- European indices open higher

- DAX records a 0.70% increase above 18,000 points

- Villeroy from the ECB confirms rate cuts in June

At the start of the new week, stock markets in Europe open higher in reaction to the declines before the weekend. Most index contracts gain around 0.80-1.10%. However, this week could also prove volatile for the markets. We will learn about many company earnings reports this week, which could influence investor sentiment in the stock market. Moreover, there are no signs of de-escalation in the Middle East conflict. Any further movements by either side could again trigger panic in the market and major movements primarily in USD, GOLD, and Oil.

Central bank uncertainty

Moreover, there is still uncertainty regarding the future interest rate policies of central banks, especially the American Federal Reserve (Fed). Since the US economy remains strong, inflation may at least stay high enough to prevent the Fed from lowering interest rates for now. At the end of the week, we will learn the preliminary GDP data for the US, which may provide more information about the condition of the US economy.

Villeroy confirms cuts in June

Meanwhile, signals in the ECB still indicate interest rate cuts in June. According to the head of the French central bank, Francois Villeroy de Galhau, tensions in the Middle East are unlikely to delay the European Central Bank (ECB)'s interest rate cuts in June. The banker noted that if there are no surprises, the ECB will not have to wait longer. Currently, the conflict does not lead to a significant increase in oil prices. If it did, then the ECB would again adjust its monetary policy to verify whether the shock is temporary and limited, or spreading beyond commodities to core inflation.

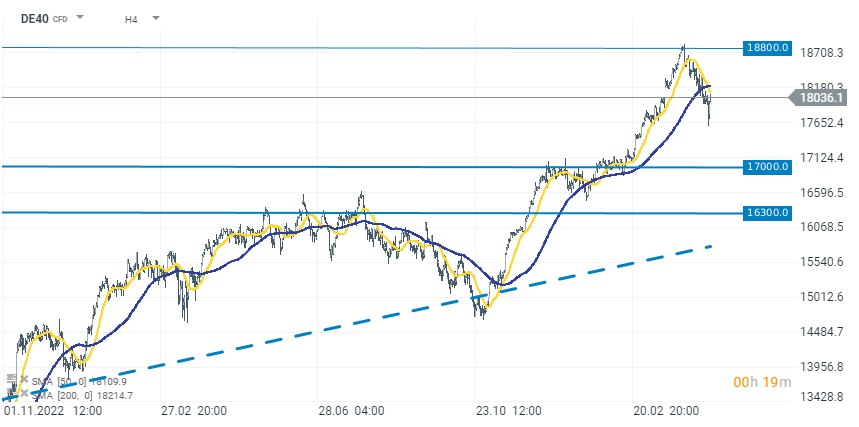

DAX (D1 interval)

The German benchmark DE40 records a 0.70% increase during today's session, thus returning above the 18,000 points level. At the time of publication, the bulls are dealing with a resistance line around 18,100-18,150 points, which was determined by the 50-day SMA.

Source: xStation 5

Company news

Daimler Truck (DTG.DE), a commercial vehicle manufacturer, claims it has made significant progress in the rapid charging of electric trucks. For the first time, designers from the Mercedes-Benz truck segment managed to charge a prototype battery-electric long-haul truck, the eActros 600, at a charging station with a power of one megawatt (1000 kilowatts). The test took place at the company's own development and testing center in Wörth am Rhein near Karlsruhe.

Maximilian Kunkel, Director of Investment in the Global Family & Institutional Wealth division at UBS (UBSG.CH), said that non-performing loans may remain low, however, net interest margins are falling. The bank observes stabilization or even a slight increase in the market.

Alstom's shares (ALSO.FR) gain 1.80% after the French train manufacturer agreed to sell its North American conventional rail signaling business to the German railway systems manufacturer Knorr-Bremse AG (KBX.DE). Shares of Knorr-Bremse gain more than 4.00% today. The transaction amount has been set at approximately 630 million euros (671 million dollars).

Source: xStation 5

Iveco (IVG.IT) loses more than 5.50% after the car manufacturer announced that CEO Gerrit Marx is leaving to head the Italian-American company CNH Industrial.

PUMA (PUMA.DE) CEO, Arne Freundt said that the group has an ambitious goal to catch up with its competitors Adidas and Nike in 2024. The CEO noted that the previous year was difficult in the USA. The company is currently ranked 8th in the market there and aims to improve. The company has already made investments towards achieving this goal, including opening a design and development center in Hollywood.

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.