Today after the US session, Disney (DIS.US), the largest US entertainment company, will report financial results. Investors expect a decline in net income and slightly higher revenues. Wall Street will pay particular attention to the streaming segment, where Disney+ has to fight growing competition, and to attendance and customer activity at Disney theme parks. This one, in turn, may provide more information on the overall health of consumers and their financial activity in the entertainment sector. According to Reuters reports, the company has already formed a group to improve its profitability through AI. Will returning CEO Bob Iger, after years away, pull Disney out of trouble?

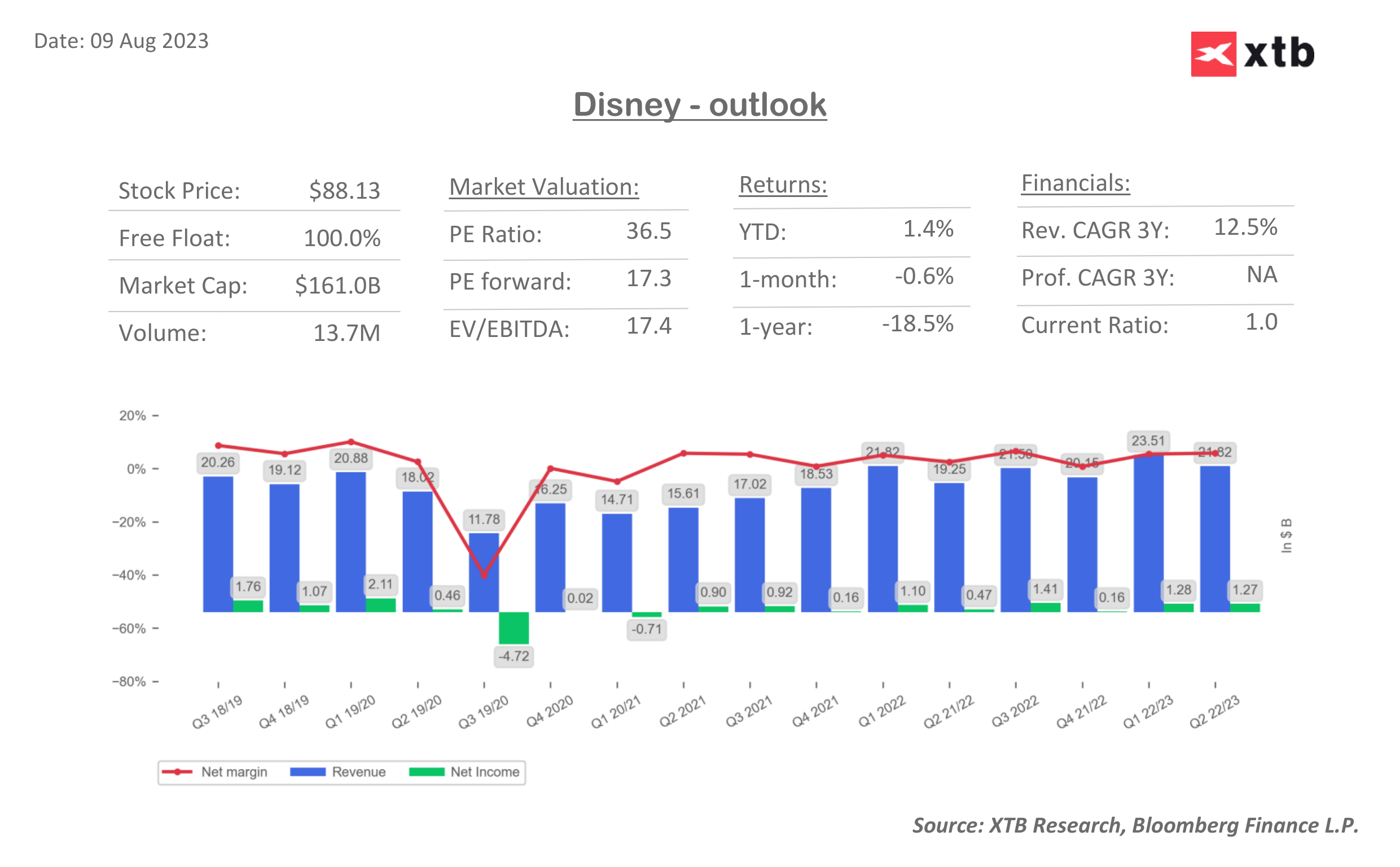

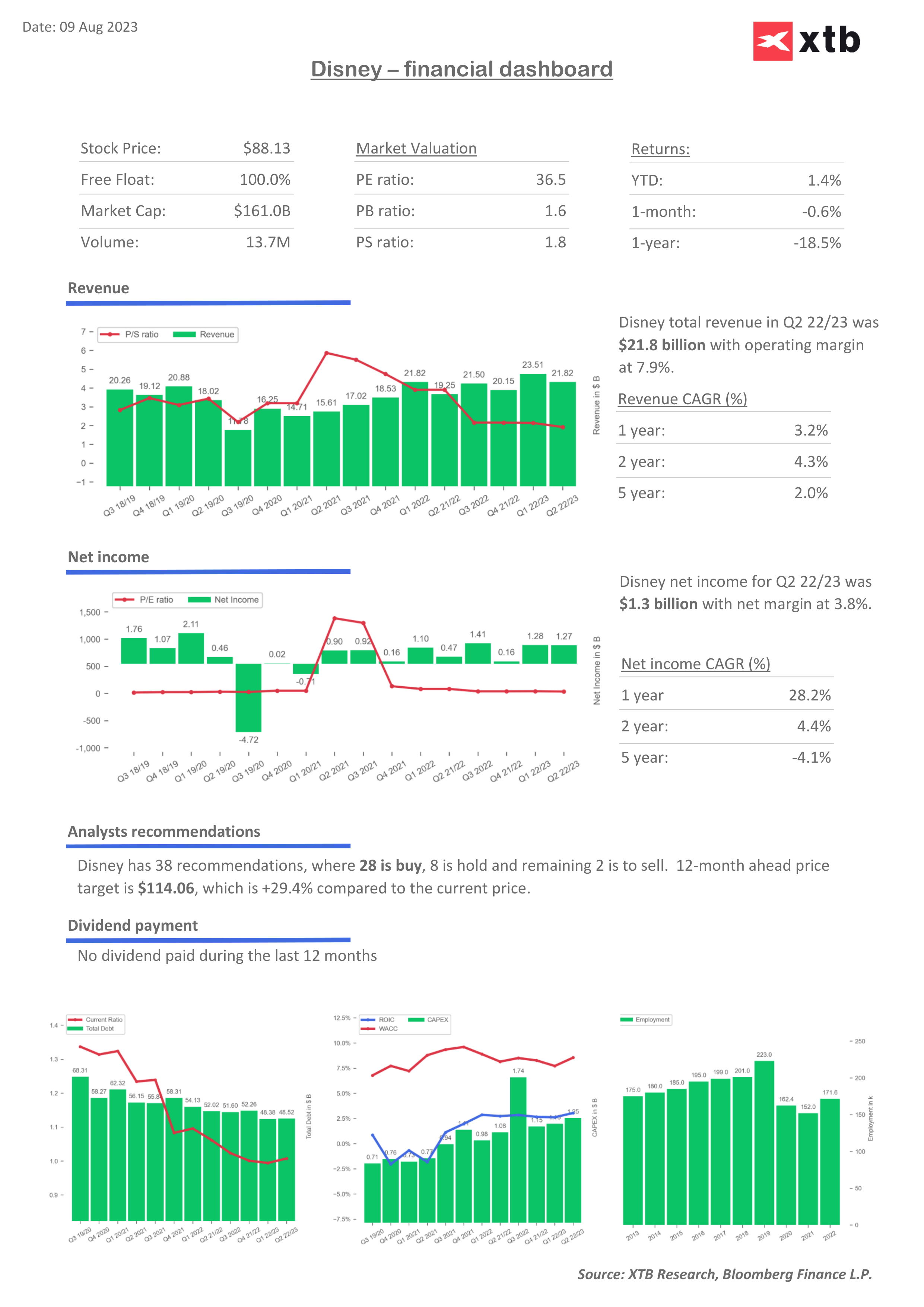

- Revenues: $22.49 billion (4.6% y/y growth)

- Earnings per share (EPS): $0.98 vs. $1.09 in Q2 2023 (down 11%)

- Disney+ subs: 154.8 million vs. 157.8 million in Q1 2023

Investors are concerned that the company's cost control and overall optimization plan being implemented will prove insufficient to combat adversity. Negative impacts could ultimately come from potentially lower advertising revenues, a strike by Hollywood actors and screenwriters worried about the impact of AI, and lower attendance at the parks. Also of interest will be the issue of ESPN's sports television, whose post-pandemic viewership is at an all-time low. Earlier Disney CEO Iger indicated that he was looking for a strategic partner to sell the ESPN business. In order to improve profitability, the company is also considering the Disney+ business has come under pressure. As of April 1 of this year

- Disney had 157.8 million paid subscribers (down from 161.8 million in Q4 2022). Competition in the form of Netflix, Amazon Prime or Paramount spells trouble for regular subscriber growth and content monetization. A possible positive surprise could improve sentiment toward the shares;

- The company aimed to save $5.5 billion through restructuring - investors will assess whether this will be possible this year.Citigroup analysts cited weaker performance in the US subscription sector, higher taxes, a lower forecast for Hotstar TV.

- Bloomberg Intelligence stressed that the theme park business appears to be the strongest, but the closure of a Star Wars-themed hotel may put pressure on results in Q2. According to BI still parks are forecast to account for more than 70% of the company's profit this year. The implication of it is that eventually recession can have huge impact on Disney's profitability;

- Results could be significantly affected by revenues from Disney productions, which included 'Guardians of the Galaxy 3' , 'The Little Mermaid' and 'Elemental' and the new Indiana Jones with nearly 370 million viewers worldwide. However, the results of the latter two were weaker than expected. Pre-Christmas productions of 'The Marvels' and 'Wish' could have a positive impact in Q4.

Disney (DIS.US) shares are trading at 2014 levels. They remain below the SMA200 (red line) for a record amount of time. Source: xStation5

Analysts downgraded Disney recommendations before Q2 report. Source: XTB Research

Analysts downgraded Disney recommendations before Q2 report. Source: XTB Research

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.