-

European stock markets indices trade higher

-

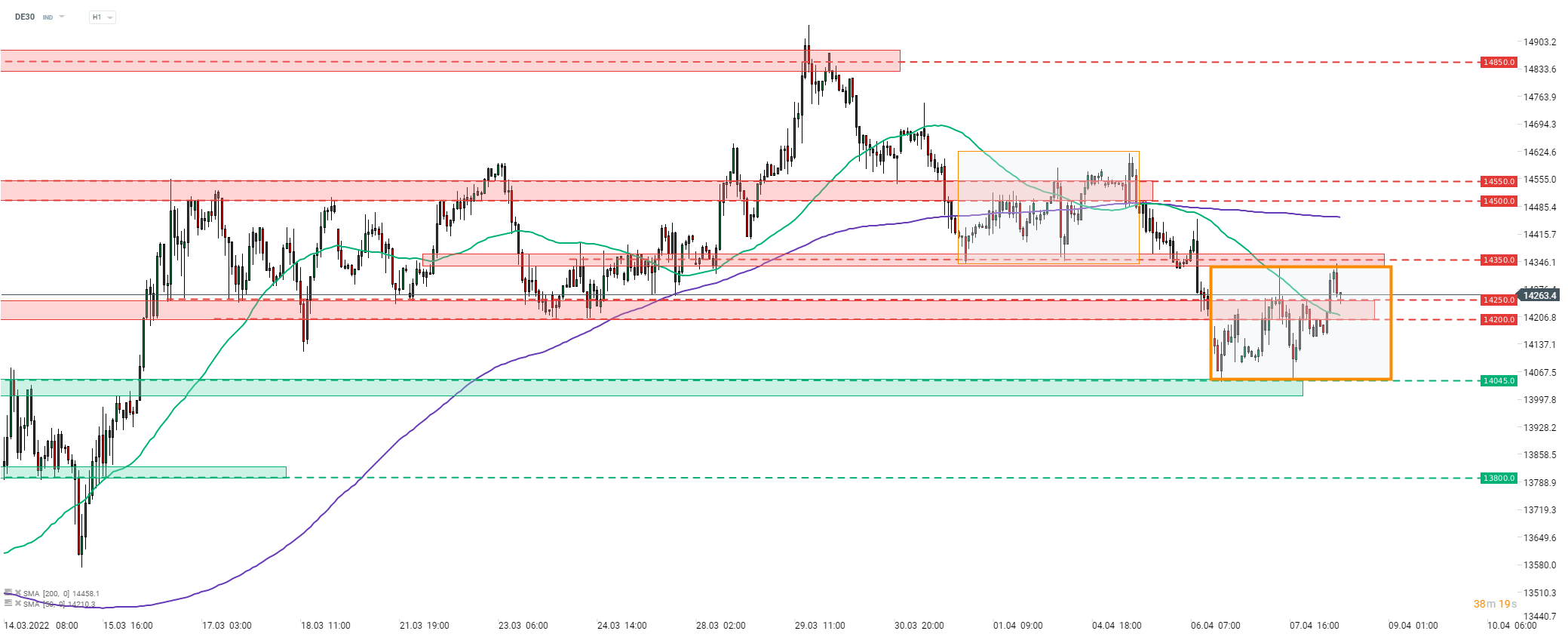

DE30 tested upper limit of market geometry at 14,350 pts

-

BMW Group global sales dropped 6.2% YoY in Q1 2022

European stock markets are trading higher on the final trading day of the week. European indices are snapping a 2-day long, post-FOMC losing streak with major blue chips indices from the Old Continent trading over 1% higher today. Italiana FTSE MIB (ITA40) is a top performer, gaining 1.7%, while Russian indices are the only ones to trade lower.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30 managed to climb back above the 14,200-14,250 pts range, marking the lower limit of a previously broken trading range. However, the upward move was halted near the 14,350 pts swing level at the beginning of the European session today, that also marks the upper limit of . A pullback was launched and the aforementioned 14,200-14,250 pts zone is being tested once again - this time as a support. In case bulls managed to defend it, another attack on the 14,350 pts resistance may be on the cards. On the other hand, a break below could herald a pullback towards recent lows in the 14,045 pts area.

Company News

BMW Group (BMW.DE) reported a 6.2% year-over-year drop in Q1 unit sales, to 596.9 thousand units. Sales in the key BMW brand were 7.3% YoY lower at 519.8 thousand vehicles. Sales in the luxury Rolls-Royce brand surged 18% YoY. US sales were almost 4% YoY higher in Q1 2022 while European sales dropped almost 8% YoY. Company also said that it has recorded an almost 150% YoY jump in EV global sales.

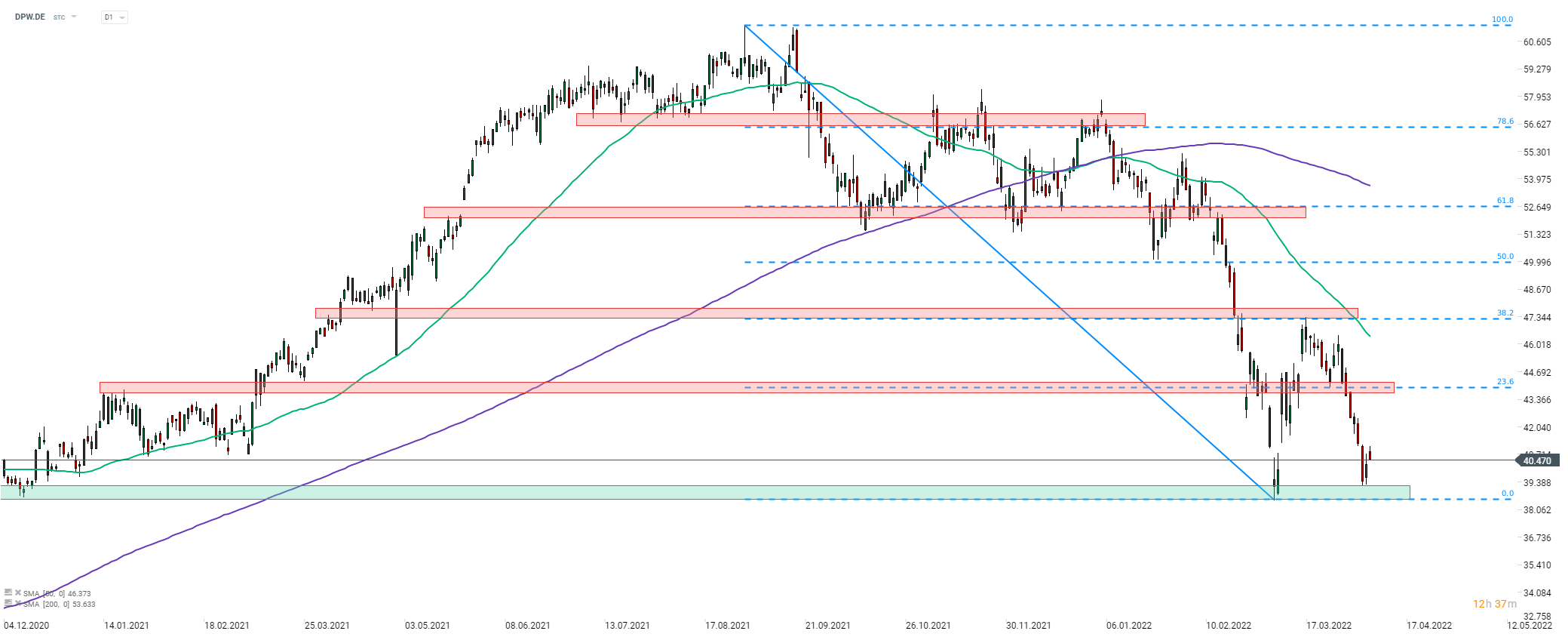

Deutsche Post (DPW.DE) begins the first phase of its €2 billion share buyback programme. First tranche of shares worth up to €500 million is scheduled to be purchased between April 8 and November 7. Whole buyback programme is expected to end in December 2024 at latest.

Analysts' actions

-

K+S (SDF.DE) was upgraded to "overweight" at JPMorgan. Price target set at €44.50

-

K+S (SDF.DE) was downgraded to "add" at JPMorgan. Price target set at €33.00

-

BASF (BAS.DE) was downgraded to "add" at Baader Helvea. Price target set at €60.00

-

Lanxess (LXS.DE) was downgraded to "add" at Baader Helvea. Price target set at €69.00

-

Covestro (1COV.DE) was downgraded to "add" at Baader Helvea. Price target set at €53.00

Deutsche Post (DPW.DE) dropped to the lower level since November 2020 following the launch of the Russian invasion of Ukraine. Stock has managed to recover but another wave of selling arrived later on. As a result, a double bottom was painted in the €39.00 area. Should bulls regain control and push the price above the neckline of the pattern in the €47.20 area, shares of Deutsche Post may be set for a bigger upward move. Source: xStation5

Deutsche Post (DPW.DE) dropped to the lower level since November 2020 following the launch of the Russian invasion of Ukraine. Stock has managed to recover but another wave of selling arrived later on. As a result, a double bottom was painted in the €39.00 area. Should bulls regain control and push the price above the neckline of the pattern in the €47.20 area, shares of Deutsche Post may be set for a bigger upward move. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.