-

European markets trade lower

-

DE30 trades within tight range

-

Munich Re presented mid-term goals

European markets trade slightly lower on Tuesday. Politics are the dominating theme today as UK Prime Minister Boris Johnson will hold in-person talks with the European Commission President Ursula von der Leyen in an attempt to find a solution to key Brexit deal obstacles. Apart from that, the EU awaits a final decision from Poland and Hungary on whether they will accept the EU budget and recovery fund.

German ZEW index for December has been released at 10:00 am GMT. Report turned out to be a huge positive surprise as the expectations index came in at 55 against expected 45.5. This marks a massive recovery from 39 registered in the previous month. On the other hand, the current situation index dropped from -64.3 to -66.5 (exp. -66). Report highlights expectations that pandemic related issues will subside next year when vaccination begins.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

DE30 struggles to distance away from the 13,250 pts price zone. The index has formed a short-term ceiling near 13,280 pts and a short-term floor near 13,230 pts. Tight range suggests that investors are waiting for the outcome of the Brexit talks as well as what ECB will do on Thursday. Upside breakout from the range will be confirmed once the price moves above the 200-hour moving average while downside breakout will be confirmed after a break below a swing level at 13,200 pts. Nevertheless, as there is still a lot of uncertainty as we head into year's end, especially when it comes to politics, the index may be set to remain in the tight 50 pts range until a clear catalyst surfaces.

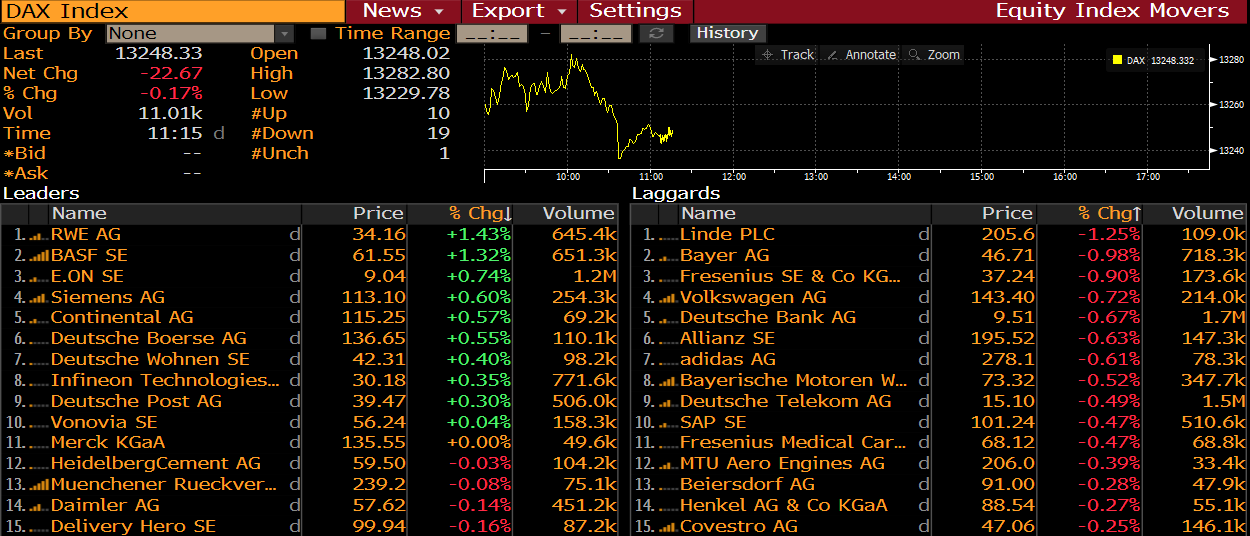

DAX members at 10:15 am GMT. Source: Bloomberg

DAX members at 10:15 am GMT. Source: Bloomberg

Company News

Munich Re (MUV2.DE) has set new mid-term goals. German reinsurer plans to increase both earnings and dividends by around 5% per year until 2025. Company also plans to increase return on equity to the 12-14% range and to continue to decrease the role of coal and oil investments in its portfolio. Solvency ratio is planned to remain at 175-220%.

China Daily reports that Volkswagen (VOW1.DE) plans to build an electric-vehicle plant in the eastern part of the country. First cars are expected to leave the plant in 2023.

Mercedes-Benz, a brand owned by Daimler (DAI.DE), has signed a partnership with Europcar to provide the latter with 25 electric vans.

Analysts' actions

-

BASF (BAS.DE) upgraded to "buy" at UBS. Price target set at €70

-

Lanxess (LXS.DE) upgraded to "buy" at UBS. Price target set at €65

-

BMW (BMW.DE) downgraded to "underperform" at BofA

Munich Re (MUV2.DE) is trading lower in spite of presenting ambitious 2025 goals. Stock pulls back from the 50-hour moving average (green line) and looks towards the lower limit of a recent trading range at €235. Source: xStation5

Munich Re (MUV2.DE) is trading lower in spite of presenting ambitious 2025 goals. Stock pulls back from the 50-hour moving average (green line) and looks towards the lower limit of a recent trading range at €235. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.