- France minister resigns again, French market in shambles

- Armed industry continues to outperform

- Retail sales in line

- France minister resigns again, French market in shambles

- Armed industry continues to outperform

- Retail sales in line

The European market opened the session with a nervous tone, reacting to the news of another resignation of the French Prime Minister. The ongoing political instability in Paris is escalating, which has led to immediate corrections in quotations, worsening sentiment, and increased risk aversion in many segments of Europe. FRA40 contracts are losing more than 1.4% today. SPA35 and NED25 are reacting better, rising over 0.2% despite the instability. Other European indices remain around the opening levels.

The CAC40 index is losing across the entire market, with French financial institutions under the most pressure.

Macroeconomic Data:

Retail sales data across the European Union met economists' expectations but still indicate weaker consumption than a year ago. In August, sales increased symbolically on a monthly basis, confirming stabilization after previous declines, but remain lower on an annual basis compared to the same period last year.

- Retail sales for August (m/m): 0.1% (forecast 0.1%; previously -0.4%)

- Retail sales for August (y/y): 1% (previously 2.1%)

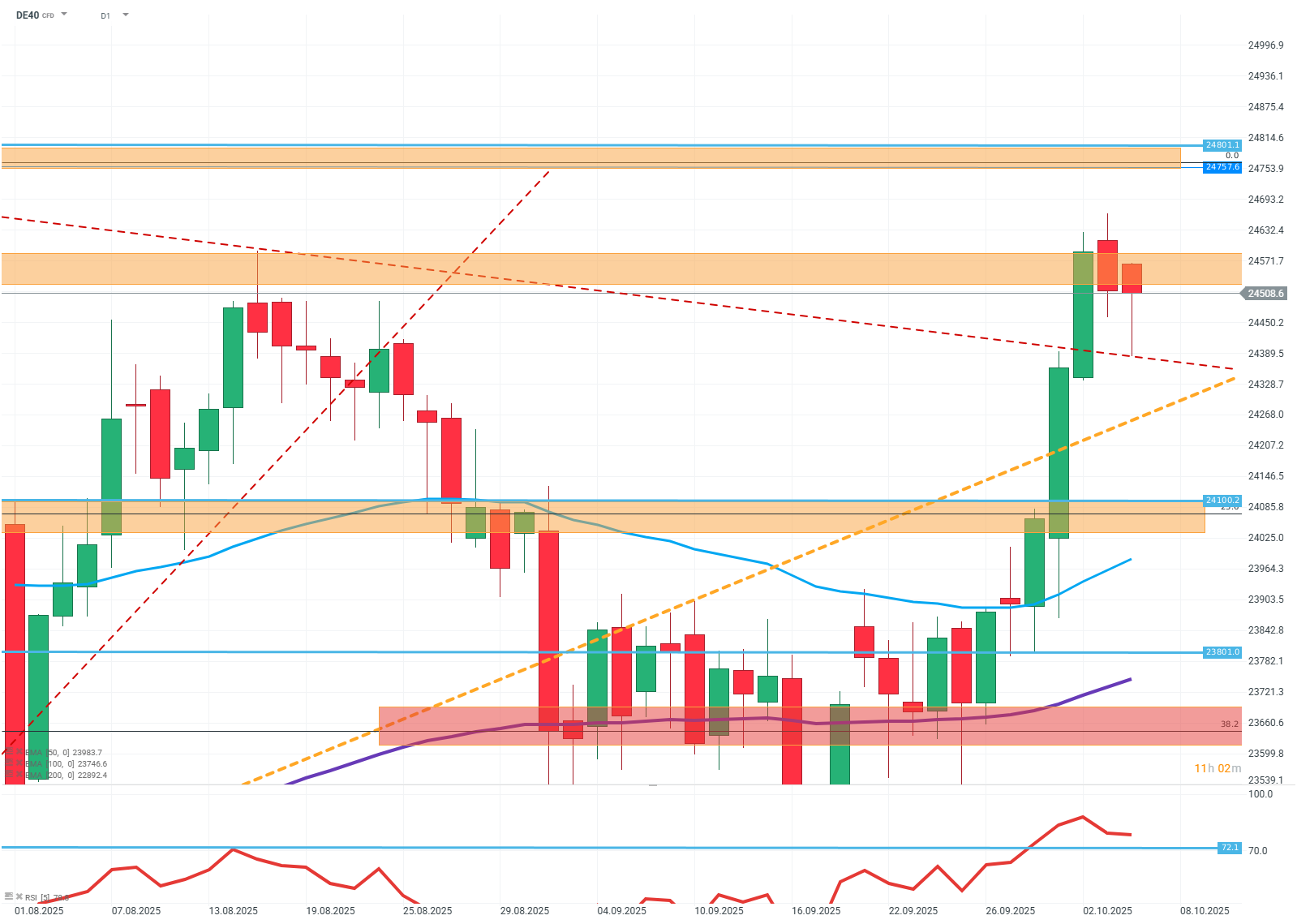

DE40 (D1)

Source: Xstation5

The price on the chart remained below the resistance level of 24600 to 24500, which is a sign of buyer weakness. Considering the high RSI indicator, the base scenario might be a downward correction towards support at FIBO 23. However, if buyers manage to overcome the nearest resistance and maintain growth momentum, the next target would be another ATH.

Company News:

Hensoldt (HAG.DE) - Defense companies are experiencing another upward session. The military optics and electronics manufacturer is rising over 1%. This is due not only to increasing geopolitical tensions but also to comments from the German government about potential share purchases in defense companies.

Aston Martin (AML.UK) - The luxury car manufacturer announced a larger loss due to pressure on markets in America and Asia. The company's shares are falling by 7%.

SEB (SK.FR) - The French kitchen equipment manufacturer published quarterly sales results that were below expectations. The company is losing 20%.

Redcare Pharmacy (RDC.DE) — The German pharmacy chain published excellent sales results and assured further growth. The company's stock is soaring by over 9%.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.