- European markets extend declines, fueled by disappointment with US rates expectations

- Spain's inflation comes out hot

- China's industry disappoints

- EU GDP in line with expectations

- Siemens Energy climbs on wind turbines and data center outlooks

- European markets extend declines, fueled by disappointment with US rates expectations

- Spain's inflation comes out hot

- China's industry disappoints

- EU GDP in line with expectations

- Siemens Energy climbs on wind turbines and data center outlooks

The last session of the week brings a deepening of declines on the European market. Recent comments from the FOMC in the USA have dashed market hopes for rate cuts in December, which is reverberating across global markets. The leaders of declines in Europe are Poland and Germany. DAX40 contracts are losing over 1%. Slightly less, but also down by about 0.7%, are the prices of SPA35, ITA40, and UK100 contracts. The French stock market is doing better, with CAC40 down by about 0.4%. Switzerland is on a slight positive at the halfway point of the session.

Source: Bloomberg Finance Lp

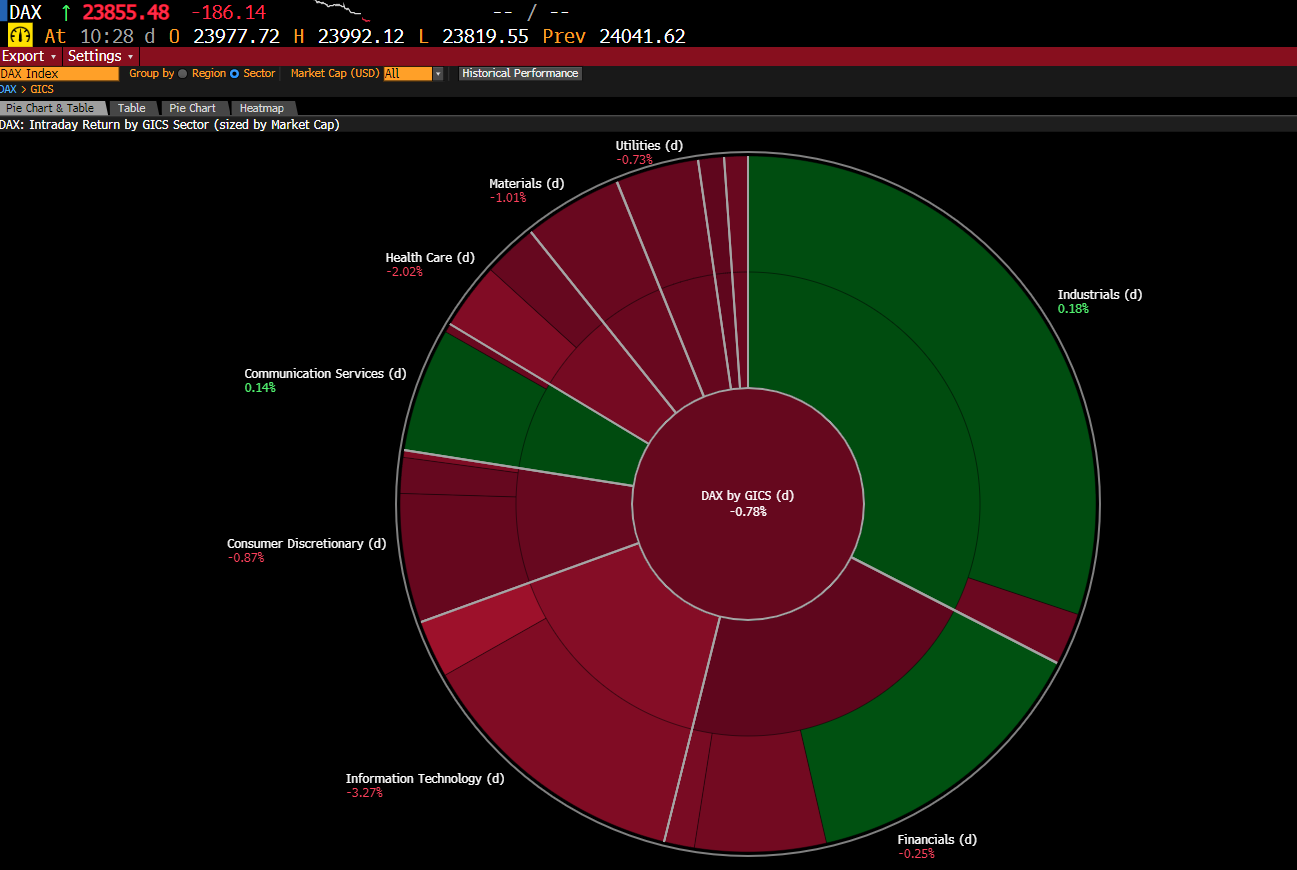

The market is under broad pressure. On the DAX index, the biggest declines are seen in technology and pharmaceutical companies. They are followed by retailers, services, and distributors. Industrial companies are currently on a slight positive.

Macroeconomic Data:

- The inflation reading from Spain still indicates a significant rise in prices. Prices increased monthly by 0.7%, and annual inflation rose to 3.1%.

- Economic growth from the European Union turned out to be slightly above expectations on an annual basis. Quarterly, the EU economy grew by 0.2%. The trade balance is also in an upward trend. After the session ends, ECB representative Philip Lane will speak on monetary policy.

- Outside Europe, the economic situation appears much weaker. China, one of Europe's key trading partners, is experiencing weak industrial production growth, with its dynamics remaining in a downward trend.

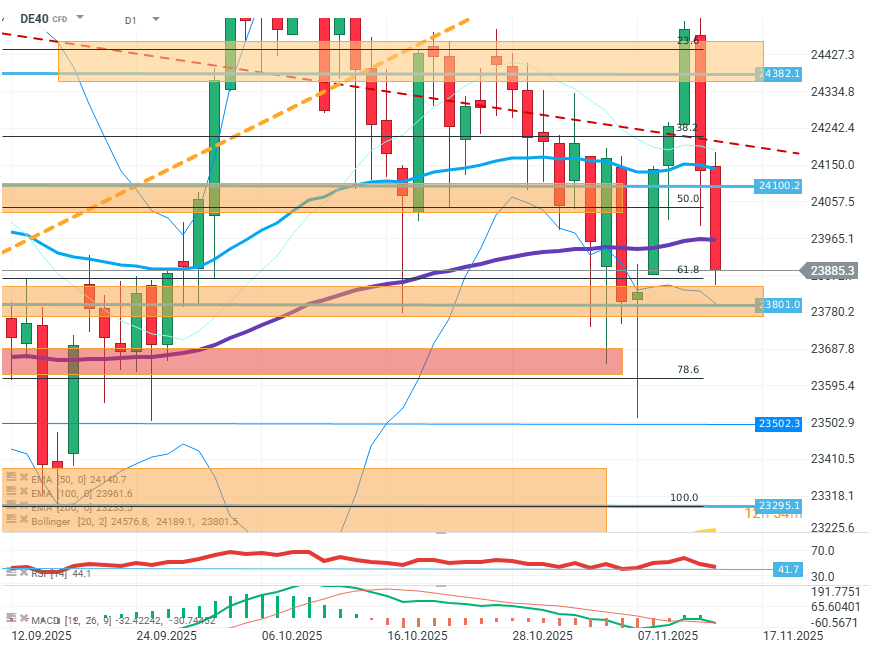

DE40 (D1)

Source: xStation5

The price extends yesterday's declines and stops in the resistance zone around the FIBO 61.8 level of the last upward wave. The most important task for buyers will be to prevent the rate from exceeding 23,800 points to avoid deepening the correction. In case of failure, further declines may reach 23,500-23,300 where the next support zones are located. The base scenario is transitioning into consolidation and waiting for a price impulse in the 24,400-23,800 zone.

Company News:

- Siemens Energy (SIE.DE) - Part of the Siemens group responsible for power systems is rising by as much as 8% in today's session. The increases are driven by excellent forecasts regarding wind turbines and demand from data centers.

- Bechtle (BC8.DE) — The German IT company published quarterly results that exceeded investor expectations regarding EBIT. The company's valuation is rising by over 10%.

- Allianz (ALV.DE) - The financial group published very good results and also raised its year-end forecast. The company is up by over 1%.

- Richemont (CFR.CH) — The fashion company published very good results, including a 14% increase in quarterly sales. The company is up by as much as 6%.

DE40 dips 3% and falls to 2026 lows 🚨📉

Middle East conflict ramps up a gear as energy price spike rips through markets

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

Economic calendar: Eurozone CPI and central bankers speeches in focus

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.