- The European session unfolds in mixed tone, with PMI readings shaping sentiment; SPA35 and UK100 lead gains, while DE40 lags, down around 0.2%.

- Most PMI services data from Western Europe came in weaker than expected, though still above the 50-point growth threshold, except in France.

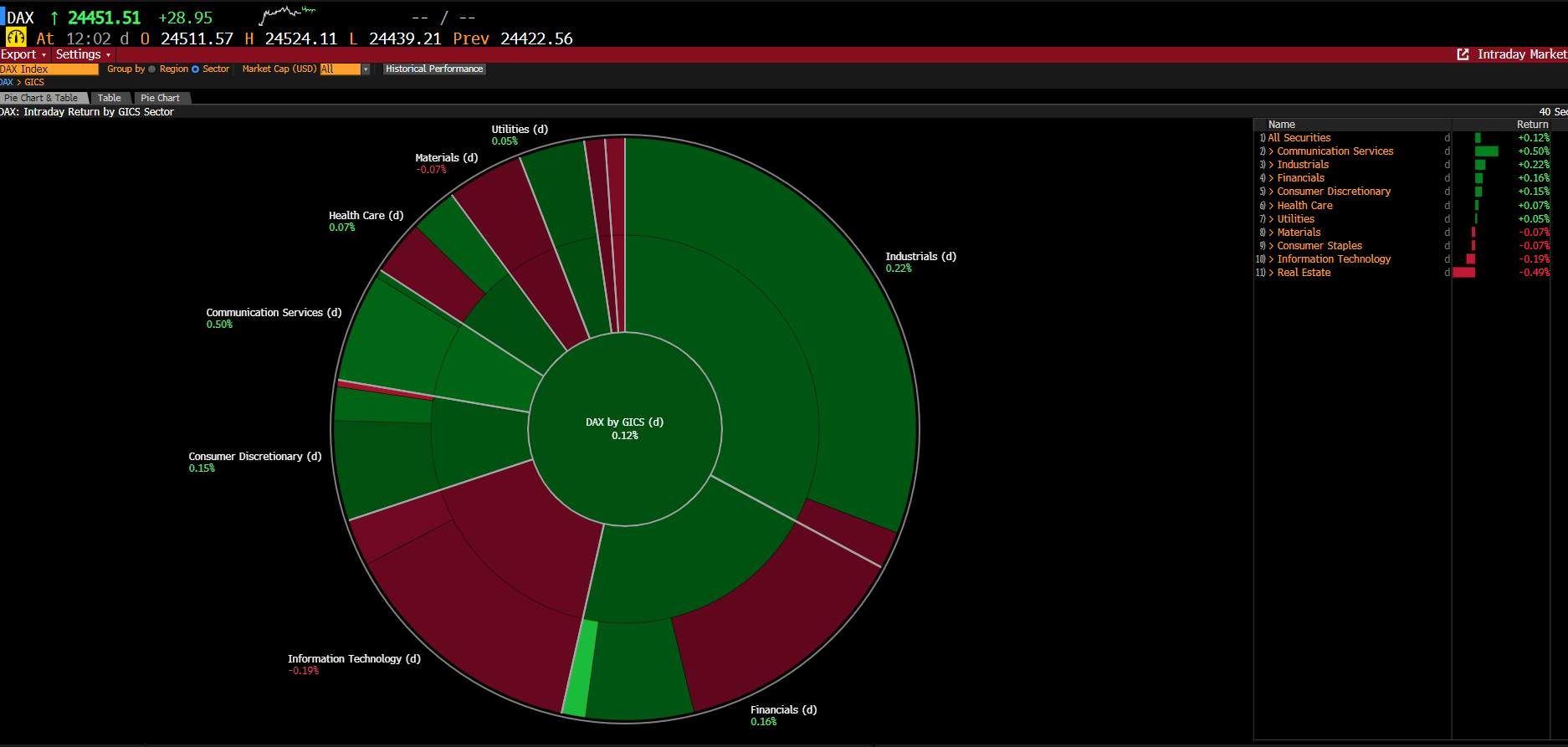

- On the German index, real estate and IT sectors weigh on performance, while telecoms and industry provide support.

- Company updates: Nemetschek gains over +2% on a buy recommendation; Raiffeisen rises more than 2% after the EU decision on Russian assets.

- The European session unfolds in mixed tone, with PMI readings shaping sentiment; SPA35 and UK100 lead gains, while DE40 lags, down around 0.2%.

- Most PMI services data from Western Europe came in weaker than expected, though still above the 50-point growth threshold, except in France.

- On the German index, real estate and IT sectors weigh on performance, while telecoms and industry provide support.

- Company updates: Nemetschek gains over +2% on a buy recommendation; Raiffeisen rises more than 2% after the EU decision on Russian assets.

Today, the European session is unfolding in a positive mood, with investors' main focus remaining on the PMI readings from key economies in the eurozone. These data set the tone for the markets, showing the condition of industry and services, thereby influencing expectations regarding further monetary policy decisions. The SPA35 and UK100 contracts are gaining the most. DE40 is performing worse, down about 0.2%.

Source: Bloomberg Finance Lp

On the German index, the real estate and IT sectors are losing the most today. Telecommunications services and the industrial sector remain supportive for the price.

Macroeconomic Data

Today's session is marked by the publication of PMI data for the services sector from major Western European economies. Below is a summary of key readings:

- Spain, Services PMI September – Expected: 53.2, Published: 54.3, Previous: 53.2

- Italy, Services PMI September – Expected: 51.5, Published: 52.5, Previous: 51.5

- France, Services PMI September – Expected: 48.9, Published: 48.5, Previous: 49.8

- Germany, Services PMI September – Expected: 52.5, Published: 51.5, Previous: 49.3

- Eurozone, PMI September – Expected: 51.4, Published: 51.3, Previous: 50.5

- United Kingdom, Services PMI (final) September – Expected: 51.9, Published: 50.8, Previous: 54.2

Most readings turned out weaker than market forecasts, introducing moderate caution on the trading floors. However, the situation remains under control, with indicators still above the 50-point threshold that separates growth from slowdown, except for France, where services are recording values below this threshold.

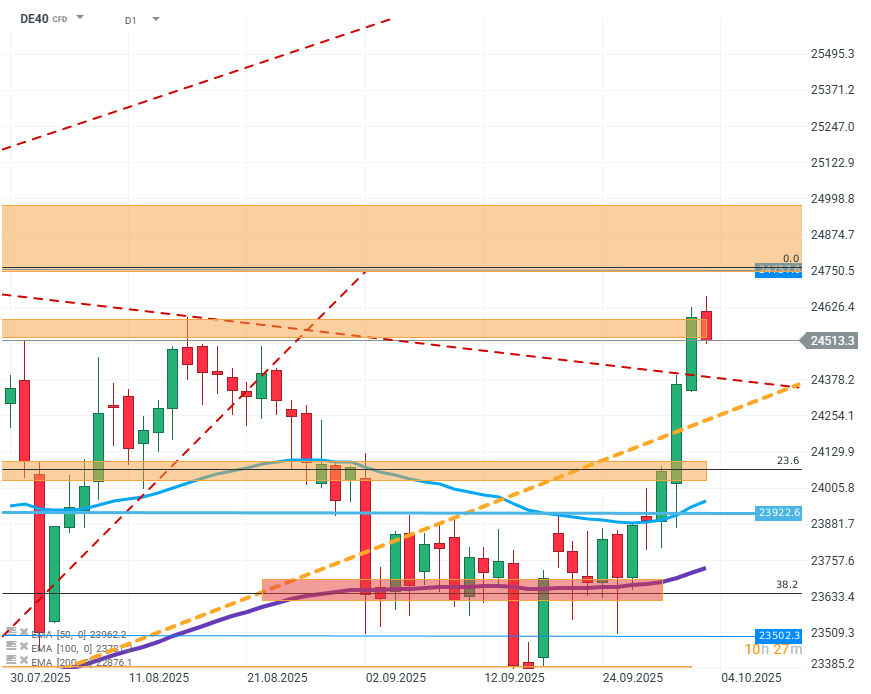

DE40 (D1)

Source: xStation5

The price on the chart briefly broke the resistance around, 24500 but quickly returned below, which is a sign of weakness among buyers after recent increases. A likely scenario is consolidation along the line of the short-term downward trend and another attempt to test the resistance. If the price breaks through the short and medium-term trend lines, the next support for it will only be the FIBO 23.6 level.

Company News:

Nemetschek (NEM.DE) - The company received a buy recommendation from an investment bank. The price is rising by over +2%.

Raiffeisen (RAW.DE) - The European Commission decides to transfer frozen assets of Russian oligarchs under the bank's management. The valuation is rising by over 2%.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.