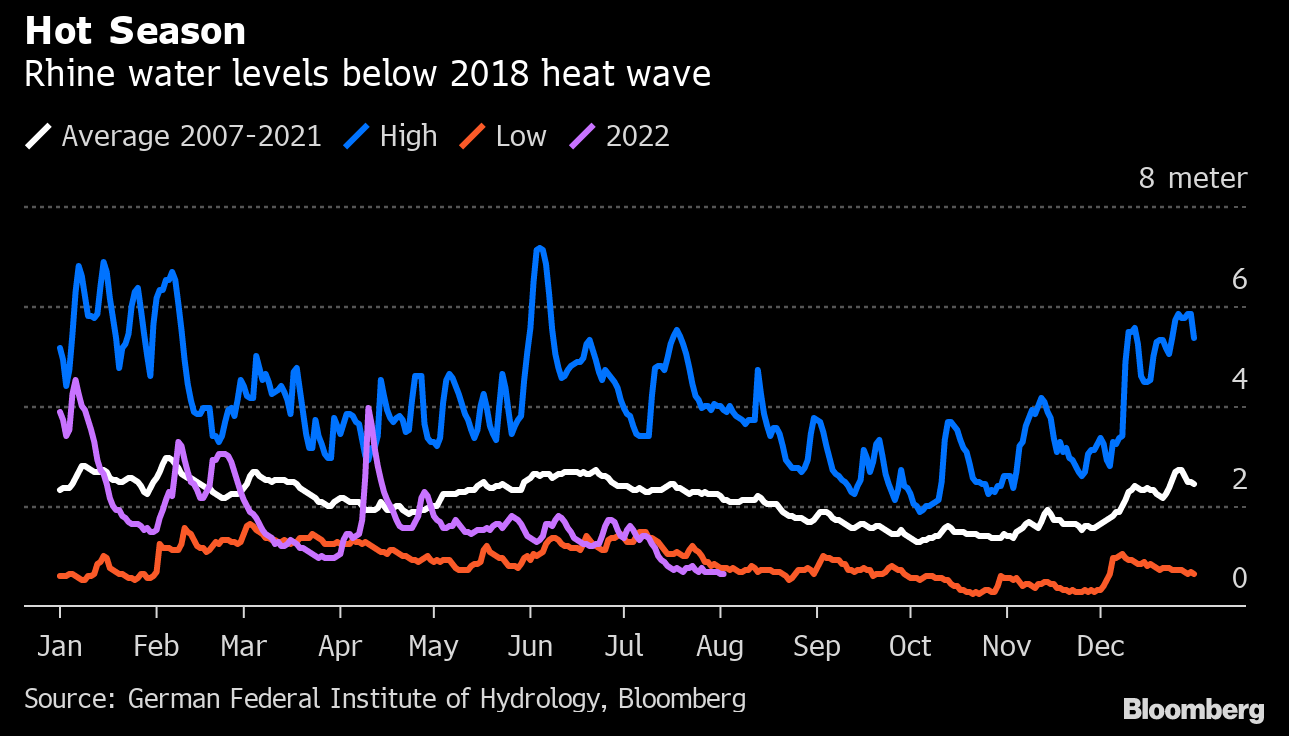

Create account Try a demo Download mobile app Download mobile appWater levels on the Rhine River continue to fall, with concerns about a halt to shipping increasingly resonating with the public. In Germany's Kaub, the water level fell to a 2018 low of just over 60 centimeters on Tuesday. A drop below 40 centimeters will translate into a halt in shipping, exacerbating the energy crisis on the Old Continent (the Rhine is a strategic hub for transporting coal, among other things). In 2018, the low state of the river translated into a 0.4% drop in Germany's GDP.

Source: Bloomberg

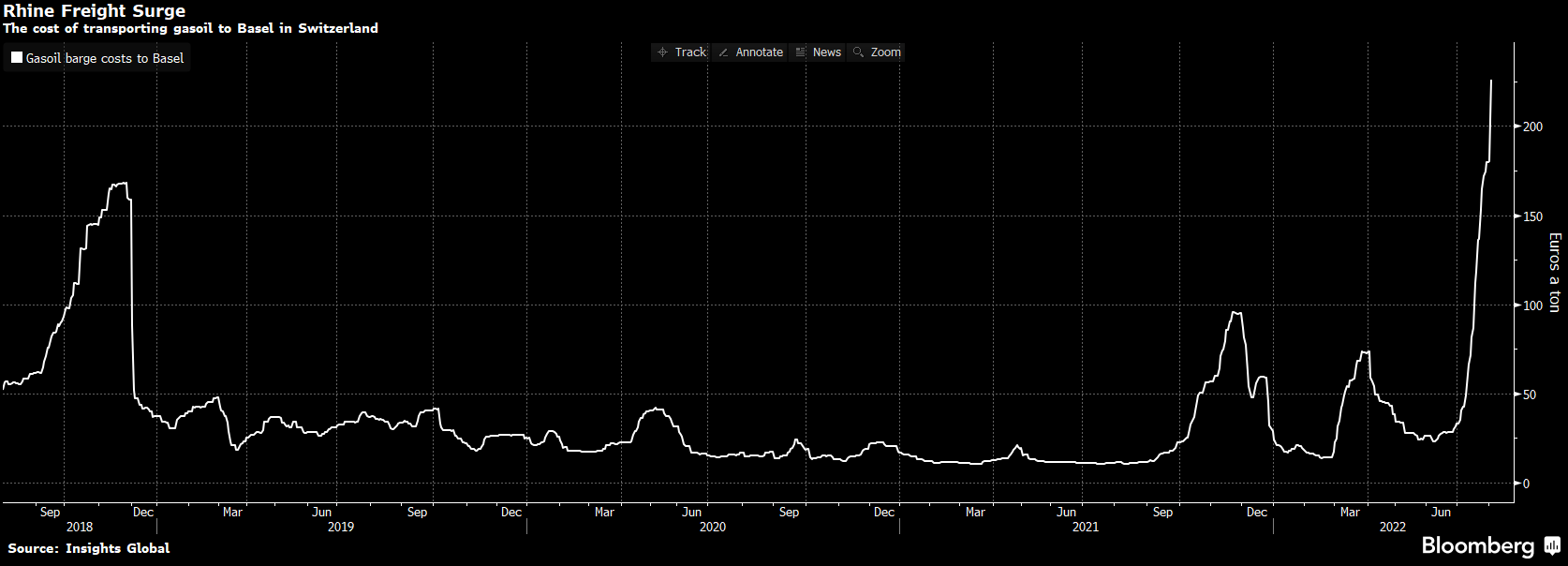

Source: Bloomberg

The cost of shipping has spiralled out of control, with about €200 being paid to send a ton of fuel to Basel, compared to €25 a few months ago. Source: Bloomberg

Chart of the DE30 index, H4 interval. The blue-chip benchmark is seeing modest gains today and has broken out above the 13,450-point zone. From a technical point of view, the closest supports are the 13,450 level and the previously mentioned exponential moving averages (blue, purple and gold curves). The psychological level of 13,000 points also remains an important point. The most important resistance now remains the previously mentioned barrier of 13,680 points. Source: xStaton 5

News:

-

The decline in demand for Covid-19 tests is weighing on the results of Siemens Healthineers (SHL.DE), which reported Q3 results for fiscal year 2021/2022. Adjusted EBIT fell 19% to €765 million (analysts had expected a result of more than €805 million). Nevertheless, the company's CEO confirmed previous earnings forecasts (sales growth of 5.5%-7.5% and adjusted EPS of €2.25-2.35.

-

Commerzbank (CBK.DE) surprised with good results. Net income came in at €470 million against forecasts of €397.5 million. Revenues amounted to €2.42 billion (+30% y/y; forecast at €2.27 billion). Operating profit was recorded at €746 million (forecast at €479.8 million). Net interest income was €1.48 billion (forecast at €1.36 billion). Net commission income at €896 million (forecast at €874.6 million). Bank maintains operating expense target, reserve balance forecast at €700 million, previously €795 million.

-

BMW (BMW.DE) shares are down more than 5.5% today despite beating second-quarter results. The reduction in full-year free cash flow forecast indicates increasing pressure in the second half of the year. Ebit was €3.43 billion; estimate €3.18 billion. Sales at 34.77 billion euros; forecast 32.07 billion euros. The company sees business difficulties in the second half of the year.

Analyst's action:

-

Bechtle (BC8.DE) with a "neutral" recommendation from Citi. Target price at €44.

Largest percentage changes of companies included in the DAX index. Source: Bloomberg

The most active stocks in the DAX index (DE30). Source: Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.