-

European indices trade higher on Thursday

-

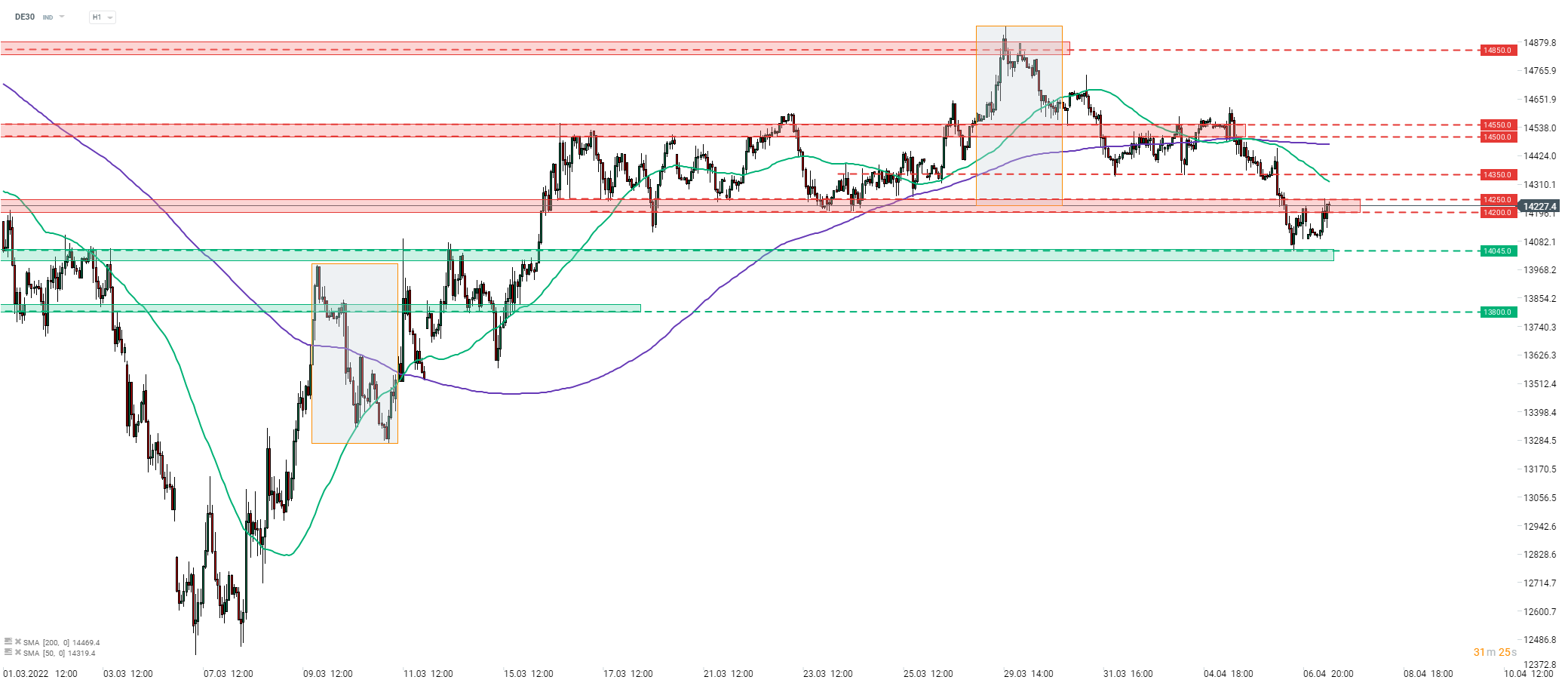

DE30 tries to climb back above 14,200 pts price zone

-

Munich Re refuses to insure East African oil pipeline

European stock markets are trading higher on Thursday. Equity markets recovered from weakness seen on the futures market during the Asian trading session and majority of the blue chips indices from the Old Continent trade higher today. Spanish IBEX (SPA35) is a top performer, gaining 1.3%, while Polish WIG20 (W20) lags the most, dropping around 0.6%. Economic calendar for today lacks top-tier market-moving releases. ECB minutes scheduled for 12:30 pm BST rarely have a major impact on indices.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30 dropped below 14,200-14,250 pts support zone yesterday, reaching the lowest level since March 16. This is quite big development from a technical point of view as a break below the aforementioned price zone also means a break below the lower limit of the local market geometry. This in turn hints that a short-term trend may have reversed. On the other hand, a break below 14,200 pts was not followed by a massive sell-off. Instead, drop was halted at the 14,045 pts swing level and an attempt of breaking back above the 14,200-14,250 pts price zone is being made today.

Company News

According to a Bloomberg report, Airbus (AIR.DE) delivered 60 aircraft in March, bringing a total quarterly deliveries to 140 aircraft in Q1 2022. This marks an increase from 125 aircraft delivered in Q1 2021. While year-over-year increase is welcome, Airbus would need to speed up deliveries significantly in Q2-Q4 if it wants to hit its full-year delivery target of 720. Airbus is expected to release official delivery data for Q1 2022 tomorrow.

Mercedes-Benz Group (MBG.DE), formerly Daimler, announced that unit sales in its Mercedes-Brand dropped 15% YoY in Q1 2022, to 501.6 thousand.

Gerresheimer (GXI.DE) is one of the best performing members of the German MDAX index today. Company reported a 13% YoY jump in Q1 adjusted EBITDA, to €61.5 million. Adjusted net income also jumped 13% YoY, to €20.9 million) while revenue was 22% YoY higher at €349.8 million. EPS improved from €0.57 in Q1 2021 to €0.63 in Q1 2022. Company expects at least 10% jump in revenue in full-2022 while EPS and EBITDA are expected to increase in the high single-digit percentage range.

Munich Re (MUV2.DE) said that it will not participate in insurance of a planned oil pipeline in East Africa. Construction of a 900 kilometer-long pipeline between Uganda and Tanzania is expected to begin in 2025 but Munich Re said that, after making an ESG assessment, it decided not to insure the project.

Analysts' actions

-

Deutsche Boerse (DB1.DE) rated "neutral" at Credit Suisse. Price target set at €164.00

Munich Re (MUV2.DE) is trading a touch lower today, following an announcement that it will not insure the East African oil pipeline. Stock is making another test of a mid-term support zone ranging around €235.00 handle today but so far it looks like bears do not have enough steam to deliver a downside breakout. Two near-term resistance to watch, in case bulls regain control, can be found at €243.50 and at 23.6% retracement of post-pandemic recovery move (€248.00). Source: xStation5

Munich Re (MUV2.DE) is trading a touch lower today, following an announcement that it will not insure the East African oil pipeline. Stock is making another test of a mid-term support zone ranging around €235.00 handle today but so far it looks like bears do not have enough steam to deliver a downside breakout. Two near-term resistance to watch, in case bulls regain control, can be found at €243.50 and at 23.6% retracement of post-pandemic recovery move (€248.00). Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.